WealthTech leverages cutting-edge technology such as AI, big data, and blockchain to streamline and innovate wealth management services, focusing on enhanced client engagement and personalized investment strategies. Digital wealth management primarily centers on online platforms and robo-advisors to offer automated, cost-effective portfolio management and financial planning for a broad client base. Explore the evolving landscape of WealthTech and digital wealth management to understand how technology is reshaping financial advisory services.

Why it is important

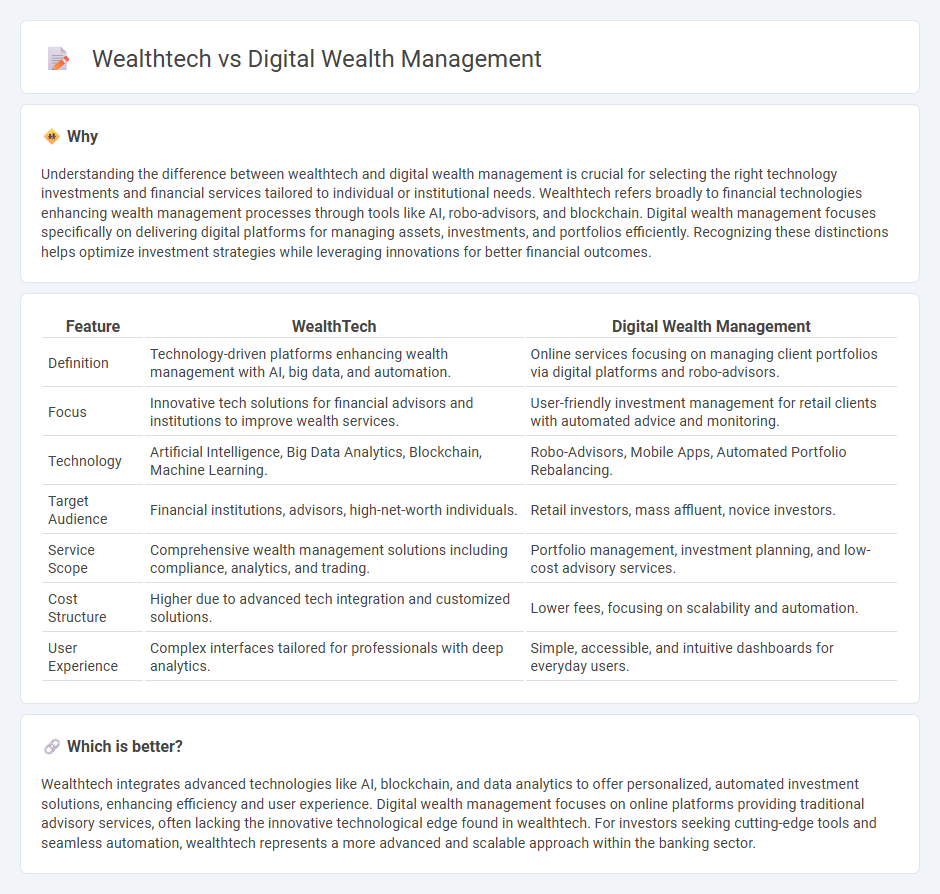

Understanding the difference between wealthtech and digital wealth management is crucial for selecting the right technology investments and financial services tailored to individual or institutional needs. Wealthtech refers broadly to financial technologies enhancing wealth management processes through tools like AI, robo-advisors, and blockchain. Digital wealth management focuses specifically on delivering digital platforms for managing assets, investments, and portfolios efficiently. Recognizing these distinctions helps optimize investment strategies while leveraging innovations for better financial outcomes.

Comparison Table

| Feature | WealthTech | Digital Wealth Management |

|---|---|---|

| Definition | Technology-driven platforms enhancing wealth management with AI, big data, and automation. | Online services focusing on managing client portfolios via digital platforms and robo-advisors. |

| Focus | Innovative tech solutions for financial advisors and institutions to improve wealth services. | User-friendly investment management for retail clients with automated advice and monitoring. |

| Technology | Artificial Intelligence, Big Data Analytics, Blockchain, Machine Learning. | Robo-Advisors, Mobile Apps, Automated Portfolio Rebalancing. |

| Target Audience | Financial institutions, advisors, high-net-worth individuals. | Retail investors, mass affluent, novice investors. |

| Service Scope | Comprehensive wealth management solutions including compliance, analytics, and trading. | Portfolio management, investment planning, and low-cost advisory services. |

| Cost Structure | Higher due to advanced tech integration and customized solutions. | Lower fees, focusing on scalability and automation. |

| User Experience | Complex interfaces tailored for professionals with deep analytics. | Simple, accessible, and intuitive dashboards for everyday users. |

Which is better?

Wealthtech integrates advanced technologies like AI, blockchain, and data analytics to offer personalized, automated investment solutions, enhancing efficiency and user experience. Digital wealth management focuses on online platforms providing traditional advisory services, often lacking the innovative technological edge found in wealthtech. For investors seeking cutting-edge tools and seamless automation, wealthtech represents a more advanced and scalable approach within the banking sector.

Connection

Wealthtech leverages advanced technologies like AI, big data, and automation to enhance digital wealth management platforms by providing personalized investment strategies and real-time portfolio analysis. Digital wealth management utilizes these wealthtech innovations to deliver scalable, cost-efficient financial advisory services and seamless client experiences. The integration of wealthtech in digital wealth management drives smarter decision-making and broader access to sophisticated wealth-building tools.

Key Terms

**Digital Wealth Management:**

Digital Wealth Management leverages advanced algorithms and AI to provide personalized investment strategies and automated portfolio management for individual investors. It integrates mobile apps, robo-advisors, and real-time data analytics to enhance client engagement and optimize asset allocation efficiently. Discover how digital wealth management transforms financial advisory services and client experience.

Robo-Advisor

Digital wealth management leverages advanced technologies like AI and machine learning to offer personalized investment advice through platforms known as Robo-Advisors. These automated tools analyze vast datasets to optimize portfolio performance, reduce costs, and improve user accessibility in wealth management services. Explore how Robo-Advisors are transforming traditional investment strategies and enhancing client experience in wealthtech innovation.

Portfolio Personalization

Digital wealth management leverages technology to provide automated, algorithm-driven financial planning services tailored to individual investors. Wealthtech platforms emphasize advanced data analytics and artificial intelligence to enhance portfolio personalization, delivering customized asset allocation and risk management. Explore our in-depth analysis to discover how these innovations transform personalized investment strategies.

Source and External Links

What is digital wealth management? - Cognizant - Digital wealth management uses digital tools for unified client experiences, enhancing engagement, transparency, collaboration, and portfolio recommendations via technologies like machine learning.

What Is Digital Wealth Management? - SmartAsset - It is the use of technology and platforms to manage investments and financial decisions, often combining automated investing with access to human advisors for personalized financial planning.

A wake-up call to tap into digital wealth | McKinsey - Digital wealth management adoption is crucial for banks to retain and attract clients, offering multichannel, customer-centric approaches with tools tailored to evolving wealth and demographic needs.

dowidth.com

dowidth.com