Sustainable finance focuses on investments that promote environmental stewardship and long-term ecological balance, integrating ESG criteria into financial decisions to support a low-carbon economy. Inclusive finance aims to provide affordable and accessible financial services to underserved populations, fostering economic participation and reducing inequality. Explore how these financial approaches transform banking to create resilient and equitable economies.

Why it is important

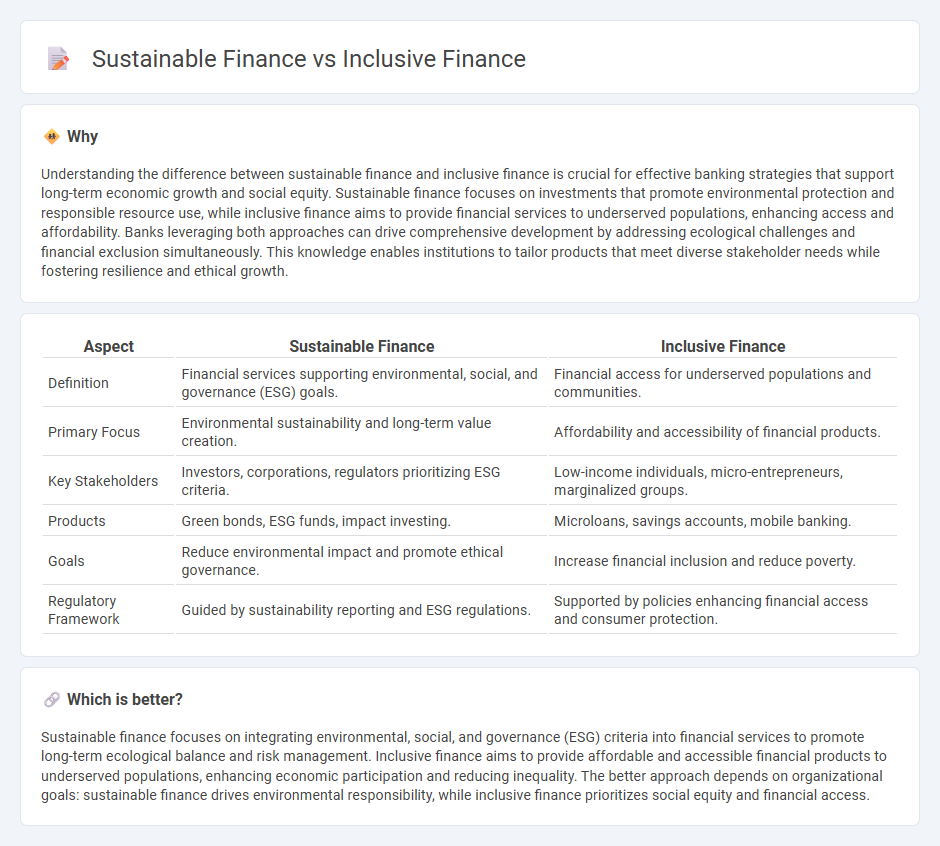

Understanding the difference between sustainable finance and inclusive finance is crucial for effective banking strategies that support long-term economic growth and social equity. Sustainable finance focuses on investments that promote environmental protection and responsible resource use, while inclusive finance aims to provide financial services to underserved populations, enhancing access and affordability. Banks leveraging both approaches can drive comprehensive development by addressing ecological challenges and financial exclusion simultaneously. This knowledge enables institutions to tailor products that meet diverse stakeholder needs while fostering resilience and ethical growth.

Comparison Table

| Aspect | Sustainable Finance | Inclusive Finance |

|---|---|---|

| Definition | Financial services supporting environmental, social, and governance (ESG) goals. | Financial access for underserved populations and communities. |

| Primary Focus | Environmental sustainability and long-term value creation. | Affordability and accessibility of financial products. |

| Key Stakeholders | Investors, corporations, regulators prioritizing ESG criteria. | Low-income individuals, micro-entrepreneurs, marginalized groups. |

| Products | Green bonds, ESG funds, impact investing. | Microloans, savings accounts, mobile banking. |

| Goals | Reduce environmental impact and promote ethical governance. | Increase financial inclusion and reduce poverty. |

| Regulatory Framework | Guided by sustainability reporting and ESG regulations. | Supported by policies enhancing financial access and consumer protection. |

Which is better?

Sustainable finance focuses on integrating environmental, social, and governance (ESG) criteria into financial services to promote long-term ecological balance and risk management. Inclusive finance aims to provide affordable and accessible financial products to underserved populations, enhancing economic participation and reducing inequality. The better approach depends on organizational goals: sustainable finance drives environmental responsibility, while inclusive finance prioritizes social equity and financial access.

Connection

Sustainable finance integrates environmental, social, and governance (ESG) criteria to promote long-term economic growth while minimizing negative impacts, closely aligning with inclusive finance's goal of providing equitable access to financial services for underserved populations. Both frameworks emphasize responsible investment that supports social equity and environmental stewardship, driving economic resilience and poverty reduction. Banks adopting sustainable and inclusive finance strategies improve risk management, foster innovation, and enhance community development through targeted products and services.

Key Terms

**Inclusive Finance:**

Inclusive finance promotes equitable access to financial services for underserved populations, including low-income individuals and small businesses, fostering economic empowerment and reducing poverty worldwide. It emphasizes affordable credit, savings, insurance, and payment services tailored to marginalized communities, addressing barriers like lack of collateral and documentation. Discover how inclusive finance drives social impact and economic resilience by learning more about its strategies and global initiatives.

Financial Inclusion

Inclusive finance prioritizes providing access to financial services for underserved populations, aiming to reduce poverty and promote economic empowerment. Sustainable finance integrates environmental, social, and governance (ESG) criteria into investment decisions to support long-term ecological and social well-being. Explore how both approaches intersect to advance financial inclusion within sustainable economic frameworks.

Microfinance

Microfinance emphasizes inclusive finance by providing small loans and financial services to underserved populations, fostering economic participation and poverty alleviation. Sustainable finance integrates environmental, social, and governance (ESG) criteria into microfinance operations to ensure long-term impact and resilience. Explore how balancing inclusion and sustainability in microfinance drives transformative change.

Source and External Links

Inclusive Finance for Low Income Households and Businesses - This course explores financial solutions to poverty by examining the lives of those in low-income markets and the strategies of inclusive finance as an industry.

Financial Inclusion Overview - World Bank - Financial inclusion provides individuals and businesses with access to affordable financial products and services, supporting economic growth and employment.

Inclusive Finance - UN Capital Development Fund (UNCDF) - UNCDF provides financial support and technical assistance to increase access to financial services for underserved households and small businesses.

dowidth.com

dowidth.com