Sustainable finance integrates environmental, social, and governance (ESG) criteria into financial decision-making to promote long-term economic growth and responsible resource use. Impact investing specifically targets projects and companies that generate measurable positive social and environmental outcomes alongside financial returns. Discover more about how these strategies shape the future of banking and investment.

Why it is important

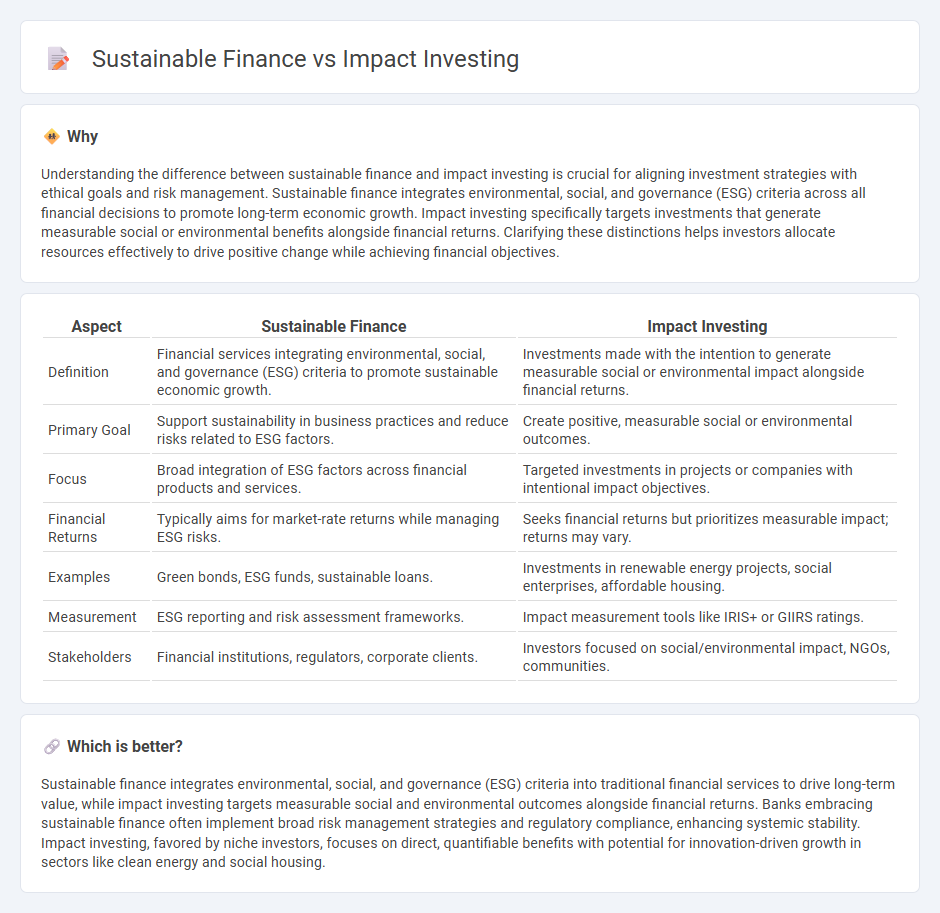

Understanding the difference between sustainable finance and impact investing is crucial for aligning investment strategies with ethical goals and risk management. Sustainable finance integrates environmental, social, and governance (ESG) criteria across all financial decisions to promote long-term economic growth. Impact investing specifically targets investments that generate measurable social or environmental benefits alongside financial returns. Clarifying these distinctions helps investors allocate resources effectively to drive positive change while achieving financial objectives.

Comparison Table

| Aspect | Sustainable Finance | Impact Investing |

|---|---|---|

| Definition | Financial services integrating environmental, social, and governance (ESG) criteria to promote sustainable economic growth. | Investments made with the intention to generate measurable social or environmental impact alongside financial returns. |

| Primary Goal | Support sustainability in business practices and reduce risks related to ESG factors. | Create positive, measurable social or environmental outcomes. |

| Focus | Broad integration of ESG factors across financial products and services. | Targeted investments in projects or companies with intentional impact objectives. |

| Financial Returns | Typically aims for market-rate returns while managing ESG risks. | Seeks financial returns but prioritizes measurable impact; returns may vary. |

| Examples | Green bonds, ESG funds, sustainable loans. | Investments in renewable energy projects, social enterprises, affordable housing. |

| Measurement | ESG reporting and risk assessment frameworks. | Impact measurement tools like IRIS+ or GIIRS ratings. |

| Stakeholders | Financial institutions, regulators, corporate clients. | Investors focused on social/environmental impact, NGOs, communities. |

Which is better?

Sustainable finance integrates environmental, social, and governance (ESG) criteria into traditional financial services to drive long-term value, while impact investing targets measurable social and environmental outcomes alongside financial returns. Banks embracing sustainable finance often implement broad risk management strategies and regulatory compliance, enhancing systemic stability. Impact investing, favored by niche investors, focuses on direct, quantifiable benefits with potential for innovation-driven growth in sectors like clean energy and social housing.

Connection

Sustainable finance integrates environmental, social, and governance (ESG) criteria into financial services, promoting investments that support long-term ecological and social well-being. Impact investing explicitly targets measurable positive social or environmental outcomes alongside financial returns, aligning closely with sustainable finance goals. Both approaches drive capital toward projects like renewable energy, affordable housing, and sustainable agriculture, fostering systemic change in banking and investment practices.

Key Terms

ESG Criteria

Impact investing directly targets measurable social and environmental outcomes alongside financial returns, emphasizing specific ESG criteria such as carbon footprint reduction and social impact metrics. Sustainable finance integrates ESG considerations into traditional investment analysis, promoting long-term value creation by assessing risks related to environmental sustainability, social responsibility, and governance practices. Explore deeper insights into how these approaches shape responsible investment strategies and drive positive change.

Social Return

Impact investing prioritizes measurable social and environmental benefits alongside financial returns, emphasizing Social Return on Investment (SROI) to evaluate positive community outcomes. Sustainable finance integrates environmental, social, and governance (ESG) criteria to promote long-term economic stability while managing risks, with less direct focus on quantifying social impact compared to impact investing. Explore how impact investing and sustainable finance uniquely drive social value and financial performance.

Green Bonds

Green bonds represent a pivotal instrument in sustainable finance, channeling capital specifically into projects with environmental benefits such as renewable energy, clean transportation, and climate change mitigation. Impact investing, while also targeting positive social and environmental outcomes, often emphasizes measurable effects and can extend beyond environmental goals to areas like social justice and community development. Explore how green bonds uniquely drive sustainable finance by combining financial returns with tangible ecological impact.

Source and External Links

What you need to know about impact investing - The GIIN - Impact investing involves making investments with the intention to generate positive, measurable social or environmental impact alongside financial returns, spanning various sectors like energy, healthcare, and sustainable agriculture with flexible return expectations depending on investor goals.

What Is Impact Investing? | NPTrust - Impact investing leverages capital to achieve positive social or environmental change while generating financial returns and is rapidly growing, reaching an estimated $1.2 trillion market in 2022 and projected to hit $6 trillion by 2031.

What is Impact Investing? | Fidelity Charitable - Impact investing aligns investments with personal values to produce social or environmental benefits alongside financial gains, driven by growing interest from millennials, women, and institutional investors.

dowidth.com

dowidth.com