Personal financial management tools empower individuals to track expenses, create budgets, and achieve financial goals with real-time insights and automation. Regulatory compliance software ensures banks and financial institutions adhere to laws like AML, KYC, and GDPR by automating reporting and risk management processes. Explore how these technologies transform financial security and operational efficiency in banking.

Why it is important

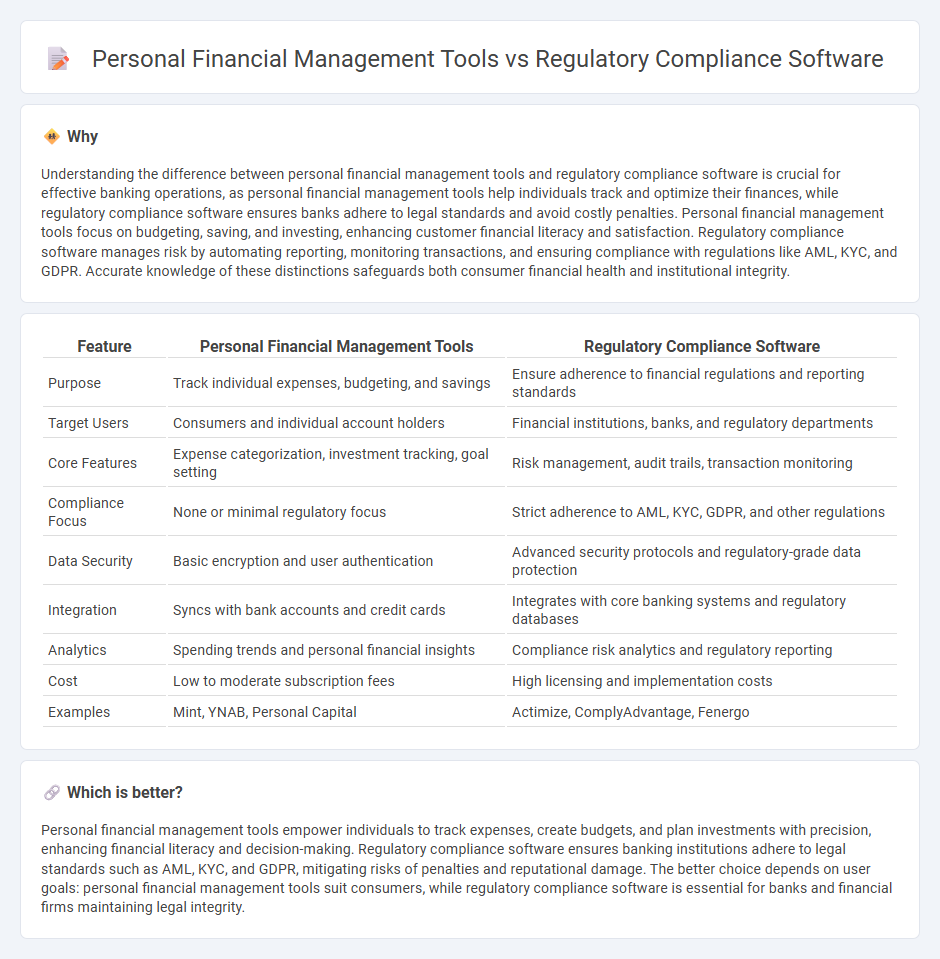

Understanding the difference between personal financial management tools and regulatory compliance software is crucial for effective banking operations, as personal financial management tools help individuals track and optimize their finances, while regulatory compliance software ensures banks adhere to legal standards and avoid costly penalties. Personal financial management tools focus on budgeting, saving, and investing, enhancing customer financial literacy and satisfaction. Regulatory compliance software manages risk by automating reporting, monitoring transactions, and ensuring compliance with regulations like AML, KYC, and GDPR. Accurate knowledge of these distinctions safeguards both consumer financial health and institutional integrity.

