Predictive analytics in banking leverages historical data and machine learning algorithms to forecast potential risks, customer behaviors, and market trends, enabling proactive decision-making. Real-time transaction monitoring focuses on immediate analysis of ongoing transactions to detect and prevent fraud, ensuring security and compliance with regulatory standards. Explore how these advanced technologies transform financial services by enhancing risk management and customer experience.

Why it is important

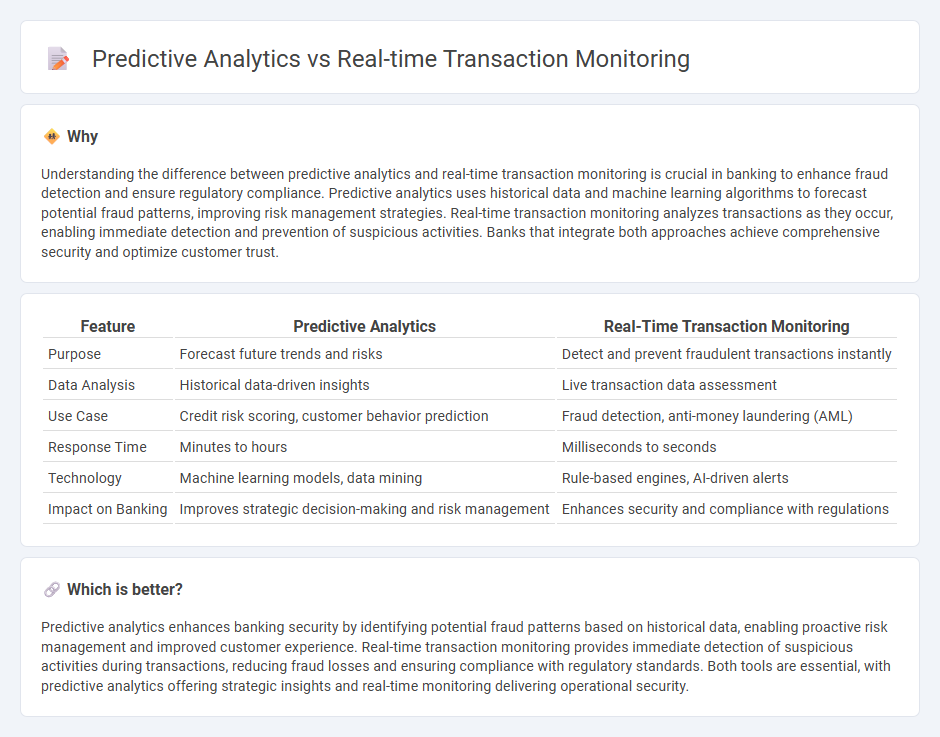

Understanding the difference between predictive analytics and real-time transaction monitoring is crucial in banking to enhance fraud detection and ensure regulatory compliance. Predictive analytics uses historical data and machine learning algorithms to forecast potential fraud patterns, improving risk management strategies. Real-time transaction monitoring analyzes transactions as they occur, enabling immediate detection and prevention of suspicious activities. Banks that integrate both approaches achieve comprehensive security and optimize customer trust.

Comparison Table

| Feature | Predictive Analytics | Real-Time Transaction Monitoring |

|---|---|---|

| Purpose | Forecast future trends and risks | Detect and prevent fraudulent transactions instantly |

| Data Analysis | Historical data-driven insights | Live transaction data assessment |

| Use Case | Credit risk scoring, customer behavior prediction | Fraud detection, anti-money laundering (AML) |

| Response Time | Minutes to hours | Milliseconds to seconds |

| Technology | Machine learning models, data mining | Rule-based engines, AI-driven alerts |

| Impact on Banking | Improves strategic decision-making and risk management | Enhances security and compliance with regulations |

Which is better?

Predictive analytics enhances banking security by identifying potential fraud patterns based on historical data, enabling proactive risk management and improved customer experience. Real-time transaction monitoring provides immediate detection of suspicious activities during transactions, reducing fraud losses and ensuring compliance with regulatory standards. Both tools are essential, with predictive analytics offering strategic insights and real-time monitoring delivering operational security.

Connection

Predictive analytics in banking utilizes historical transaction data and machine learning algorithms to anticipate fraudulent activities before they occur, enhancing risk management. Real-time transaction monitoring continuously analyzes ongoing financial operations, instantly identifying anomalies based on predictive models and predefined rules. The integration of both technologies enables banks to detect and prevent fraud more effectively, improving security and customer trust.

Key Terms

**Real-time transaction monitoring:**

Real-time transaction monitoring involves continuous analysis of financial transactions to detect and prevent fraud instantly by using algorithms and machine learning models. This approach enhances security by flagging suspicious activities as they occur, reducing the risk of financial losses and regulatory penalties. Explore more to understand how real-time monitoring transforms fraud detection and compliance strategies.

Fraud detection

Real-time transaction monitoring analyzes ongoing transactions to immediately identify suspicious activity, leveraging rule-based systems and behavioral analytics for instant fraud detection. Predictive analytics uses historical data and machine learning algorithms to forecast potential fraudulent behavior before it occurs, improving long-term fraud prevention strategies. Explore how combining both approaches can enhance your fraud detection capabilities.

Alerts

Real-time transaction monitoring generates immediate alerts by analyzing ongoing transactions to detect fraud or suspicious activities as they occur, ensuring rapid response and mitigation. Predictive analytics uses historical data and machine learning models to forecast potential fraudulent activities and generate alerts before transactions happen, enhancing preventive measures. Explore how integrating both approaches can optimize alert accuracy and operational efficiency in financial security systems.

Source and External Links

What is Real-Time Transaction Monitoring: Steps & Prevention in 2025 - Real-time transaction monitoring allows financial institutions to detect suspicious transactions instantly using advanced analytics and machine learning, enabling immediate alerts, transaction blocking, and compliance with regulatory requirements to prevent fraud and financial crime.

Real-Time And Offsite Transaction Monitoring - Real-time transaction monitoring involves analyzing transactions as they occur and sending instant alerts to prevent processing of suspicious activities, based on parameters such as transaction thresholds and origin, helping financial institutions identify and act on fraud swiftly.

What is Transaction Monitoring? - IBM - Transaction monitoring continuously analyzes financial transactions using risk-based approaches and predefined rules to detect suspicious behavior and generate alerts for compliance officers to investigate and prevent fraud.

dowidth.com

dowidth.com