Real-time payments enable instant transfer of funds between bank accounts, offering enhanced speed and convenience compared to traditional checks, which require processing time and manual verification. The shift towards real-time payments reduces delays, lowers fraud risks, and improves cash flow management for businesses and consumers alike. Discover how real-time payment systems are revolutionizing financial transactions and transforming modern banking.

Why it is important

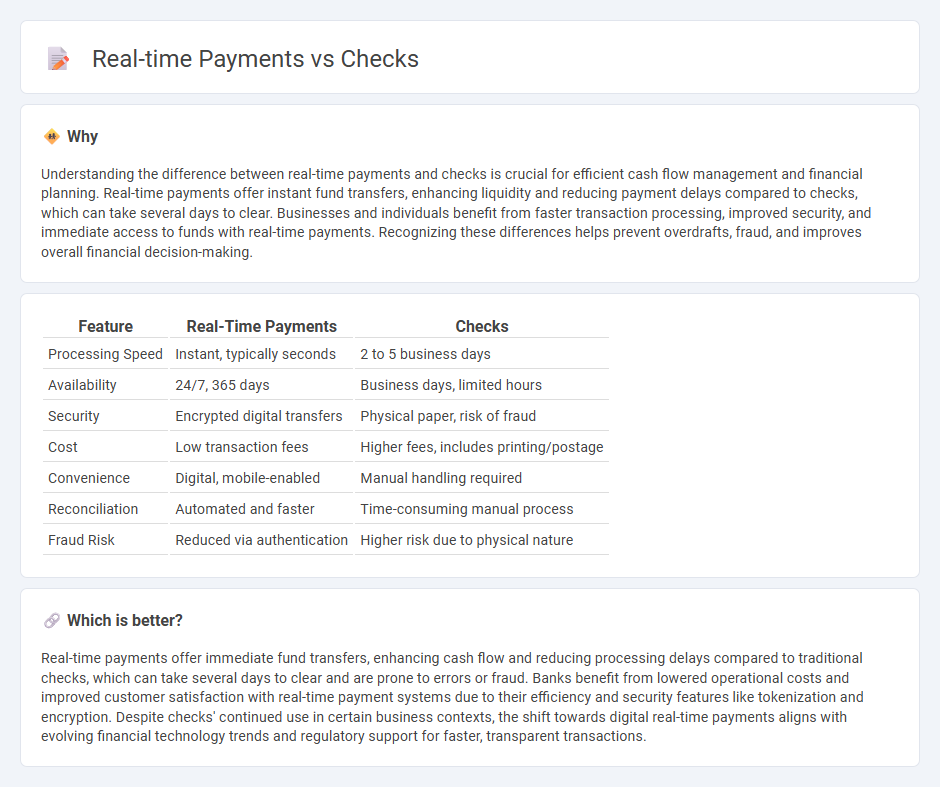

Understanding the difference between real-time payments and checks is crucial for efficient cash flow management and financial planning. Real-time payments offer instant fund transfers, enhancing liquidity and reducing payment delays compared to checks, which can take several days to clear. Businesses and individuals benefit from faster transaction processing, improved security, and immediate access to funds with real-time payments. Recognizing these differences helps prevent overdrafts, fraud, and improves overall financial decision-making.

Comparison Table

| Feature | Real-Time Payments | Checks |

|---|---|---|

| Processing Speed | Instant, typically seconds | 2 to 5 business days |

| Availability | 24/7, 365 days | Business days, limited hours |

| Security | Encrypted digital transfers | Physical paper, risk of fraud |

| Cost | Low transaction fees | Higher fees, includes printing/postage |

| Convenience | Digital, mobile-enabled | Manual handling required |

| Reconciliation | Automated and faster | Time-consuming manual process |

| Fraud Risk | Reduced via authentication | Higher risk due to physical nature |

Which is better?

Real-time payments offer immediate fund transfers, enhancing cash flow and reducing processing delays compared to traditional checks, which can take several days to clear and are prone to errors or fraud. Banks benefit from lowered operational costs and improved customer satisfaction with real-time payment systems due to their efficiency and security features like tokenization and encryption. Despite checks' continued use in certain business contexts, the shift towards digital real-time payments aligns with evolving financial technology trends and regulatory support for faster, transparent transactions.

Connection

Real-time payments and checks are interconnected through the modernization of banking clearing systems, enabling faster verification and settlement of check transactions. Financial institutions leverage real-time payment infrastructure to accelerate check clearing, reducing processing times from days to minutes. This integration enhances liquidity management and customer experience by bridging traditional check usage with digital payment efficiency.

Key Terms

Clearing

Checks clear through a batch processing system that can take several days, while real-time payments use instant clearing networks to transfer funds within seconds. The clearing process for checks involves multiple intermediaries, increasing the risk of delays and fraud. Explore how advancements in payment technology are revolutionizing clearing processes by learning more about these systems.

Settlement

Checks rely on a multi-step clearing process that can take several days to fully settle, involving banks, clearinghouses, and sometimes third-party intermediaries, which increases the risk of delays and errors. Real-time payments use instant settlement technology facilitated by modern payment networks and APIs, allowing funds to be transferred and accessed immediately, improving cash flow and reducing fraud. Explore more about how these settlement differences impact business efficiency and financial management.

Funds Availability

Checks typically require several business days for funds availability due to manual processing and bank clearing times, impacting cash flow and transaction speed. Real-time payments enable immediate funds transfer and availability, enhancing liquidity management and reducing settlement risks for individuals and businesses. Explore the advantages of real-time payments over checks to optimize your funds availability strategy.

Source and External Links

Bradford Exchange Checks - Offers a wide variety of personalized, stylish checks and matching accessories, with savings up to 70% off bank prices and fast, secure online ordering.

Walmart Checks - Provides thousands of personal, designer, and desk check designs, including themed and high-security options, with most orders shipping in about three business days.

Deluxe Personal Checks - Features classic, scenic, and charitable check designs with advanced security features and easy, secure online ordering, backed by a satisfaction guarantee.

dowidth.com

dowidth.com