Wealthtech focuses on digital solutions that enhance wealth management, investment advice, and portfolio optimization, leveraging AI and machine learning to provide personalized financial planning. Fintech encompasses a broader range of financial services including payments, lending, and banking innovations aimed at improving accessibility and efficiency. Explore the evolving landscape of banking technology to understand how wealthtech and fintech reshape financial experiences.

Why it is important

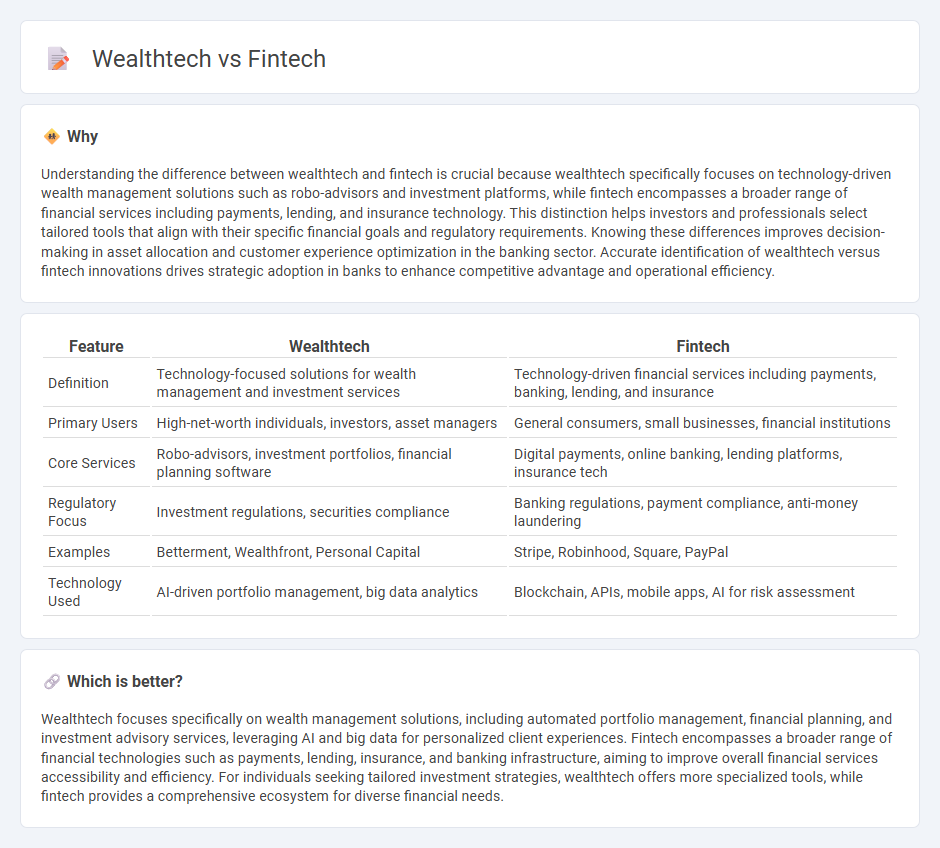

Understanding the difference between wealthtech and fintech is crucial because wealthtech specifically focuses on technology-driven wealth management solutions such as robo-advisors and investment platforms, while fintech encompasses a broader range of financial services including payments, lending, and insurance technology. This distinction helps investors and professionals select tailored tools that align with their specific financial goals and regulatory requirements. Knowing these differences improves decision-making in asset allocation and customer experience optimization in the banking sector. Accurate identification of wealthtech versus fintech innovations drives strategic adoption in banks to enhance competitive advantage and operational efficiency.

Comparison Table

| Feature | Wealthtech | Fintech |

|---|---|---|

| Definition | Technology-focused solutions for wealth management and investment services | Technology-driven financial services including payments, banking, lending, and insurance |

| Primary Users | High-net-worth individuals, investors, asset managers | General consumers, small businesses, financial institutions |

| Core Services | Robo-advisors, investment portfolios, financial planning software | Digital payments, online banking, lending platforms, insurance tech |

| Regulatory Focus | Investment regulations, securities compliance | Banking regulations, payment compliance, anti-money laundering |

| Examples | Betterment, Wealthfront, Personal Capital | Stripe, Robinhood, Square, PayPal |

| Technology Used | AI-driven portfolio management, big data analytics | Blockchain, APIs, mobile apps, AI for risk assessment |

Which is better?

Wealthtech focuses specifically on wealth management solutions, including automated portfolio management, financial planning, and investment advisory services, leveraging AI and big data for personalized client experiences. Fintech encompasses a broader range of financial technologies such as payments, lending, insurance, and banking infrastructure, aiming to improve overall financial services accessibility and efficiency. For individuals seeking tailored investment strategies, wealthtech offers more specialized tools, while fintech provides a comprehensive ecosystem for diverse financial needs.

Connection

Wealthtech and fintech intersect by utilizing advanced digital platforms to enhance financial services, enabling personalized wealth management and streamlined banking operations. Both sectors leverage artificial intelligence, big data analytics, and mobile technology to offer efficient investment solutions and real-time financial insights. The integration of these technologies drives innovation in banking by improving customer experience and expanding access to automated financial advisory services.

Key Terms

Digital Payments

Fintech and wealthtech both drive innovation in digital payments, with fintech offering broad solutions across transactions, remittances, and mobile wallets, while wealthtech integrates digital payment capabilities within investment and asset management platforms. Payment processing speed, security features such as encryption, and seamless user interfaces are essential in both sectors to enhance customer experience. Explore how these evolving technologies are transforming financial interactions and investment payments.

Robo-Advisors

Fintech encompasses a broad range of financial technologies including payments, lending, and insurance, while wealthtech specifically targets digital solutions for wealth management such as robo-advisors. Robo-advisors utilize algorithms and AI to provide automated, low-cost investment advice and portfolio management, making wealthtech innovations more accessible to a wider audience. Explore how robo-advisors are transforming wealth management by delivering personalized, efficient investment strategies.

Personal Finance Management

Fintech encompasses a broad range of financial technologies, including payment processing, lending, and personal finance management (PFM) tools designed to help individuals budget, track expenses, and plan savings efficiently. Wealthtech, a specialized subset of fintech, focuses primarily on investment management, portfolio optimization, and automated financial advisory services tailored for wealth accumulation and preservation. Explore the nuances between fintech and wealthtech to understand their distinct roles in transforming personal finance management.

Source and External Links

What is Fintech? | IBM - Fintech, or financial technology, refers to mobile apps, software, and other technologies enabling users and enterprises to access financial services like personal finance management, investing, lending, and the use of AI to help make smarter financial decisions.

What is fintech? 6 main types of fintech and how they work - Plaid - Fintech includes a broad range of services such as digital banking (neobanks), cashless payments, and tools that improve financial access, with payment volumes rising significantly and enhancing convenience for consumers and businesses.

Innovation, fintech and AI - Bank for International Settlements - Fintech represents technology-enabled innovation transforming financial services and the global economy, influencing everything from payments to monetary policy, with central banks actively engaging in its evolving role.

dowidth.com

dowidth.com