Alt credit data incorporates unconventional financial and non-financial information to assess borrower creditworthiness beyond traditional credit scores, enhancing inclusivity for underbanked populations. Artificial intelligence risk models utilize machine learning algorithms to analyze vast datasets, identify complex patterns, and predict credit risk with higher accuracy and efficiency. Explore how integrating alt credit data and AI risk models transforms banking risk assessment and lending practices.

Why it is important

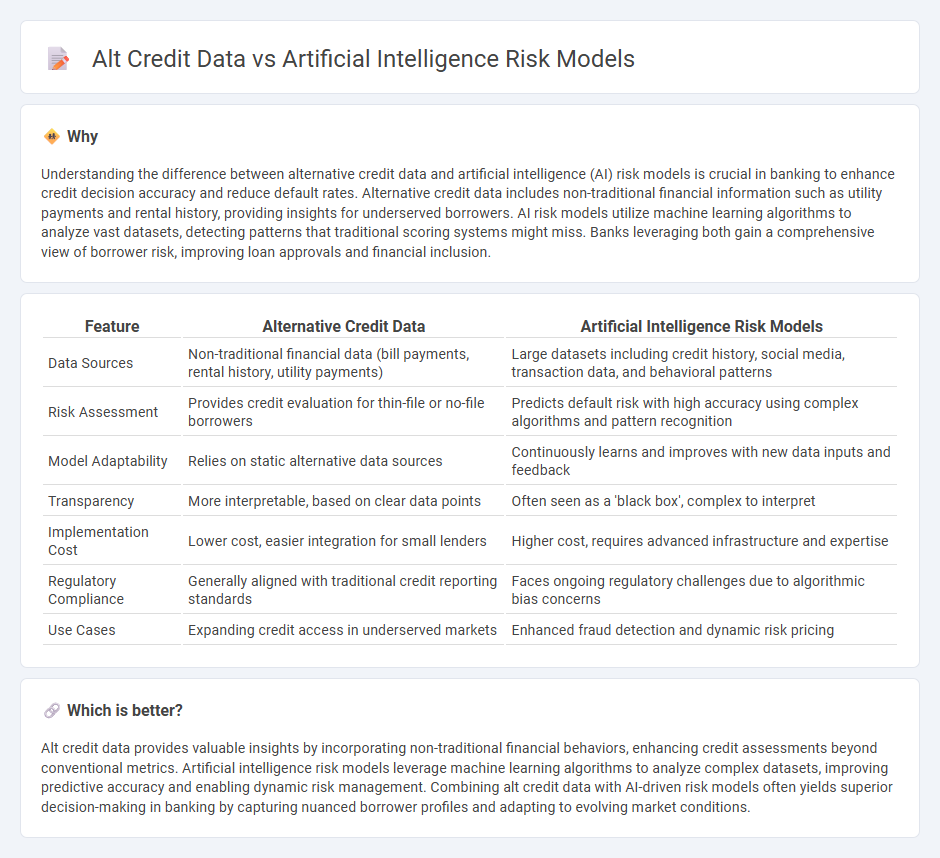

Understanding the difference between alternative credit data and artificial intelligence (AI) risk models is crucial in banking to enhance credit decision accuracy and reduce default rates. Alternative credit data includes non-traditional financial information such as utility payments and rental history, providing insights for underserved borrowers. AI risk models utilize machine learning algorithms to analyze vast datasets, detecting patterns that traditional scoring systems might miss. Banks leveraging both gain a comprehensive view of borrower risk, improving loan approvals and financial inclusion.

Comparison Table

| Feature | Alternative Credit Data | Artificial Intelligence Risk Models |

|---|---|---|

| Data Sources | Non-traditional financial data (bill payments, rental history, utility payments) | Large datasets including credit history, social media, transaction data, and behavioral patterns |

| Risk Assessment | Provides credit evaluation for thin-file or no-file borrowers | Predicts default risk with high accuracy using complex algorithms and pattern recognition |

| Model Adaptability | Relies on static alternative data sources | Continuously learns and improves with new data inputs and feedback |

| Transparency | More interpretable, based on clear data points | Often seen as a 'black box', complex to interpret |

| Implementation Cost | Lower cost, easier integration for small lenders | Higher cost, requires advanced infrastructure and expertise |

| Regulatory Compliance | Generally aligned with traditional credit reporting standards | Faces ongoing regulatory challenges due to algorithmic bias concerns |

| Use Cases | Expanding credit access in underserved markets | Enhanced fraud detection and dynamic risk pricing |

Which is better?

Alt credit data provides valuable insights by incorporating non-traditional financial behaviors, enhancing credit assessments beyond conventional metrics. Artificial intelligence risk models leverage machine learning algorithms to analyze complex datasets, improving predictive accuracy and enabling dynamic risk management. Combining alt credit data with AI-driven risk models often yields superior decision-making in banking by capturing nuanced borrower profiles and adapting to evolving market conditions.

Connection

Alt credit data enhances artificial intelligence risk models by providing diverse, non-traditional financial information such as utility payments, rental history, and social media activity. Integrating these alternative data points enables AI algorithms to analyze a more comprehensive risk profile, improving credit scoring accuracy for underbanked populations. Consequently, lenders can make more informed decisions, reducing default rates and expanding credit inclusion.

Key Terms

Machine Learning Algorithms

Machine learning algorithms harness alt credit data to enhance artificial intelligence risk models by identifying nuanced patterns in non-traditional credit inputs, leading to more accurate credit risk assessment and fraud detection. These models analyze diverse datasets such as utility payments, rental history, and social behavior to predict borrower reliability beyond conventional credit scores. Explore how integrating machine learning with alternative credit data revolutionizes risk modeling and financial decision-making.

Alternative Data Sources

Artificial intelligence risk models leverage alternative credit data sources such as social media behavior, utility payments, and transaction patterns to enhance creditworthiness assessments beyond traditional credit scores. These models improve predictive accuracy by integrating non-traditional data, enabling lenders to better evaluate borrowers with limited credit history. Explore further how alternative data transforms credit risk modeling for innovative financial solutions.

Model Interpretability

Artificial intelligence risk models leverage advanced algorithms to analyze alternative credit data, enhancing predictive accuracy for creditworthiness assessments in non-traditional lending markets. Model interpretability is crucial, as transparent AI frameworks enable stakeholders to understand decision-making processes, ensuring compliance with regulatory standards and fostering user trust. Explore how integrating interpretable AI with alternative credit data reshapes risk modeling techniques.

Source and External Links

AI Risk Management Frameworks | Osano - Defines AI risk as the product of the probability of an AI model producing an incorrect or exploited output and the severity of the resulting consequences, highlighting that risk varies from minor inconveniences to potentially life-altering impacts depending on context.

The MIT AI Risk Repository - Offers a living, searchable database categorizing over 1,600 AI risks by cause and domain, with structured taxonomies to help users systematically identify and understand various types of AI-related risks and their origins.

AI Risk Management - Robust Intelligence - Focuses on automated tools and practices for proactive AI risk management, emphasizing real-time validation, comprehensive testing, and resource efficiency to enable safer, scalable AI deployments.

dowidth.com

dowidth.com