Income streaming in banking refers to strategies that optimize revenue by diversifying sources such as interest income, fees, and investment returns, enhancing financial stability. Penalty charges, imposed for late payments or overdrafts, serve as deterrents to risky behavior while contributing to bank profitability through fines and fees. Explore the balance between income streaming and penalty charges to understand their impact on banking revenue and customer relations.

Why it is important

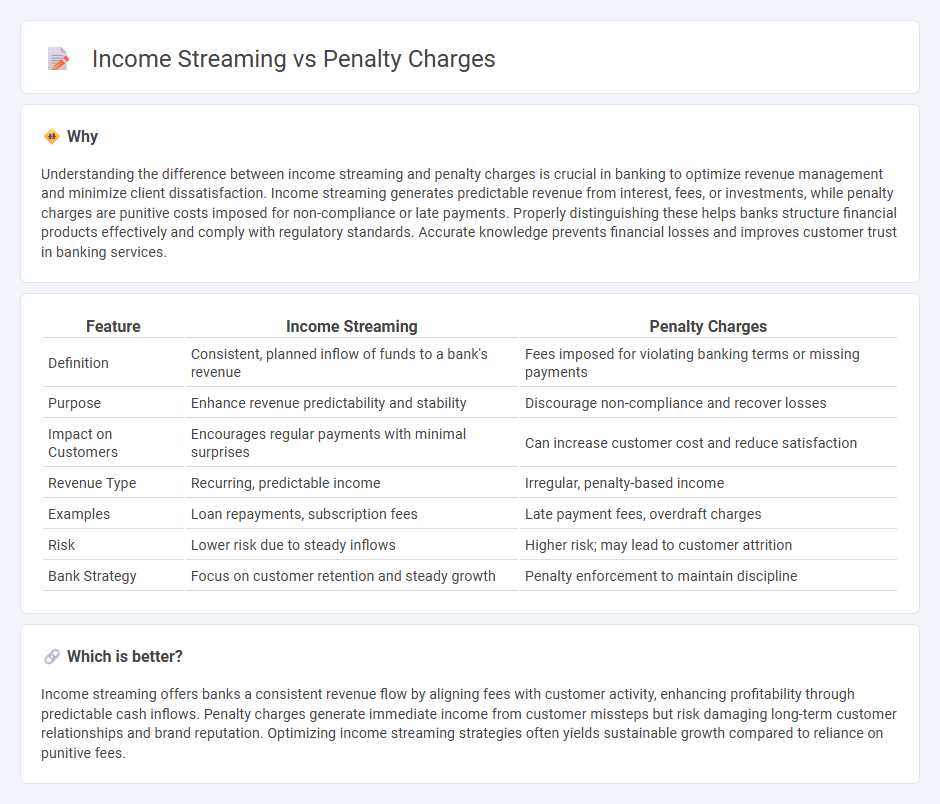

Understanding the difference between income streaming and penalty charges is crucial in banking to optimize revenue management and minimize client dissatisfaction. Income streaming generates predictable revenue from interest, fees, or investments, while penalty charges are punitive costs imposed for non-compliance or late payments. Properly distinguishing these helps banks structure financial products effectively and comply with regulatory standards. Accurate knowledge prevents financial losses and improves customer trust in banking services.

Comparison Table

| Feature | Income Streaming | Penalty Charges |

|---|---|---|

| Definition | Consistent, planned inflow of funds to a bank's revenue | Fees imposed for violating banking terms or missing payments |

| Purpose | Enhance revenue predictability and stability | Discourage non-compliance and recover losses |

| Impact on Customers | Encourages regular payments with minimal surprises | Can increase customer cost and reduce satisfaction |

| Revenue Type | Recurring, predictable income | Irregular, penalty-based income |

| Examples | Loan repayments, subscription fees | Late payment fees, overdraft charges |

| Risk | Lower risk due to steady inflows | Higher risk; may lead to customer attrition |

| Bank Strategy | Focus on customer retention and steady growth | Penalty enforcement to maintain discipline |

Which is better?

Income streaming offers banks a consistent revenue flow by aligning fees with customer activity, enhancing profitability through predictable cash inflows. Penalty charges generate immediate income from customer missteps but risk damaging long-term customer relationships and brand reputation. Optimizing income streaming strategies often yields sustainable growth compared to reliance on punitive fees.

Connection

Income streaming in banking refers to the regular flow of revenue generated through various financial products and services, while penalty charges serve as consequential fees imposed when customers violate terms, such as overdrawing accounts or missing loan repayments. Penalty charges directly impact income streaming by increasing banks' revenue from non-interest sources, contributing to overall profitability. Effective management of penalty charges ensures balanced income streams without compromising customer satisfaction or regulatory compliance.

Key Terms

Overdraft Fees

Overdraft fees represent a significant source of penalty charges for bank account holders who exceed their available balance, often incurring daily fees that contribute to high cumulative costs. Income streaming, a financial strategy, can help mitigate overdraft penalties by aligning cash inflows with scheduled expenses, reducing the likelihood of account overdrafts. Discover more effective methods to optimize income streaming and minimize costly overdraft fees.

Direct Deposit

Penalty charges often arise from missed payments or bank fees, which reduce overall income and can disrupt cash flow management. Income streaming through Direct Deposit ensures timely, automated payments directly to bank accounts, minimizing delays and avoiding costly penalties. Explore how Direct Deposit optimizes income streaming and reduces penalty risks for better financial stability.

Early Withdrawal Penalty

Early Withdrawal Penalties typically impose a financial charge on funds withdrawn from retirement accounts like IRAs or 401(k)s before reaching the age of 59 1/2, impacting retirement savings growth. Income streaming strategies, such as systematic withdrawals or annuitization, aim to minimize tax liabilities and avoid these penalties by structuring distributions efficiently. Explore how optimized income streaming can reduce early withdrawal penalties and enhance retirement income.

Source and External Links

Interest, penalties, and fees - Taxes - City of Philadelphia - Philadelphia charges a penalty of 1.25% per month for late tax payments (excluding Liquor Tax and Real Estate Taxes), effective since January 1, 2014, with higher graduated rates applying to older debts.

Failure to Pay Penalty | Internal Revenue Service - The IRS failure-to-pay penalty is 0.5% of the unpaid taxes for each month or part of a month late, not exceeding 25% of your unpaid taxes, with reduced rates if you have an approved payment plan.

Interest and penalties - Department of Taxation and Finance - NY.gov - New York imposes a 0.5% late payment penalty per month (up to 25%) and a 5% late filing penalty per month (up to 25%), with a minimum penalty of $100 or the tax due if filed more than 60 days late.

dowidth.com

dowidth.com