Cloud core banking offers scalable, cost-effective solutions with real-time data access and seamless integration capabilities, enhancing agility for financial institutions. On-premise core banking provides greater control, customization, and data security by maintaining infrastructure within the organization. Explore the key advantages and challenges of each to make an informed decision for your banking technology needs.

Why it is important

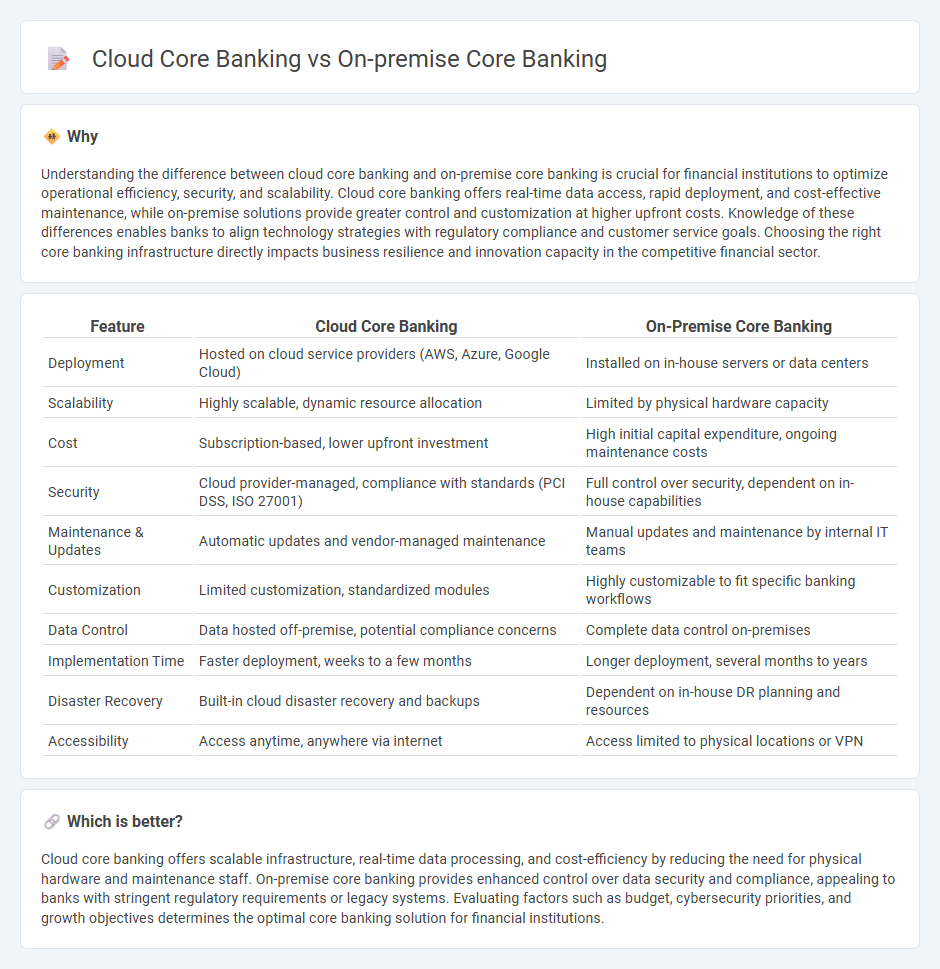

Understanding the difference between cloud core banking and on-premise core banking is crucial for financial institutions to optimize operational efficiency, security, and scalability. Cloud core banking offers real-time data access, rapid deployment, and cost-effective maintenance, while on-premise solutions provide greater control and customization at higher upfront costs. Knowledge of these differences enables banks to align technology strategies with regulatory compliance and customer service goals. Choosing the right core banking infrastructure directly impacts business resilience and innovation capacity in the competitive financial sector.

