A regulatory sandbox provides a structured space where financial technology firms can test innovative products under regulatory supervision without full compliance burden. In contrast, a controlled testing environment offers a more restricted setting focused on operational and security testing within predefined parameters. Explore further to understand the distinct benefits and applications of both frameworks in banking innovation.

Why it is important

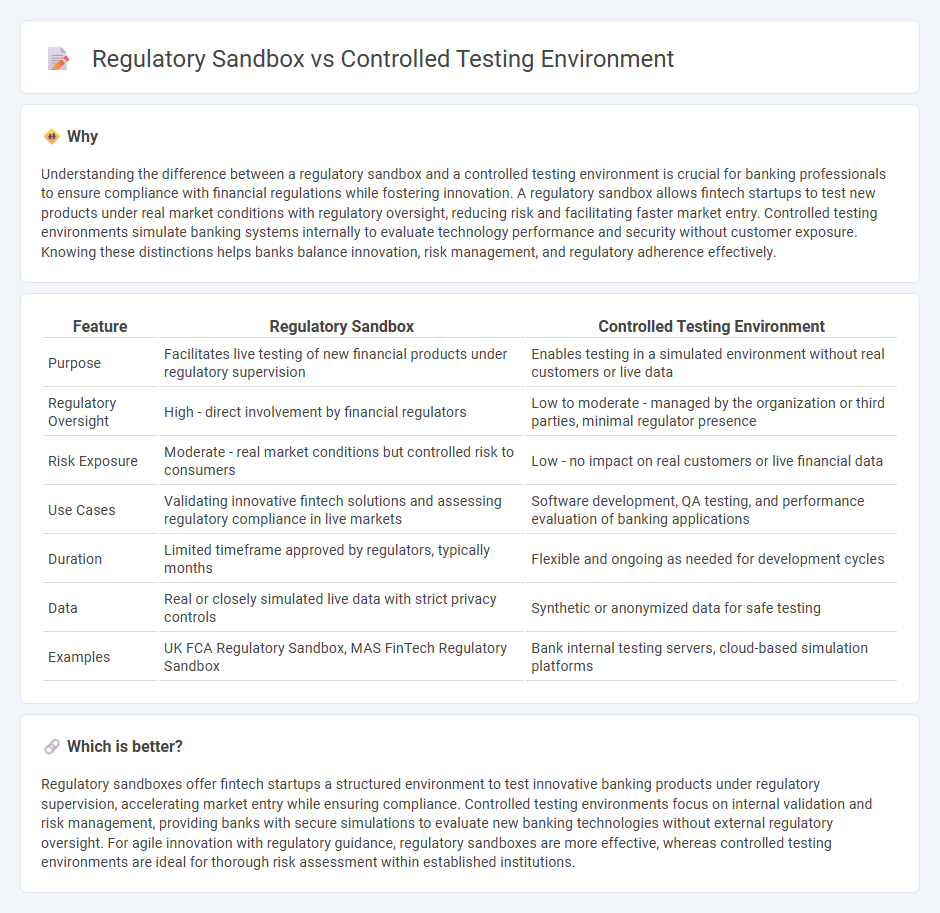

Understanding the difference between a regulatory sandbox and a controlled testing environment is crucial for banking professionals to ensure compliance with financial regulations while fostering innovation. A regulatory sandbox allows fintech startups to test new products under real market conditions with regulatory oversight, reducing risk and facilitating faster market entry. Controlled testing environments simulate banking systems internally to evaluate technology performance and security without customer exposure. Knowing these distinctions helps banks balance innovation, risk management, and regulatory adherence effectively.

Comparison Table

| Feature | Regulatory Sandbox | Controlled Testing Environment |

|---|---|---|

| Purpose | Facilitates live testing of new financial products under regulatory supervision | Enables testing in a simulated environment without real customers or live data |

| Regulatory Oversight | High - direct involvement by financial regulators | Low to moderate - managed by the organization or third parties, minimal regulator presence |

| Risk Exposure | Moderate - real market conditions but controlled risk to consumers | Low - no impact on real customers or live financial data |

| Use Cases | Validating innovative fintech solutions and assessing regulatory compliance in live markets | Software development, QA testing, and performance evaluation of banking applications |

| Duration | Limited timeframe approved by regulators, typically months | Flexible and ongoing as needed for development cycles |

| Data | Real or closely simulated live data with strict privacy controls | Synthetic or anonymized data for safe testing |

| Examples | UK FCA Regulatory Sandbox, MAS FinTech Regulatory Sandbox | Bank internal testing servers, cloud-based simulation platforms |

Which is better?

Regulatory sandboxes offer fintech startups a structured environment to test innovative banking products under regulatory supervision, accelerating market entry while ensuring compliance. Controlled testing environments focus on internal validation and risk management, providing banks with secure simulations to evaluate new banking technologies without external regulatory oversight. For agile innovation with regulatory guidance, regulatory sandboxes are more effective, whereas controlled testing environments are ideal for thorough risk assessment within established institutions.

Connection

Regulatory sandboxes enable banks and fintech firms to test innovative financial products and services in a controlled testing environment under regulatory supervision. These environments minimize risks by allowing real-world experimentation with temporary regulatory relaxations while ensuring consumer protection. The integration of sandboxes with controlled testing fosters innovation, compliance, and faster market entry in the banking sector.

Key Terms

Risk Management

A controlled testing environment allows fintech companies to rigorously assess risk management strategies by simulating real-world scenarios without regulatory penalties, ensuring comprehensive identification and mitigation of potential threats. Regulatory sandboxes provide an authorized space for innovation under close regulatory oversight, enabling firms to test products while ensuring compliance and managing risks in a live market context. Explore the nuances of both frameworks to enhance your risk management approach effectively.

Compliance

A controlled testing environment allows businesses to validate products under restricted conditions with full regulatory oversight, ensuring compliance with legal standards before market release. Regulatory sandboxes offer a more flexible framework where innovations can be tested in real-world scenarios with temporary exemptions from certain regulations, promoting compliance through iterative learning and adaptation. Explore the differences and benefits of both approaches to optimize your regulatory strategy.

Innovation

A controlled testing environment offers innovators a secure setting to experiment with new technologies and business models under predefined conditions, minimizing risks while gathering valuable data. Regulatory sandboxes provide a dynamic framework where innovative products are tested in real market conditions with regulatory oversight, facilitating faster adaptation and compliance. Explore how each approach accelerates innovation and reshapes industry standards by learning more about their unique advantages.

Source and External Links

The Importance of Controlled Environment Testing - OpsMatters - Controlled environment testing involves conducting experiments in isolated settings where variables are carefully monitored to ensure accurate, reliable, and regulatory-compliant product development, which helps detect issues early and maintain customer trust.

Test Environment Strategies for High-Quality Software Delivery - A controlled test environment is a reproducible setup including hardware and software where software is rigorously tested to identify defects under stable conditions, enabling QA teams to verify requirements and minimize deployment risks.

Test environment: A guide to managing your testing - Testim.io - A test environment is a controlled server setup configured with specific data, hardware, and software to systematically execute test cases, with emphasis on documentation and automation to ensure replicability and effective management across multiple environments.

dowidth.com

dowidth.com