Alternative credit data includes non-traditional financial information such as utility payments, rental history, and social media activity, enhancing creditworthiness assessment beyond standard credit reports. Peer-to-peer lending data focuses on transaction history and borrower behavior within decentralized lending platforms, providing granular insights into repayment patterns and risk profiles. Explore how these data types transform credit evaluation and lending decisions.

Why it is important

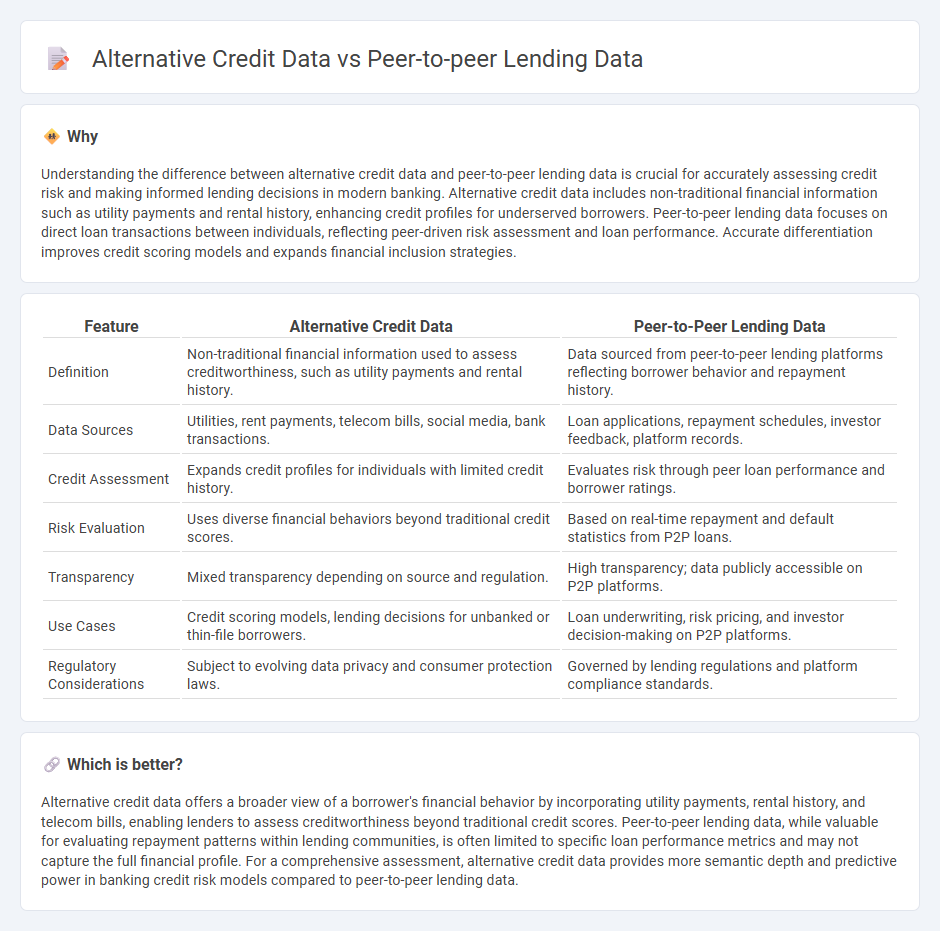

Understanding the difference between alternative credit data and peer-to-peer lending data is crucial for accurately assessing credit risk and making informed lending decisions in modern banking. Alternative credit data includes non-traditional financial information such as utility payments and rental history, enhancing credit profiles for underserved borrowers. Peer-to-peer lending data focuses on direct loan transactions between individuals, reflecting peer-driven risk assessment and loan performance. Accurate differentiation improves credit scoring models and expands financial inclusion strategies.

