Open banking enhances financial services by enabling banks to securely share customer data with third-party providers through APIs, fostering innovation and personalized offerings. Decentralized finance (DeFi) operates on blockchain technology, allowing peer-to-peer financial transactions without intermediaries, increasing transparency and reducing costs. Explore the distinctions and advantages of open banking and DeFi to understand the future of financial ecosystems.

Why it is important

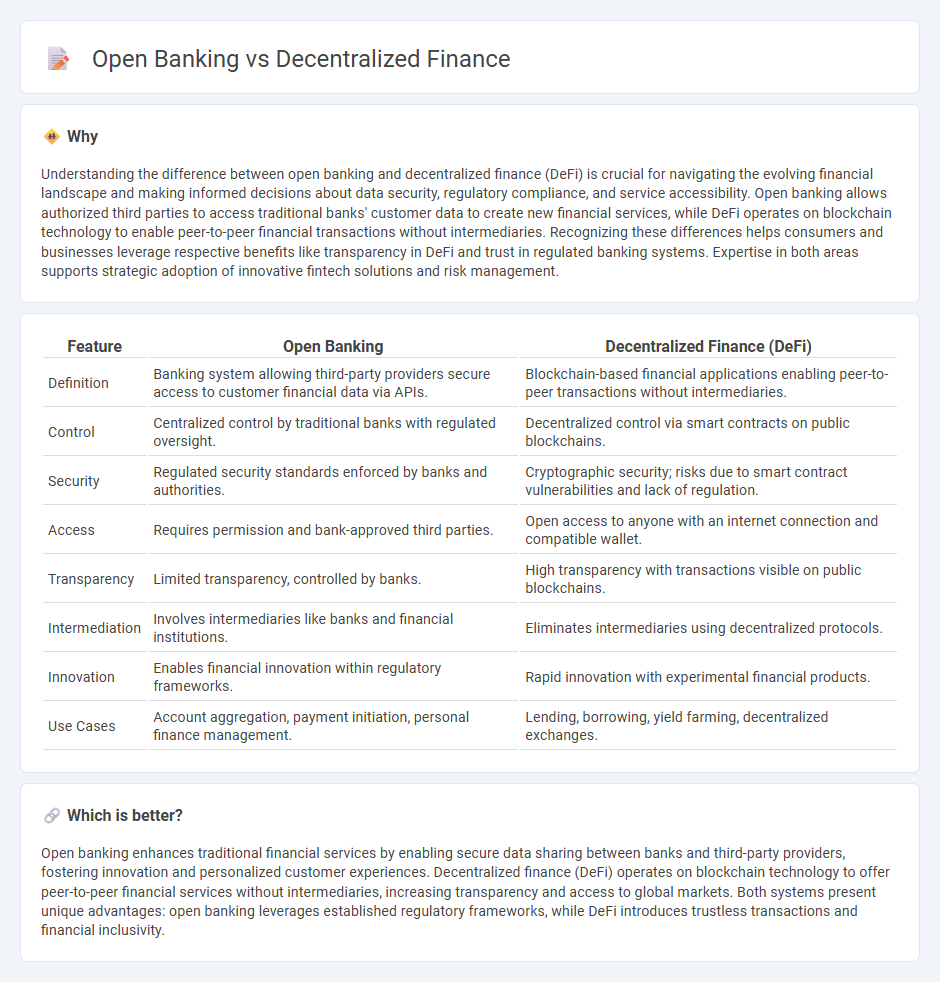

Understanding the difference between open banking and decentralized finance (DeFi) is crucial for navigating the evolving financial landscape and making informed decisions about data security, regulatory compliance, and service accessibility. Open banking allows authorized third parties to access traditional banks' customer data to create new financial services, while DeFi operates on blockchain technology to enable peer-to-peer financial transactions without intermediaries. Recognizing these differences helps consumers and businesses leverage respective benefits like transparency in DeFi and trust in regulated banking systems. Expertise in both areas supports strategic adoption of innovative fintech solutions and risk management.

Comparison Table

| Feature | Open Banking | Decentralized Finance (DeFi) |

|---|---|---|

| Definition | Banking system allowing third-party providers secure access to customer financial data via APIs. | Blockchain-based financial applications enabling peer-to-peer transactions without intermediaries. |

| Control | Centralized control by traditional banks with regulated oversight. | Decentralized control via smart contracts on public blockchains. |

| Security | Regulated security standards enforced by banks and authorities. | Cryptographic security; risks due to smart contract vulnerabilities and lack of regulation. |

| Access | Requires permission and bank-approved third parties. | Open access to anyone with an internet connection and compatible wallet. |

| Transparency | Limited transparency, controlled by banks. | High transparency with transactions visible on public blockchains. |

| Intermediation | Involves intermediaries like banks and financial institutions. | Eliminates intermediaries using decentralized protocols. |

| Innovation | Enables financial innovation within regulatory frameworks. | Rapid innovation with experimental financial products. |

| Use Cases | Account aggregation, payment initiation, personal finance management. | Lending, borrowing, yield farming, decentralized exchanges. |

Which is better?

Open banking enhances traditional financial services by enabling secure data sharing between banks and third-party providers, fostering innovation and personalized customer experiences. Decentralized finance (DeFi) operates on blockchain technology to offer peer-to-peer financial services without intermediaries, increasing transparency and access to global markets. Both systems present unique advantages: open banking leverages established regulatory frameworks, while DeFi introduces trustless transactions and financial inclusivity.

Connection

Open banking leverages API technology to enable secure data sharing between financial institutions and third-party developers, fostering innovation in financial services. Decentralized finance (DeFi) builds on this concept by utilizing blockchain technology to create transparent, permissionless financial ecosystems without traditional intermediaries. Together, they revolutionize banking by enhancing accessibility, reducing costs, and promoting financial inclusion through interconnected digital platforms.

Key Terms

**Decentralized Finance:**

Decentralized Finance (DeFi) leverages blockchain technology to create financial services without centralized intermediaries, enabling peer-to-peer transactions and increased financial inclusion. Key components of DeFi include smart contracts, decentralized exchanges (DEXs), and yield farming, which provide transparency and reduced transaction costs compared to traditional banking systems. Explore more about how DeFi is transforming global finance and its potential to reshape financial accessibility.

Smart Contracts

Smart contracts automate transactions and enforce agreements in decentralized finance (DeFi), eliminating intermediaries and enhancing transparency through blockchain technology. Open banking leverages APIs to share financial data securely among institutions but relies on centralized governance without smart contract automation. Explore how smart contracts revolutionize financial ecosystems by visiting our detailed analysis.

Blockchain

Decentralized finance (DeFi) leverages blockchain technology to create a transparent, secure financial ecosystem without intermediaries, enabling peer-to-peer transactions and smart contract automation. Open banking, on the other hand, uses APIs to allow third-party developers to build applications and services around traditional bank data, promoting innovation while still relying on centralized financial institutions. Explore the transformative impact of blockchain on financial services to understand how DeFi and open banking are reshaping the industry.

Source and External Links

Decentralized finance - Decentralized finance (DeFi) provides financial instruments and services through smart contracts on permissionless blockchains, eliminating the need for traditional intermediaries like banks and brokerages.

The Technology of Decentralized Finance (DeFi) - DeFi leverages distributed ledger technologies to offer lending, investing, and trading services without centralized intermediaries, using programmable smart contracts to automate financial operations.

What is DeFi? - DeFi is a global, peer-to-peer suite of financial services on public blockchains that enables activities like earning interest, borrowing, lending, and trading assets quickly and without traditional paperwork or third-party approval.

dowidth.com

dowidth.com