Composable banking allows financial institutions to create customized banking solutions by integrating best-of-breed components via APIs, offering unmatched flexibility and speed in product innovation. Modular banking, on the other hand, relies on pre-built modules within a core banking system that can be activated or deactivated, simplifying maintenance but potentially limiting agility. Discover how these approaches transform the future of banking technology and customer experience.

Why it is important

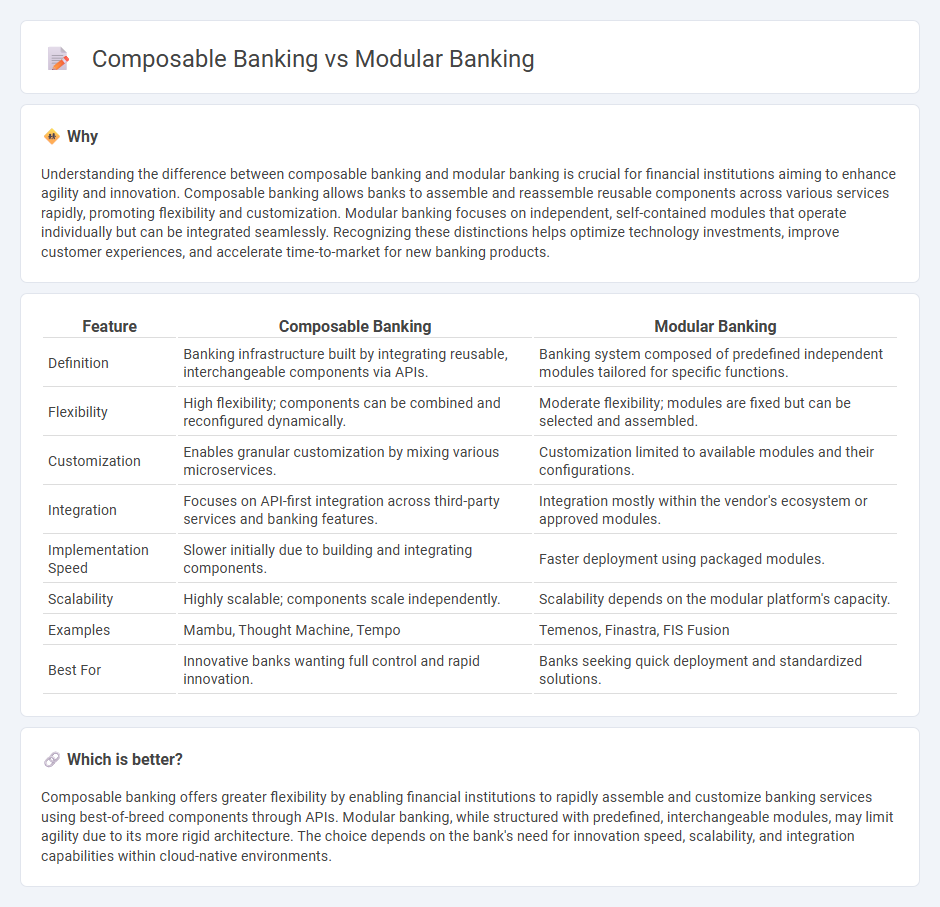

Understanding the difference between composable banking and modular banking is crucial for financial institutions aiming to enhance agility and innovation. Composable banking allows banks to assemble and reassemble reusable components across various services rapidly, promoting flexibility and customization. Modular banking focuses on independent, self-contained modules that operate individually but can be integrated seamlessly. Recognizing these distinctions helps optimize technology investments, improve customer experiences, and accelerate time-to-market for new banking products.

Comparison Table

| Feature | Composable Banking | Modular Banking |

|---|---|---|

| Definition | Banking infrastructure built by integrating reusable, interchangeable components via APIs. | Banking system composed of predefined independent modules tailored for specific functions. |

| Flexibility | High flexibility; components can be combined and reconfigured dynamically. | Moderate flexibility; modules are fixed but can be selected and assembled. |

| Customization | Enables granular customization by mixing various microservices. | Customization limited to available modules and their configurations. |

| Integration | Focuses on API-first integration across third-party services and banking features. | Integration mostly within the vendor's ecosystem or approved modules. |

| Implementation Speed | Slower initially due to building and integrating components. | Faster deployment using packaged modules. |

| Scalability | Highly scalable; components scale independently. | Scalability depends on the modular platform's capacity. |

| Examples | Mambu, Thought Machine, Tempo | Temenos, Finastra, FIS Fusion |

| Best For | Innovative banks wanting full control and rapid innovation. | Banks seeking quick deployment and standardized solutions. |

Which is better?

Composable banking offers greater flexibility by enabling financial institutions to rapidly assemble and customize banking services using best-of-breed components through APIs. Modular banking, while structured with predefined, interchangeable modules, may limit agility due to its more rigid architecture. The choice depends on the bank's need for innovation speed, scalability, and integration capabilities within cloud-native environments.

Connection

Composable banking and modular banking are interconnected through their focus on flexibility and scalability in financial services architecture. Composable banking leverages modular banking components as interchangeable building blocks, allowing banks to customize and rapidly deploy new products and services. This synergy enhances operational efficiency, accelerates innovation, and improves customer experience in the digital banking ecosystem.

Key Terms

Microservices

Microservices architecture in modular banking enables independent deployment of discrete functions, improving scalability and flexibility in financial services. Composable banking leverages microservices to create customizable, interoperable banking components for rapid innovation and personalized customer experiences. Explore the differences and advantages of these approaches to transform your banking operations.

APIs

Modular banking utilizes pre-built, standardized components to simplify integration and accelerate deployment, while composable banking emphasizes highly customizable, API-driven architecture for granular control over services. APIs play a critical role in both approaches, enabling banks to mix and match functionalities and rapidly innovate in response to market demands. Explore how API strategies shape the future of banking technology and customer experience.

Interoperability

Modular banking enables financial institutions to integrate pre-built, standalone modules for specific functions, ensuring basic interoperability within existing banking systems. Composable banking advances this concept by using APIs and microservices to create fully customizable, interoperable platforms that easily connect with diverse third-party solutions. Explore deeper insights into how interoperability drives innovation and agility in modern banking architectures.

Source and External Links

Modular Banking: A Simple Guide - Modular banking breaks down banking functions into independent software modules that can be integrated easily, allowing banks and fintechs to offer services like loan origination or fraud detection without building them from scratch.

Next-Level Banking with Modular Architecture - Modular banking architecture enables banks to act in four roles: integrator, producer, distributor, and platform, revolutionizing service distribution and creation in the banking industry.

Modular Financial Services - Modular financial services involve separating distribution platforms from product providers, enabling customers to access a wide range of specialized firms supplying different financial services, creating more choice and transparency.

dowidth.com

dowidth.com