Finfluencers leverage social media platforms to provide accessible financial advice, blending personal experiences with trends to engage a broad audience interested in banking and investments. Private bankers offer personalized wealth management and bespoke banking solutions tailored to high-net-worth clients, emphasizing confidentiality and expert financial planning. Explore the distinct advantages and services of finfluencers versus private bankers to determine which approach aligns with your financial goals.

Why it is important

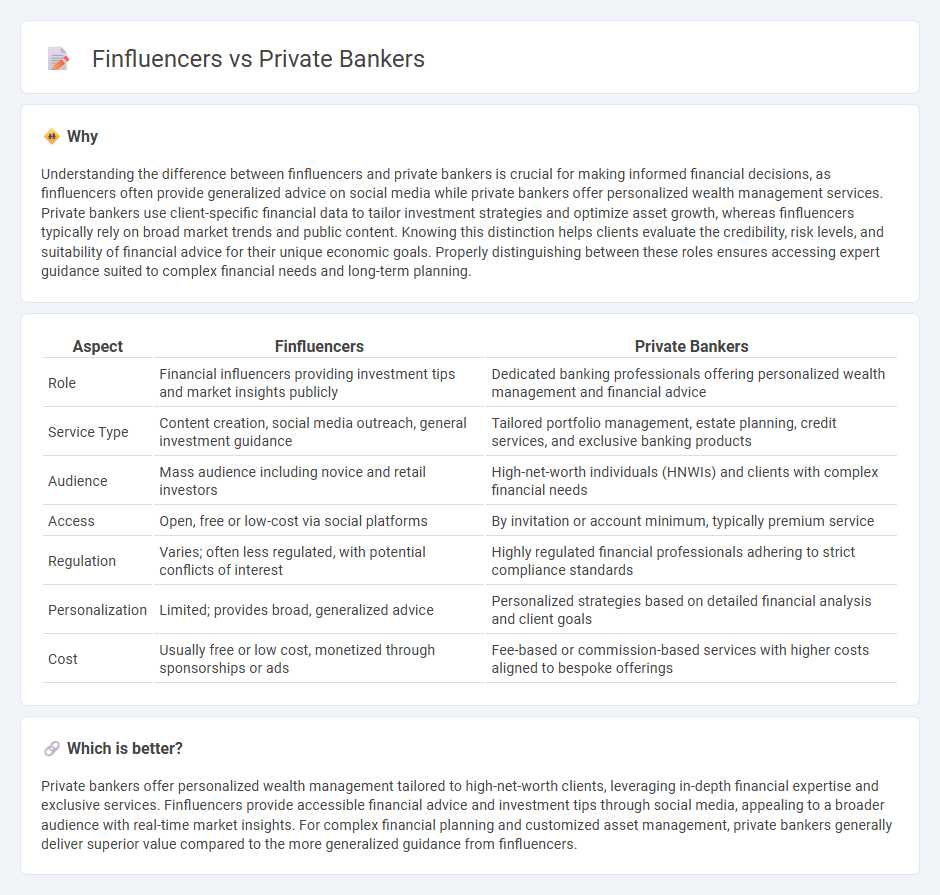

Understanding the difference between finfluencers and private bankers is crucial for making informed financial decisions, as finfluencers often provide generalized advice on social media while private bankers offer personalized wealth management services. Private bankers use client-specific financial data to tailor investment strategies and optimize asset growth, whereas finfluencers typically rely on broad market trends and public content. Knowing this distinction helps clients evaluate the credibility, risk levels, and suitability of financial advice for their unique economic goals. Properly distinguishing between these roles ensures accessing expert guidance suited to complex financial needs and long-term planning.

Comparison Table

| Aspect | Finfluencers | Private Bankers |

|---|---|---|

| Role | Financial influencers providing investment tips and market insights publicly | Dedicated banking professionals offering personalized wealth management and financial advice |

| Service Type | Content creation, social media outreach, general investment guidance | Tailored portfolio management, estate planning, credit services, and exclusive banking products |

| Audience | Mass audience including novice and retail investors | High-net-worth individuals (HNWIs) and clients with complex financial needs |

| Access | Open, free or low-cost via social platforms | By invitation or account minimum, typically premium service |

| Regulation | Varies; often less regulated, with potential conflicts of interest | Highly regulated financial professionals adhering to strict compliance standards |

| Personalization | Limited; provides broad, generalized advice | Personalized strategies based on detailed financial analysis and client goals |

| Cost | Usually free or low cost, monetized through sponsorships or ads | Fee-based or commission-based services with higher costs aligned to bespoke offerings |

Which is better?

Private bankers offer personalized wealth management tailored to high-net-worth clients, leveraging in-depth financial expertise and exclusive services. Finfluencers provide accessible financial advice and investment tips through social media, appealing to a broader audience with real-time market insights. For complex financial planning and customized asset management, private bankers generally deliver superior value compared to the more generalized guidance from finfluencers.

Connection

Finfluencers leverage social media platforms to educate and influence retail investors on banking products, investment strategies, and financial planning, often driving demand for personalized wealth management services. Private bankers capitalize on this engagement by offering tailored solutions that address clients' specific financial goals, enhancing client acquisition and retention. The synergy between finfluencers' reach and private bankers' expertise creates a dynamic ecosystem that shapes modern banking relationships.

Key Terms

Fiduciary Duty

Private bankers are bound by fiduciary duty, legally required to act in their clients' best interests by providing personalized financial advice and managing assets with confidentiality and prudence. Finfluencers, on the other hand, often share general investment tips and market insights without the legal obligation to ensure suitability or protect client assets. Discover the critical differences in responsibility and trust between these financial advisors to make informed decisions.

Regulatory Compliance

Private bankers operate under stringent regulatory frameworks such as the Bank Secrecy Act and Anti-Money Laundering regulations, ensuring client transactions and advice comply with legal standards. Finfluencers, while influential on social media platforms, often lack formal regulatory oversight and may face scrutiny for providing unlicensed financial advice or promoting risky investments. Explore deeper insights into how compliance impacts trust and legal accountability in financial advisory roles.

Conflict of Interest

Private bankers prioritize personalized financial strategies tailored to individual client portfolios, ensuring fiduciary duty and confidentiality, whereas finfluencers often promote general investment tips primarily driven by sponsorships or affiliate marketing, creating potential conflicts of interest. The lack of regulatory oversight for many finfluencers amplifies risks of biased advice, contrasting with the stringent compliance standards private bankers must adhere to. Explore how these differences impact investor trust and decision-making to better understand the risks involved.

Source and External Links

Private Banking: Careers, Salaries, Recruiting, and Exits - Private bankers manage financial assets for high-net-worth (HNW) and ultra-high-net-worth (UHNW) individuals, providing investment, tax, estate, and philanthropic planning for clients typically worth $1 million or more.

Citi Private Bank: Private banking services for Global Citizens - Citi Private Bank offers customized private banking and wealth management services to wealthy individuals and families globally, with a history dating back to 1812 and a focus on preserving and growing clients' wealth worldwide.

Private banking - Wikipedia - Private banking refers to banking, investment, and financial services aimed at high-net-worth clients, usually requiring minimum assets ranging from $500,000 to $10 million, with segmentation of clients into high, very high, and ultra-high net worth categories.

dowidth.com

dowidth.com