Comparison Table

| Feature | Cloud Core Banking | On-Premise Core Banking |

|---|---|---|

| Deployment | Hosted on cloud service providers (AWS, Azure, Google Cloud) | Installed on in-house servers or data centers |

| Scalability | Highly scalable, dynamic resource allocation | Limited by physical hardware capacity |

| Cost | Subscription-based, lower upfront investment | High initial capital expenditure, ongoing maintenance costs |

| Security | Cloud provider-managed, compliance with standards (PCI DSS, ISO 27001) | Full control over security, dependent on in-house capabilities |

| Maintenance & Updates | Automatic updates and vendor-managed maintenance | Manual updates and maintenance by internal IT teams |

| Customization | Limited customization, standardized modules | Highly customizable to fit specific banking workflows |

| Data Control | Data hosted off-premise, potential compliance concerns | Complete data control on-premises |

| Implementation Time | Faster deployment, weeks to a few months | Longer deployment, several months to years |

| Disaster Recovery | Built-in cloud disaster recovery and backups | Dependent on in-house DR planning and resources |

| Accessibility | Access anytime, anywhere via internet | Access limited to physical locations or VPN |

Which is better?

Cloud core banking offers scalable infrastructure, real-time data processing, and cost-efficiency by reducing the need for physical hardware and maintenance staff. On-premise core banking provides enhanced control over data security and compliance, appealing to banks with stringent regulatory requirements or legacy systems. Evaluating factors such as budget, cybersecurity priorities, and growth objectives determines the optimal core banking solution for financial institutions.

Connection

Cloud core banking and on-premise core banking are connected through hybrid integration frameworks that enable seamless data exchange and operational continuity. APIs and middleware facilitate real-time synchronization between cloud-hosted banking services and on-premise systems, ensuring consistent customer experiences and regulatory compliance. This interconnected architecture supports scalability, enhanced security protocols, and efficient transaction processing across both platforms.

Key Terms

Infrastructure

On-premise core banking systems require significant upfront investment in physical servers, networking hardware, and data centers, with ongoing costs for maintenance, security, and upgrades. Cloud core banking leverages scalable, virtualized infrastructure hosted by providers like AWS, Azure, or Google Cloud, offering flexibility, reduced capital expenditure, and enhanced disaster recovery capabilities. Explore detailed comparisons to understand which infrastructure aligns best with your banking operations and growth strategy.

Scalability

On-premise core banking systems often face limitations in scalability due to fixed hardware capacity and high infrastructure costs, which can hinder rapid growth and adaptability. Cloud core banking solutions leverage elastic resources and distributed architectures, enabling instant scaling to handle increased transaction volumes and customer demands efficiently. Explore more about how scalability impacts banking performance and customer experience in cloud versus on-premise deployments.

Deployment Model

On-premise core banking systems require businesses to manage their own infrastructure, ensuring complete control over data and security but often involving higher upfront costs and longer deployment times. Cloud core banking leverages third-party providers to deliver scalable, flexible solutions with faster implementation and reduced maintenance overhead, suitable for dynamic financial environments. Explore the detailed benefits and challenges of each deployment model to determine the best fit for your banking institution.

Source and External Links

Cloud-Based vs. On-Premise Core Banking Solutions: Pros & Cons - On-premise core banking solutions are hosted within a bank's internal infrastructure, offering enhanced security, regulatory compliance, greater customization, and reliable operation even with limited internet, but require higher initial investment and longer deployment time compared to cloud-based systems.

What is Core Banking? - IBM - Core banking systems serve as a centralized, real-time back-end hub for multiple branches of a bank, allowing seamless access to banking services, and can be deployed either on-premise or cloud-based depending on the bank's needs.

Why Banks Prefer On-Premise Deployment Over Cloud for CBS - Banks prefer on-premise deployment for core banking systems due to complete control over data and security, alignment with risk management frameworks, higher performance reliability, and the ability to avoid latency or outages common in cloud environments.

dowidth.com

dowidth.com