Hyperpersonalization in banking uses advanced data analytics and AI to tailor financial products and services to individual customer preferences, enhancing engagement and satisfaction. Digital onboarding streamlines the account opening process through seamless identity verification and intuitive interfaces, reducing friction and improving conversion rates. Explore how these innovations transform customer experiences and drive growth in modern banking.

Why it is important

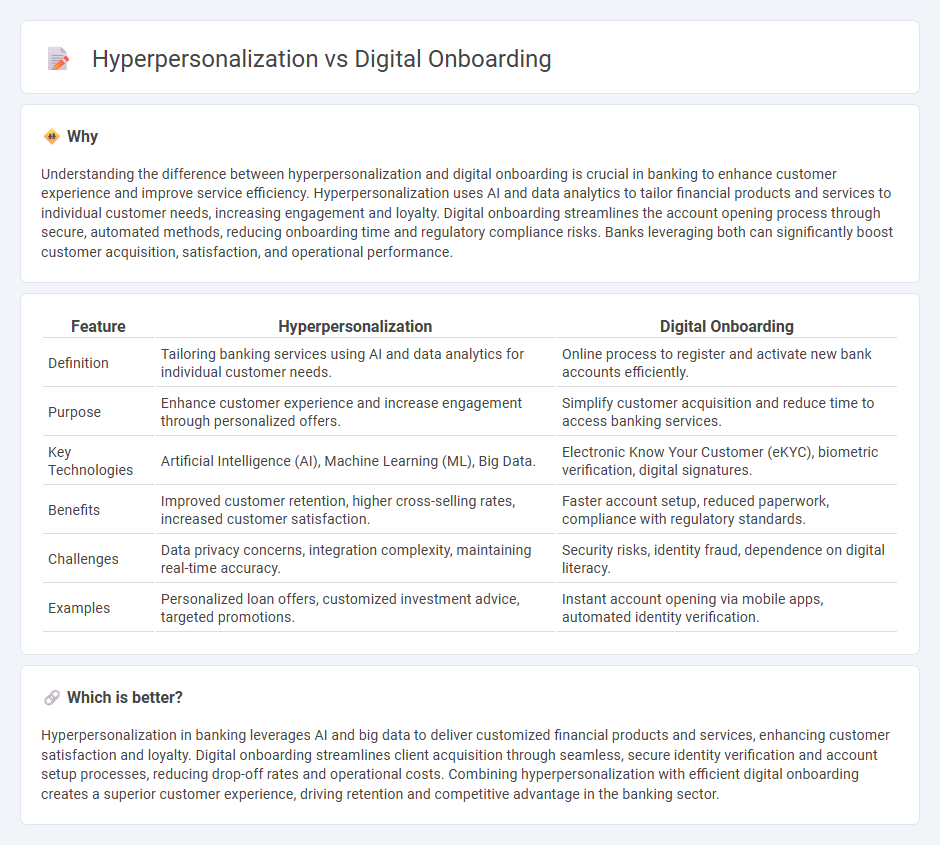

Understanding the difference between hyperpersonalization and digital onboarding is crucial in banking to enhance customer experience and improve service efficiency. Hyperpersonalization uses AI and data analytics to tailor financial products and services to individual customer needs, increasing engagement and loyalty. Digital onboarding streamlines the account opening process through secure, automated methods, reducing onboarding time and regulatory compliance risks. Banks leveraging both can significantly boost customer acquisition, satisfaction, and operational performance.

Comparison Table

| Feature | Hyperpersonalization | Digital Onboarding |

|---|---|---|

| Definition | Tailoring banking services using AI and data analytics for individual customer needs. | Online process to register and activate new bank accounts efficiently. |

| Purpose | Enhance customer experience and increase engagement through personalized offers. | Simplify customer acquisition and reduce time to access banking services. |

| Key Technologies | Artificial Intelligence (AI), Machine Learning (ML), Big Data. | Electronic Know Your Customer (eKYC), biometric verification, digital signatures. |

| Benefits | Improved customer retention, higher cross-selling rates, increased customer satisfaction. | Faster account setup, reduced paperwork, compliance with regulatory standards. |

| Challenges | Data privacy concerns, integration complexity, maintaining real-time accuracy. | Security risks, identity fraud, dependence on digital literacy. |

| Examples | Personalized loan offers, customized investment advice, targeted promotions. | Instant account opening via mobile apps, automated identity verification. |

Which is better?

Hyperpersonalization in banking leverages AI and big data to deliver customized financial products and services, enhancing customer satisfaction and loyalty. Digital onboarding streamlines client acquisition through seamless, secure identity verification and account setup processes, reducing drop-off rates and operational costs. Combining hyperpersonalization with efficient digital onboarding creates a superior customer experience, driving retention and competitive advantage in the banking sector.

Connection

Hyperpersonalization in banking leverages data analytics and AI to tailor financial products and services to individual customer needs, enhancing user experience and satisfaction. Digital onboarding utilizes seamless, user-friendly technology to verify identity and gather customer information efficiently, providing a foundation for hyperpersonalized services. Together, these technologies streamline customer acquisition while delivering customized banking solutions that increase engagement and loyalty.

Key Terms

**Digital Onboarding:**

Digital onboarding streamlines customer integration by leveraging automated verification, secure identity authentication, and intuitive user interfaces to reduce friction and accelerate account setup. Enhanced by AI-driven analytics, it ensures compliance with regulatory standards such as KYC and AML while delivering a seamless, user-centric experience. Discover how cutting-edge digital onboarding technologies transform client acquisition and retention.

eKYC

Digital onboarding streamlines customer identity verification by integrating electronic Know Your Customer (eKYC) processes, reducing manual paperwork and accelerating account activation. Hyperpersonalization leverages data analytics and AI to tailor onboarding experiences, enhancing user engagement and compliance accuracy through personalized verification steps. Explore how combining digital onboarding with hyperpersonalization can transform your eKYC strategy for improved customer satisfaction and regulatory adherence.

Biometric Authentication

Digital onboarding leverages biometric authentication techniques such as fingerprint scanning, facial recognition, and voice identification to enhance user verification accuracy and security. Hyperpersonalization integrates biometric data with AI-driven insights to tailor the onboarding experience uniquely to each user's behavior and preferences. Discover how combining biometric authentication with hyperpersonalization can revolutionize user engagement and streamline digital onboarding processes.

Source and External Links

Digital Onboarding: How to Do It Right - Dropbox.com - Digital onboarding uses online tools to streamline the process of integrating new employees by automating paperwork, enabling electronic signatures, and offering flexible remote onboarding instead of in-person sessions.

Digital Onboarding | Entrust - Entrust's digital onboarding solution focuses on secure, seamless customer account creation, leveraging identity verification and eKYC to reduce fraud, lower abandonment rates, and foster trust in the brand.

Digital Onboarding - Q2 - Q2's platform delivers a fully digital, omnichannel account opening and onboarding experience, designed to increase conversion, deepen customer engagement, and maximize revenue through intuitive, personalized journeys.

dowidth.com

dowidth.com