Digital onboarding streamlines account creation by enabling customers to complete registration entirely online through secure platforms, reducing the need for physical branch visits. Biometric authentication enhances security by using unique biological traits such as fingerprints or facial recognition to verify identity, minimizing fraud and improving user experience. Discover how these innovations transform banking by combining convenience with advanced security measures.

Why it is important

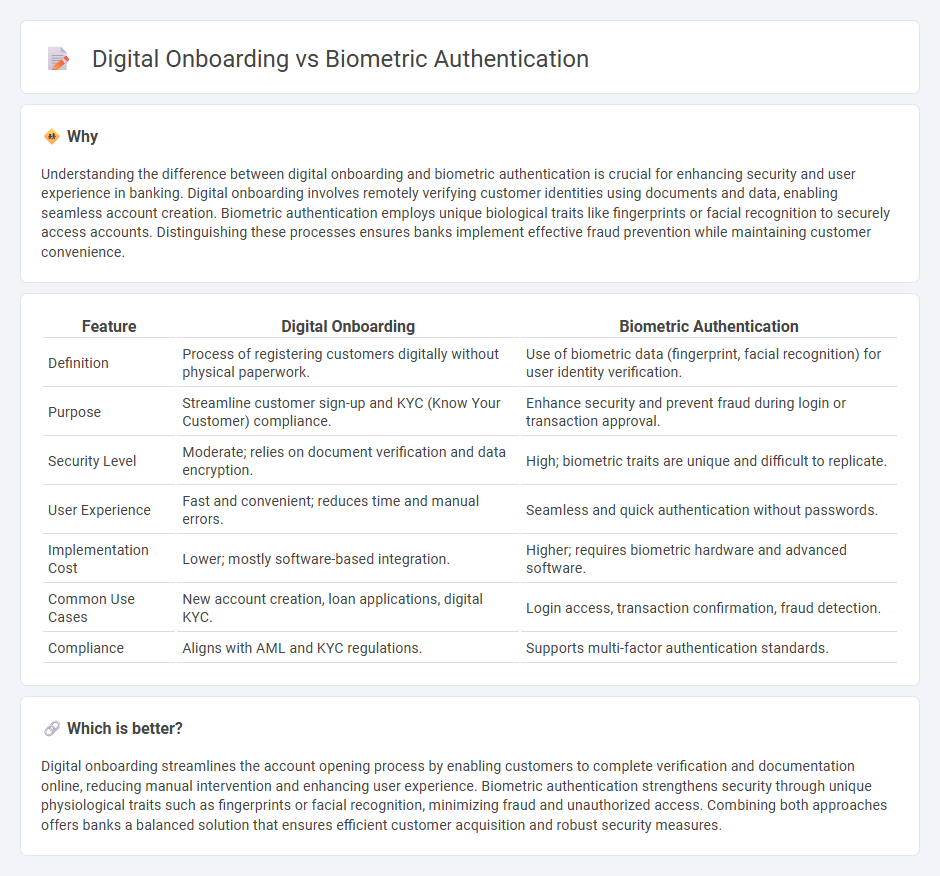

Understanding the difference between digital onboarding and biometric authentication is crucial for enhancing security and user experience in banking. Digital onboarding involves remotely verifying customer identities using documents and data, enabling seamless account creation. Biometric authentication employs unique biological traits like fingerprints or facial recognition to securely access accounts. Distinguishing these processes ensures banks implement effective fraud prevention while maintaining customer convenience.

Comparison Table

| Feature | Digital Onboarding | Biometric Authentication |

|---|---|---|

| Definition | Process of registering customers digitally without physical paperwork. | Use of biometric data (fingerprint, facial recognition) for user identity verification. |

| Purpose | Streamline customer sign-up and KYC (Know Your Customer) compliance. | Enhance security and prevent fraud during login or transaction approval. |

| Security Level | Moderate; relies on document verification and data encryption. | High; biometric traits are unique and difficult to replicate. |

| User Experience | Fast and convenient; reduces time and manual errors. | Seamless and quick authentication without passwords. |

| Implementation Cost | Lower; mostly software-based integration. | Higher; requires biometric hardware and advanced software. |

| Common Use Cases | New account creation, loan applications, digital KYC. | Login access, transaction confirmation, fraud detection. |

| Compliance | Aligns with AML and KYC regulations. | Supports multi-factor authentication standards. |

Which is better?

Digital onboarding streamlines the account opening process by enabling customers to complete verification and documentation online, reducing manual intervention and enhancing user experience. Biometric authentication strengthens security through unique physiological traits such as fingerprints or facial recognition, minimizing fraud and unauthorized access. Combining both approaches offers banks a balanced solution that ensures efficient customer acquisition and robust security measures.

Connection

Digital onboarding streamlines customer registration by integrating biometric authentication methods such as fingerprint scanning and facial recognition to enhance security and reduce identity fraud in banking. Implementing biometrics within digital onboarding accelerates customer verification, minimizes manual errors, and complies with Know Your Customer (KYC) regulations efficiently. This synergy improves user experience while strengthening fraud prevention measures and regulatory compliance for banks.

Key Terms

**Biometric Authentication:**

Biometric authentication leverages unique physiological traits such as fingerprints, facial recognition, and iris scans to verify identity quickly and accurately, enhancing security in digital transactions. It reduces fraud risks and streamlines user access, making it a preferred method in sectors like banking, healthcare, and government services. Explore more about how biometric authentication transforms security and user experience in various industries.

Fingerprint Recognition

Fingerprint recognition offers a highly secure biometric authentication method by analyzing unique patterns in finger ridges to verify identity with low false acceptance rates. Digital onboarding leverages fingerprint recognition technology to streamline user verification, reducing fraud and enhancing user experience in sectors like banking, healthcare, and government services. Explore the advantages of integrating fingerprint recognition into digital onboarding processes to boost security and efficiency.

Facial Recognition

Facial recognition technology enhances biometric authentication by providing accurate, real-time identity verification through unique facial features, improving security and user convenience. Digital onboarding leverages facial recognition to streamline user registration processes by matching live selfies with official IDs, reducing fraud and accelerating access to services. Discover how integrating facial recognition in biometric authentication and digital onboarding transforms identity verification workflows.

Source and External Links

What is Biometric Authentication and How Does It Work? - Biometric authentication verifies a user's identity using unique biological traits such as fingerprints, voices, retinas, and facial features, providing stronger security than traditional authentication methods.

What is Biometric Authentication? - It is a method to safeguard sensitive information by confirming identity through physical attributes like fingerprints, iris patterns, and facial or voice recognition, offering enhanced security compared to passwords.

What is Biometric Authentication? Use Cases, Pros & Cons - Biometric authentication systems use data-generated models of unique human traits for secure access control, combining strong authentication with ease of use, and are considered more secure and convenient than passwords despite some myths about their vulnerabilities.

dowidth.com

dowidth.com