Comparison Table

| Feature | Personal Financial Management Tools | Regulatory Compliance Software |

|---|---|---|

| Purpose | Track individual expenses, budgeting, and savings | Ensure adherence to financial regulations and reporting standards |

| Target Users | Consumers and individual account holders | Financial institutions, banks, and regulatory departments |

| Core Features | Expense categorization, investment tracking, goal setting | Risk management, audit trails, transaction monitoring |

| Compliance Focus | None or minimal regulatory focus | Strict adherence to AML, KYC, GDPR, and other regulations |

| Data Security | Basic encryption and user authentication | Advanced security protocols and regulatory-grade data protection |

| Integration | Syncs with bank accounts and credit cards | Integrates with core banking systems and regulatory databases |

| Analytics | Spending trends and personal financial insights | Compliance risk analytics and regulatory reporting |

| Cost | Low to moderate subscription fees | High licensing and implementation costs |

| Examples | Mint, YNAB, Personal Capital | Actimize, ComplyAdvantage, Fenergo |

Which is better?

Personal financial management tools empower individuals to track expenses, create budgets, and plan investments with precision, enhancing financial literacy and decision-making. Regulatory compliance software ensures banking institutions adhere to legal standards such as AML, KYC, and GDPR, mitigating risks of penalties and reputational damage. The better choice depends on user goals: personal financial management tools suit consumers, while regulatory compliance software is essential for banks and financial firms maintaining legal integrity.

Connection

Personal financial management tools gather user financial data that must be processed in compliance with regulations such as GDPR and PCI DSS, ensuring data privacy and security. Regulatory compliance software monitors these tools for adherence to financial laws and reporting standards, reducing the risk of penalties and fraud. Integration of both systems enhances transparency and trust in banking services by aligning user data handling with strict regulatory requirements.

Key Terms

Regulatory Compliance Software:

Regulatory compliance software ensures businesses adhere to industry-specific laws and regulations by automating risk assessments, audit trails, and reporting processes, significantly reducing the risk of costly penalties. Unlike personal financial management tools designed for budgeting and individual finance tracking, compliance software targets enterprises needing robust governance frameworks and real-time monitoring of regulatory changes. Explore how regulatory compliance software can safeguard your operations and streamline compliance efforts in complex regulatory environments.

Anti-Money Laundering (AML)

Regulatory compliance software tailored for AML ensures organizations meet stringent legal requirements through automated monitoring, reporting, and transaction analysis, reducing the risk of financial crimes. Personal financial management tools focus on budgeting and expense tracking for individuals, lacking the robust AML features necessary for institutional compliance. Explore how specialized AML solutions protect businesses and support regulatory adherence.

Know Your Customer (KYC)

Regulatory compliance software streamlines the Know Your Customer (KYC) process by automating identity verification, risk assessment, and ongoing monitoring to meet stringent legal standards and prevent financial crimes. Personal financial management tools primarily help users track spending and budget but often lack advanced KYC features required for formal compliance and regulatory reporting. Explore the key differences and functionalities to choose the right solution for your needs.

Source and External Links

Regulatory Compliance Software | Objective Corporation - Objective RegWorks is a specialized compliance management platform for government agencies, automating workflows, tracking regulatory actions, and providing real-time collaboration and advanced reporting to support informed, risk-based decision-making.

Regulatory Compliance Management Software | Quantivate - Quantivate offers a centralized platform to track legal and regulatory changes, organize compliance documentation, conduct risk assessments, and generate customizable reports, with integrated alerts for new requirements and support for both industry-specific and cross-industry regulations.

9 Best Compliance Management Software Tools of 2025 - This roundup highlights top tools like Cflow (cloud-based workflow automation), Ideagen Qualtrax (document control and audit management), and Risk Hawk (customizable risk and compliance tracking), each offering centralized, automated solutions for diverse compliance needs across industries.

dowidth.com

dowidth.com