Personal finance automation leverages technology to streamline budgeting, expense tracking, and investment management for individuals, enhancing financial control and efficiency. Corporate treasury management focuses on optimizing liquidity, risk management, and capital allocation within organizations to support strategic goals. Explore the distinct benefits and tools of each approach to strengthen your financial strategy.

Why it is important

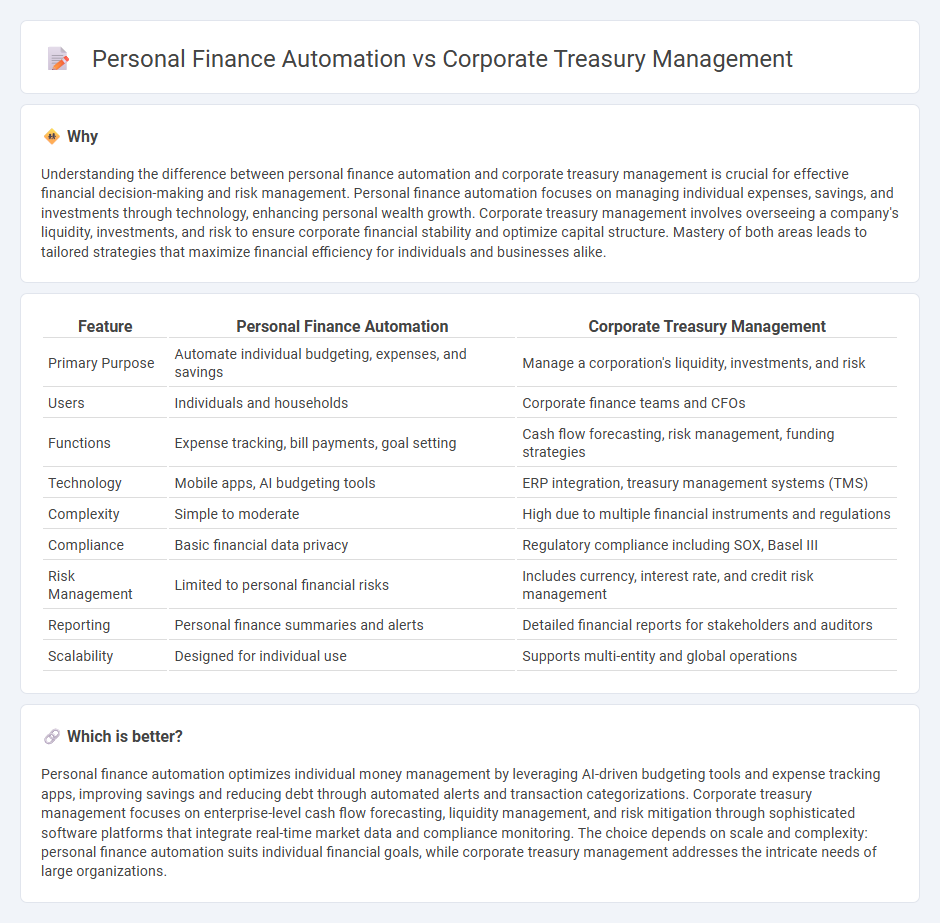

Understanding the difference between personal finance automation and corporate treasury management is crucial for effective financial decision-making and risk management. Personal finance automation focuses on managing individual expenses, savings, and investments through technology, enhancing personal wealth growth. Corporate treasury management involves overseeing a company's liquidity, investments, and risk to ensure corporate financial stability and optimize capital structure. Mastery of both areas leads to tailored strategies that maximize financial efficiency for individuals and businesses alike.

Comparison Table

| Feature | Personal Finance Automation | Corporate Treasury Management |

|---|---|---|

| Primary Purpose | Automate individual budgeting, expenses, and savings | Manage a corporation's liquidity, investments, and risk |

| Users | Individuals and households | Corporate finance teams and CFOs |

| Functions | Expense tracking, bill payments, goal setting | Cash flow forecasting, risk management, funding strategies |

| Technology | Mobile apps, AI budgeting tools | ERP integration, treasury management systems (TMS) |

| Complexity | Simple to moderate | High due to multiple financial instruments and regulations |

| Compliance | Basic financial data privacy | Regulatory compliance including SOX, Basel III |

| Risk Management | Limited to personal financial risks | Includes currency, interest rate, and credit risk management |

| Reporting | Personal finance summaries and alerts | Detailed financial reports for stakeholders and auditors |

| Scalability | Designed for individual use | Supports multi-entity and global operations |

Which is better?

Personal finance automation optimizes individual money management by leveraging AI-driven budgeting tools and expense tracking apps, improving savings and reducing debt through automated alerts and transaction categorizations. Corporate treasury management focuses on enterprise-level cash flow forecasting, liquidity management, and risk mitigation through sophisticated software platforms that integrate real-time market data and compliance monitoring. The choice depends on scale and complexity: personal finance automation suits individual financial goals, while corporate treasury management addresses the intricate needs of large organizations.

Connection

Personal finance automation streamlines individual budgeting, expense tracking, and investment management through AI-driven tools, which share underlying technologies with corporate treasury management systems that optimize liquidity, cash flow forecasting, and risk mitigation. Both domains rely on real-time data analytics, secure cloud platforms, and integration with banking APIs to enhance financial decision-making and operational efficiency. The convergence of these technologies enables seamless financial control from personal finances to large-scale corporate treasury operations, driving accuracy and strategic financial planning.

Key Terms

**Corporate Treasury Management:**

Corporate Treasury Management centralizes cash flow oversight, risk mitigation, and liquidity planning to optimize enterprise financial stability and operational efficiency. Advanced automation tools enhance forecasting accuracy, streamline compliance reporting, and facilitate real-time cash position monitoring for multinational corporations. Explore how integrating AI-driven treasury solutions transforms corporate financial strategies and risk management workflows.

Cash Flow Forecasting

Corporate treasury management employs advanced cash flow forecasting techniques using real-time data integration and predictive analytics to optimize liquidity and mitigate financial risks. Personal finance automation leverages budgeting apps and AI-driven tools to track spending patterns and predict cash inflows and outflows, enhancing individual financial planning. Explore the latest innovations in cash flow forecasting to improve financial decision-making at both organizational and personal levels.

Liquidity Management

Corporate treasury management emphasizes advanced liquidity management techniques such as cash flow forecasting, liquidity risk assessment, and centralized cash positioning to optimize working capital and ensure operational continuity. Personal finance automation tools focus on real-time tracking of income and expenses, automated bill payments, and savings optimization to maintain personal cash flow and emergency fund liquidity. Explore how tailored liquidity management strategies enhance financial stability in both corporate and personal contexts.

Source and External Links

Corporate treasury: What is it, and why do companies need it? - Rho - Corporate treasury manages capital preservation, liquidity, and risk, using automation and real-time communication to optimize cash flow and investment strategies.

The guide to corporate treasury management for finance teams - Brex - Corporate treasury management involves policies, accurate cash flow forecasting, and automation to optimize cash, mitigate risks, and drive business growth.

Corporate Treasury: What It Is and Why It's Important - Priority Commerce - Corporate treasury centralizes cash management, automates payments, enforces compliance, leverages technology for risk mitigation, and emphasizes policy creation and team training.

dowidth.com

dowidth.com