Hyperpersonalization in banking leverages detailed customer data to tailor individual financial products and services, enhancing customer satisfaction and loyalty. AI-driven recommendations analyze transactional behavior and predictive analytics to offer timely, relevant financial advice and product suggestions. Explore how these advanced technologies are transforming personalized banking experiences.

Why it is important

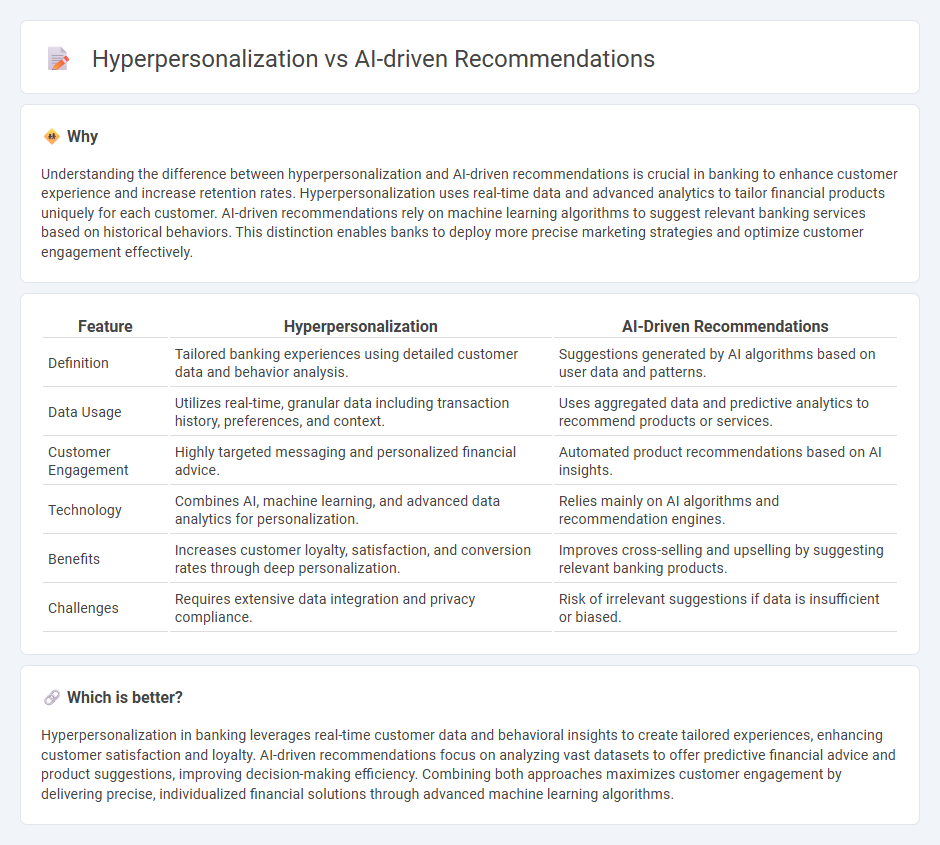

Understanding the difference between hyperpersonalization and AI-driven recommendations is crucial in banking to enhance customer experience and increase retention rates. Hyperpersonalization uses real-time data and advanced analytics to tailor financial products uniquely for each customer. AI-driven recommendations rely on machine learning algorithms to suggest relevant banking services based on historical behaviors. This distinction enables banks to deploy more precise marketing strategies and optimize customer engagement effectively.

Comparison Table

| Feature | Hyperpersonalization | AI-Driven Recommendations |

|---|---|---|

| Definition | Tailored banking experiences using detailed customer data and behavior analysis. | Suggestions generated by AI algorithms based on user data and patterns. |

| Data Usage | Utilizes real-time, granular data including transaction history, preferences, and context. | Uses aggregated data and predictive analytics to recommend products or services. |

| Customer Engagement | Highly targeted messaging and personalized financial advice. | Automated product recommendations based on AI insights. |

| Technology | Combines AI, machine learning, and advanced data analytics for personalization. | Relies mainly on AI algorithms and recommendation engines. |

| Benefits | Increases customer loyalty, satisfaction, and conversion rates through deep personalization. | Improves cross-selling and upselling by suggesting relevant banking products. |

| Challenges | Requires extensive data integration and privacy compliance. | Risk of irrelevant suggestions if data is insufficient or biased. |

Which is better?

Hyperpersonalization in banking leverages real-time customer data and behavioral insights to create tailored experiences, enhancing customer satisfaction and loyalty. AI-driven recommendations focus on analyzing vast datasets to offer predictive financial advice and product suggestions, improving decision-making efficiency. Combining both approaches maximizes customer engagement by delivering precise, individualized financial solutions through advanced machine learning algorithms.

Connection

Hyperpersonalization in banking leverages AI-driven recommendations to analyze vast amounts of customer data, enabling tailored financial products and services that meet individual needs. Machine learning algorithms identify patterns in spending habits, credit scores, and investment preferences to deliver predictive insights that enhance customer engagement and satisfaction. This integration improves risk management while fostering personalized experiences that drive loyalty and revenue growth in the banking sector.

Key Terms

Predictive Analytics

AI-driven recommendations leverage machine learning algorithms to analyze user behavior and preferences, providing tailored suggestions that increase engagement and conversion rates. Hyperpersonalization employs predictive analytics to anticipate individual needs in real-time, delivering contextually relevant experiences by integrating diverse data sources such as browsing history, purchase patterns, and social media activity. Explore the nuances of predictive analytics to unlock the full potential of personalized marketing strategies.

Customer Segmentation

AI-driven recommendations enhance customer segmentation by analyzing large datasets to identify patterns and preferences, enabling tailored product suggestions that improve engagement. Hyperpersonalization goes beyond segmentation by leveraging real-time data and advanced machine learning algorithms to deliver individualized experiences across channels. Explore how integrating these technologies can revolutionize your customer engagement strategies.

Real-time Personalization

AI-driven recommendations utilize machine learning algorithms to analyze user behavior and preferences, delivering tailored content and product suggestions. Hyperpersonalization takes this further by integrating real-time data such as location, time, and device to create highly contextualized experiences. Explore how real-time personalization transforms customer engagement and boosts conversion rates.

Source and External Links

Complete Guide to AI-Based Recommendations - Tealium - AI-based recommendations are personalized suggestions generated by algorithms analyzing user data like browsing history and purchases to enhance customer experiences and engagement.

This is how AI powers content recommendation - Algolia Blog - AI-powered recommendation systems analyze user interactions, learn preferences, and use advanced techniques like natural language processing to deliver real-time, context-aware content and product suggestions.

AI-based recommendation system: Types, use cases, development - AI-driven recommendation systems use collaborative filtering and other machine learning models to predict user preferences by comparing behavior patterns across large datasets, enabling accurate, scalable suggestions for products or content.

dowidth.com

dowidth.com