Alternative credit data, such as utility payments and rental history, provides lenders with a broader view of creditworthiness beyond traditional credit scores. Mobile phone usage data, including call patterns and top-up frequency, offers real-time behavioral insights that can enhance risk assessment in lending decisions. Discover how combining these data sources transforms credit evaluation and financial inclusion.

Why it is important

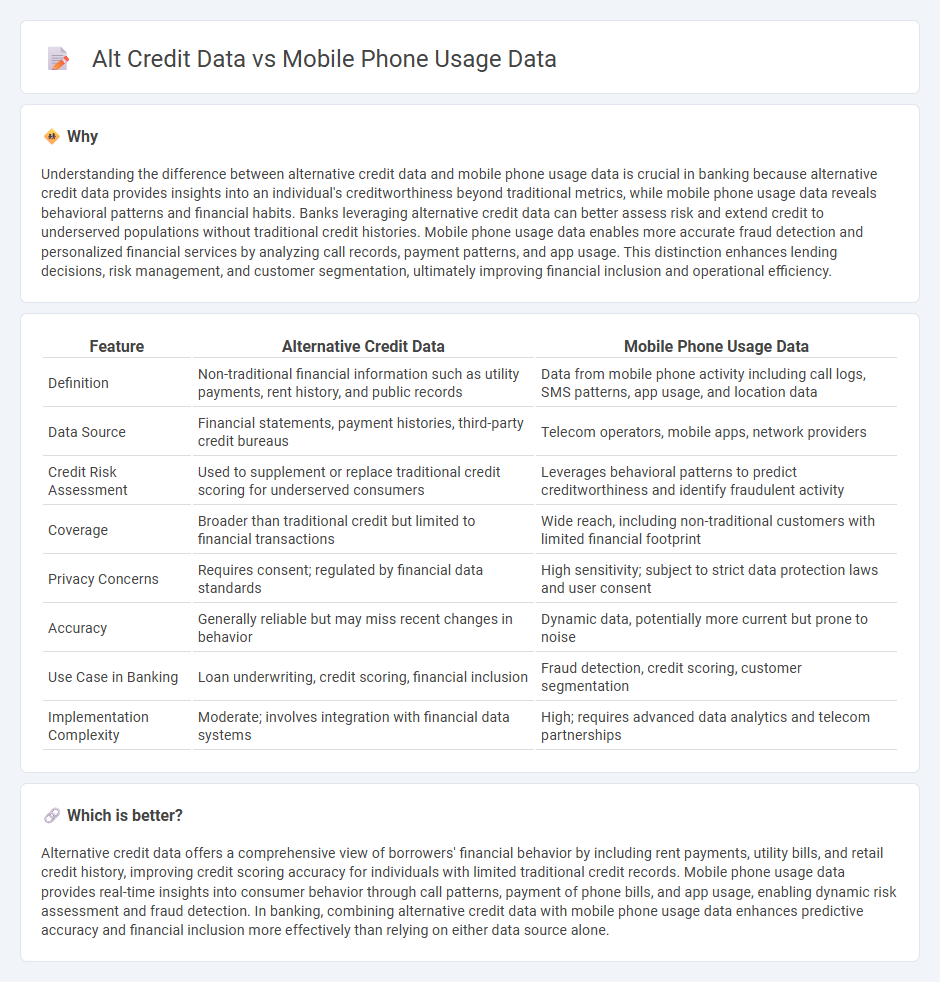

Understanding the difference between alternative credit data and mobile phone usage data is crucial in banking because alternative credit data provides insights into an individual's creditworthiness beyond traditional metrics, while mobile phone usage data reveals behavioral patterns and financial habits. Banks leveraging alternative credit data can better assess risk and extend credit to underserved populations without traditional credit histories. Mobile phone usage data enables more accurate fraud detection and personalized financial services by analyzing call records, payment patterns, and app usage. This distinction enhances lending decisions, risk management, and customer segmentation, ultimately improving financial inclusion and operational efficiency.