Comparison Table

| Feature | Alternative Credit Data | Peer-to-Peer Lending Data |

|---|---|---|

| Definition | Non-traditional financial information used to assess creditworthiness, such as utility payments and rental history. | Data sourced from peer-to-peer lending platforms reflecting borrower behavior and repayment history. |

| Data Sources | Utilities, rent payments, telecom bills, social media, bank transactions. | Loan applications, repayment schedules, investor feedback, platform records. |

| Credit Assessment | Expands credit profiles for individuals with limited credit history. | Evaluates risk through peer loan performance and borrower ratings. |

| Risk Evaluation | Uses diverse financial behaviors beyond traditional credit scores. | Based on real-time repayment and default statistics from P2P loans. |

| Transparency | Mixed transparency depending on source and regulation. | High transparency; data publicly accessible on P2P platforms. |

| Use Cases | Credit scoring models, lending decisions for unbanked or thin-file borrowers. | Loan underwriting, risk pricing, and investor decision-making on P2P platforms. |

| Regulatory Considerations | Subject to evolving data privacy and consumer protection laws. | Governed by lending regulations and platform compliance standards. |

Which is better?

Alternative credit data offers a broader view of a borrower's financial behavior by incorporating utility payments, rental history, and telecom bills, enabling lenders to assess creditworthiness beyond traditional credit scores. Peer-to-peer lending data, while valuable for evaluating repayment patterns within lending communities, is often limited to specific loan performance metrics and may not capture the full financial profile. For a comprehensive assessment, alternative credit data provides more semantic depth and predictive power in banking credit risk models compared to peer-to-peer lending data.

Connection

Alternative credit data, including utility payments, rental history, and social media activity, enhances traditional credit assessments by providing a broader financial profile of borrowers. Peer-to-peer lending platforms leverage this data to evaluate creditworthiness, enabling more accurate risk assessment and expanding access to credit for underserved individuals. Integrating alternative data with peer-to-peer lending models drives innovation in banking by fostering inclusivity and improving loan performance.

Key Terms

Borrower Risk Assessment

Peer-to-peer lending data provide direct insights into borrower behavior and repayment history within decentralized platforms, crucial for accurate borrower risk assessment. Alternative credit data, including utility payments, rental histories, and social media activity, expands the risk evaluation spectrum by incorporating non-traditional financial indicators especially for thin-file borrowers. Explore deeper analysis of how combining these data types enhances predictive accuracy in borrower risk assessment.

Non-traditional Data Sources

Peer-to-peer lending relies heavily on alternative credit data such as social media activity, utility payments, and mobile phone usage to assess borrower creditworthiness beyond traditional financial histories. Non-traditional data sources offer richer insights into consumer behavior, enabling more inclusive lending decisions and reduced default rates. Explore how integrating non-traditional data enhances risk assessment models and borrower access in peer-to-peer lending platforms.

Payment History Verification

Peer-to-peer lending platforms utilize payment history verification to assess borrower reliability by analyzing past loan repayments within their network, offering real-time insights inaccessible through traditional credit bureaus. Alternative credit data expands this scope by incorporating non-traditional financial behaviors such as utility payments, rent, and mobile phone bills, enhancing the accuracy of creditworthiness evaluations. Explore how integrating both data types can revolutionize risk assessment and lending decisions in modern finance.

Source and External Links

Dataset from the US Peer-to-peer Lending Platform ... - Mendeley Data - A comprehensive dataset covering LendingClub's US peer-to-peer loans from 2008 to 2019 with over 2.7 million observations including borrower, loan, and state-level economic variables, enabling detailed macroeconomic and cross-sectional analysis.

Peer-to-peer lending to small businesses - Federal Reserve Board - An analysis of Lending Club loan-level data focusing on peer-to-peer lending for small businesses, highlighting loan funding characteristics, interest rate premiums, and delinquency risks compared to traditional loans.

Peer to Peer (P2P) Lending Market Size and Forecast 2025 to 2034 - Market data and forecasts showing the global P2P lending market growing from USD 176.5 billion in 2025 to about USD 1.38 trillion by 2034, driven by AI and machine learning enhancing lending processes and risk assessment.

dowidth.com

dowidth.com