Social trading enables investors to replicate or follow the trades of experienced market participants through digital platforms, offering transparency and community-driven market insights. Discretionary trading relies on the trader's expertise and judgment to make individual decisions based on market analysis and intuition without algorithmic constraints. Discover how these distinct trading approaches can fit your financial goals and risk tolerance.

Why it is important

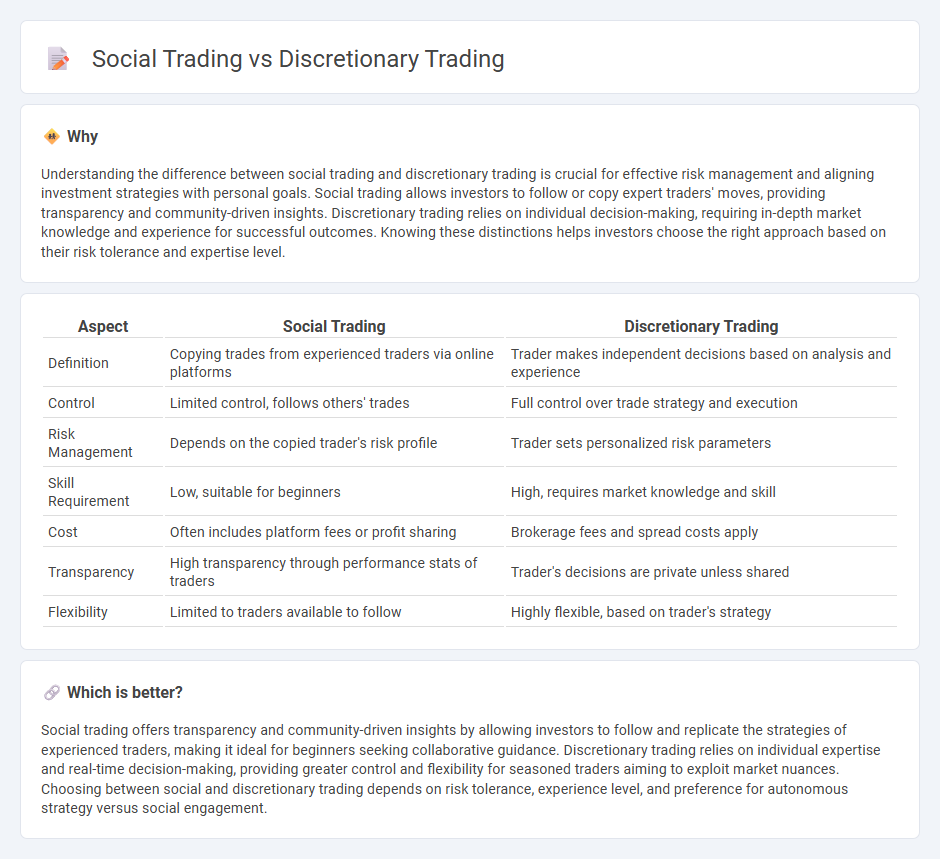

Understanding the difference between social trading and discretionary trading is crucial for effective risk management and aligning investment strategies with personal goals. Social trading allows investors to follow or copy expert traders' moves, providing transparency and community-driven insights. Discretionary trading relies on individual decision-making, requiring in-depth market knowledge and experience for successful outcomes. Knowing these distinctions helps investors choose the right approach based on their risk tolerance and expertise level.

Comparison Table

| Aspect | Social Trading | Discretionary Trading |

|---|---|---|

| Definition | Copying trades from experienced traders via online platforms | Trader makes independent decisions based on analysis and experience |

| Control | Limited control, follows others' trades | Full control over trade strategy and execution |

| Risk Management | Depends on the copied trader's risk profile | Trader sets personalized risk parameters |

| Skill Requirement | Low, suitable for beginners | High, requires market knowledge and skill |

| Cost | Often includes platform fees or profit sharing | Brokerage fees and spread costs apply |

| Transparency | High transparency through performance stats of traders | Trader's decisions are private unless shared |

| Flexibility | Limited to traders available to follow | Highly flexible, based on trader's strategy |

Which is better?

Social trading offers transparency and community-driven insights by allowing investors to follow and replicate the strategies of experienced traders, making it ideal for beginners seeking collaborative guidance. Discretionary trading relies on individual expertise and real-time decision-making, providing greater control and flexibility for seasoned traders aiming to exploit market nuances. Choosing between social and discretionary trading depends on risk tolerance, experience level, and preference for autonomous strategy versus social engagement.

Connection

Social trading leverages collective market insights from multiple traders to inform decision-making, while discretionary trading relies on individual expertise and judgment. Both methods intersect when discretionary traders observe and adapt strategies based on trends and signals derived from social trading platforms. This synergy enhances risk management and potential returns by combining crowd wisdom with personalized analysis.

Key Terms

Autonomy

Discretionary trading offers complete autonomy, allowing traders to rely on their own judgment and experience to make decisions without algorithmic intervention. Social trading, however, blends personal discretion with communal insights by enabling traders to mirror the strategies of experienced investors, reducing individual risk. Explore more to understand which trading style best suits your autonomy needs and investment goals.

Copy Trading

Discretionary trading relies on individual trader analysis and decision-making, whereas social trading enables investors to replicate expert strategies automatically, with copy trading being a key component that links followers to experienced traders. Copy trading platforms facilitate real-time strategy replication, allowing less experienced investors to gain exposure to professional insights without extensive market knowledge. Explore how copy trading can transform your investment approach by understanding the benefits and risks involved.

Strategy Sharing

Discretionary trading relies on individual judgment and real-time decision-making, enabling traders to adjust strategies based on market conditions and personal insights. Social trading emphasizes strategy sharing by allowing participants to follow, replicate, or learn from the trades and techniques of experienced investors within a community. Explore how strategy sharing in social trading can enhance your trading approach and offer collaborative advantages.

Source and External Links

What is Discretionary Trading? | FBS Glossary - Discretionary trading involves directly controlling trades based on intuition and understanding of current market conditions, allowing for adaptability and quick decision-making.

Mechanical Trading Strategies Vs. Discretionary Trading Strategies - Discretionary trading strategies are decision-based approaches where traders decide which trades to take based on current market conditions and their judgment.

Discretionary Trading: Strategies for Savvy Investors - Discretionary trading allows investors to use their judgment, mixing market analysis with intuition to quickly adjust to new market situations.

dowidth.com

dowidth.com