Comparison Table

| Feature | Alternative Credit Data | Mobile Phone Usage Data |

|---|---|---|

| Definition | Non-traditional financial information such as utility payments, rent history, and public records | Data from mobile phone activity including call logs, SMS patterns, app usage, and location data |

| Data Source | Financial statements, payment histories, third-party credit bureaus | Telecom operators, mobile apps, network providers |

| Credit Risk Assessment | Used to supplement or replace traditional credit scoring for underserved consumers | Leverages behavioral patterns to predict creditworthiness and identify fraudulent activity |

| Coverage | Broader than traditional credit but limited to financial transactions | Wide reach, including non-traditional customers with limited financial footprint |

| Privacy Concerns | Requires consent; regulated by financial data standards | High sensitivity; subject to strict data protection laws and user consent |

| Accuracy | Generally reliable but may miss recent changes in behavior | Dynamic data, potentially more current but prone to noise |

| Use Case in Banking | Loan underwriting, credit scoring, financial inclusion | Fraud detection, credit scoring, customer segmentation |

| Implementation Complexity | Moderate; involves integration with financial data systems | High; requires advanced data analytics and telecom partnerships |

Which is better?

Alternative credit data offers a comprehensive view of borrowers' financial behavior by including rent payments, utility bills, and retail credit history, improving credit scoring accuracy for individuals with limited traditional credit records. Mobile phone usage data provides real-time insights into consumer behavior through call patterns, payment of phone bills, and app usage, enabling dynamic risk assessment and fraud detection. In banking, combining alternative credit data with mobile phone usage data enhances predictive accuracy and financial inclusion more effectively than relying on either data source alone.

Connection

Alternative credit data, including mobile phone usage patterns such as call frequency, SMS history, and app behavior, significantly enhance credit risk assessment models in banking. Integrating mobile phone data provides lenders with real-time insights into customer reliability and financial habits, especially for underbanked populations lacking traditional credit history. This connection improves loan accessibility and reduces default rates by enabling more accurate credit scoring.

Key Terms

Mobile Usage Patterns

Mobile phone usage data provides granular insights into call frequency, text messaging habits, app usage, and location patterns, which reflect consumer behavior and financial reliability more dynamically than traditional credit reports. Alternative credit data utilizing mobile usage metrics enhances the accuracy of credit scoring models by capturing real-time user engagement and behavioral trends. Explore how integrating mobile usage patterns can transform credit risk assessment and expand financial inclusion.

Alternative Credit Scoring

Mobile phone usage data offers alternative credit scoring models a dynamic and real-time insight into user behavior, capturing patterns such as call frequency, data consumption, and payment regularity, which traditional credit bureaus often overlook. Alternative credit scoring leverages this data to enhance creditworthiness predictions, especially for unbanked and underbanked populations with limited formal credit history. Explore how mobile data-driven credit scoring revolutionizes lending practices and financial inclusion.

Data Privacy

Mobile phone usage data and alternative credit data provide unique insights for credit scoring but raise significant concerns regarding data privacy and user consent. Regulations such as GDPR and CCPA enforce strict guidelines on the collection, storage, and sharing of personal information to protect consumer rights. Explore how these frameworks balance innovation with privacy to understand their impact on financial technology.

Source and External Links

Cell Phone Statistics 2025 - Americans spend an average of 4 hours and 30 minutes per day on their mobile phones, with nearly 57% considering themselves "mobile phone addicts."

Smartphone Usage Statistics for 2025 (Surprising) - There are 4.69 billion global smartphone users in 2025, and American adults average 4 hours and 2 minutes daily on internet activities using smartphones.

Phone Screen Time Addiction & Usage - New Survey Data - Americans now spend 5 hours and 16 minutes per day on their phones, with Gen Z averaging 6 hours and 27 minutes daily and over half of users wanting to reduce their usage.

dowidth.com

dowidth.com