Debt recycling is a strategic financial approach that involves using the equity in your home to invest, aiming to pay off non-deductible mortgage debt while simultaneously building taxable investments. A redraw facility allows borrowers to access extra repayments made on their home loan, providing flexibility to manage cash flow and reduce interest costs. Explore how each option can optimize your mortgage and investment strategy tailored to your financial goals.

Why it is important

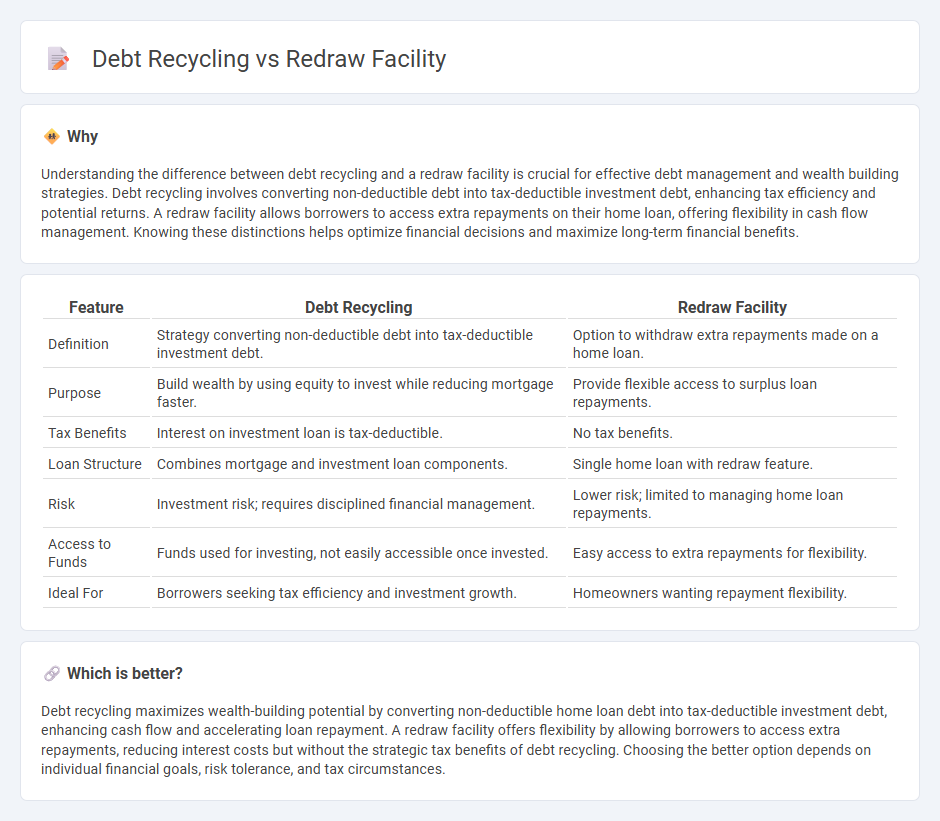

Understanding the difference between debt recycling and a redraw facility is crucial for effective debt management and wealth building strategies. Debt recycling involves converting non-deductible debt into tax-deductible investment debt, enhancing tax efficiency and potential returns. A redraw facility allows borrowers to access extra repayments on their home loan, offering flexibility in cash flow management. Knowing these distinctions helps optimize financial decisions and maximize long-term financial benefits.

Comparison Table

| Feature | Debt Recycling | Redraw Facility |

|---|---|---|

| Definition | Strategy converting non-deductible debt into tax-deductible investment debt. | Option to withdraw extra repayments made on a home loan. |

| Purpose | Build wealth by using equity to invest while reducing mortgage faster. | Provide flexible access to surplus loan repayments. |

| Tax Benefits | Interest on investment loan is tax-deductible. | No tax benefits. |

| Loan Structure | Combines mortgage and investment loan components. | Single home loan with redraw feature. |

| Risk | Investment risk; requires disciplined financial management. | Lower risk; limited to managing home loan repayments. |

| Access to Funds | Funds used for investing, not easily accessible once invested. | Easy access to extra repayments for flexibility. |

| Ideal For | Borrowers seeking tax efficiency and investment growth. | Homeowners wanting repayment flexibility. |

Which is better?

Debt recycling maximizes wealth-building potential by converting non-deductible home loan debt into tax-deductible investment debt, enhancing cash flow and accelerating loan repayment. A redraw facility offers flexibility by allowing borrowers to access extra repayments, reducing interest costs but without the strategic tax benefits of debt recycling. Choosing the better option depends on individual financial goals, risk tolerance, and tax circumstances.

Connection

Debt recycling involves converting non-deductible home loan debt into tax-deductible investment debt, often utilizing a redraw facility to access extra repayments made towards the home loan. A redraw facility allows borrowers to withdraw surplus funds paid above their minimum mortgage repayments, providing flexible access to capital for investment purposes. This synergy enhances cash flow management and optimizes tax benefits within a debt recycling strategy.

Key Terms

Loan principal

Redraw facilities allow borrowers to withdraw any extra payments made on their loan principal, providing flexible access to funds without additional approvals. Debt recycling, on the other hand, involves using redraws to convert non-deductible mortgage debt into tax-deductible investment debt, optimizing loan principal management for tax benefits. Explore how effectively managing your loan principal through these strategies can enhance financial outcomes.

Interest payments

Redraw facilities enable borrowers to make extra repayments and access those funds later, effectively reducing the interest payable on the outstanding principal by lowering the average loan balance. Debt recycling involves converting non-deductible home loan debt into tax-deductible investment debt, which can optimize interest payments through tax benefits on the investment loan portion. To understand how these strategies impact your interest costs and financial planning, explore detailed comparisons and tailored advice.

Equity release

Redraw facilities allow borrowers to access surplus funds from their mortgage repayments, providing flexible liquidity without affecting the original loan terms. Debt recycling involves converting non-deductible debt into tax-deductible investment debt, often by using equity released through mechanisms like redraw facilities or home equity loans. Explore how combining redraw facilities with debt recycling strategies can optimize equity release and improve financial efficiency.

Source and External Links

What is a home loan redraw facility? - A redraw facility allows homeowners to access extra mortgage payments for emergencies or expenses while reducing interest charges on their loan.

How does a redraw facility work? - This facility enables homeowners to make additional loan repayments, which can be redrawn later, reducing interest charges on the loan principal.

Understanding how the redraw facility feature at Unloan works - Unloan's redraw facility allows homeowners to access extra repayments made on their home loan, helping reduce interest charges and enabling faster loan repayment.

dowidth.com

dowidth.com