Super apps integrate multiple financial services within one platform, offering seamless user experiences and real-time transactions. Core banking systems serve as the foundational infrastructure, ensuring secure, reliable processing of customer accounts and banking operations. Explore how these technologies transform modern banking ecosystems.

Why it is important

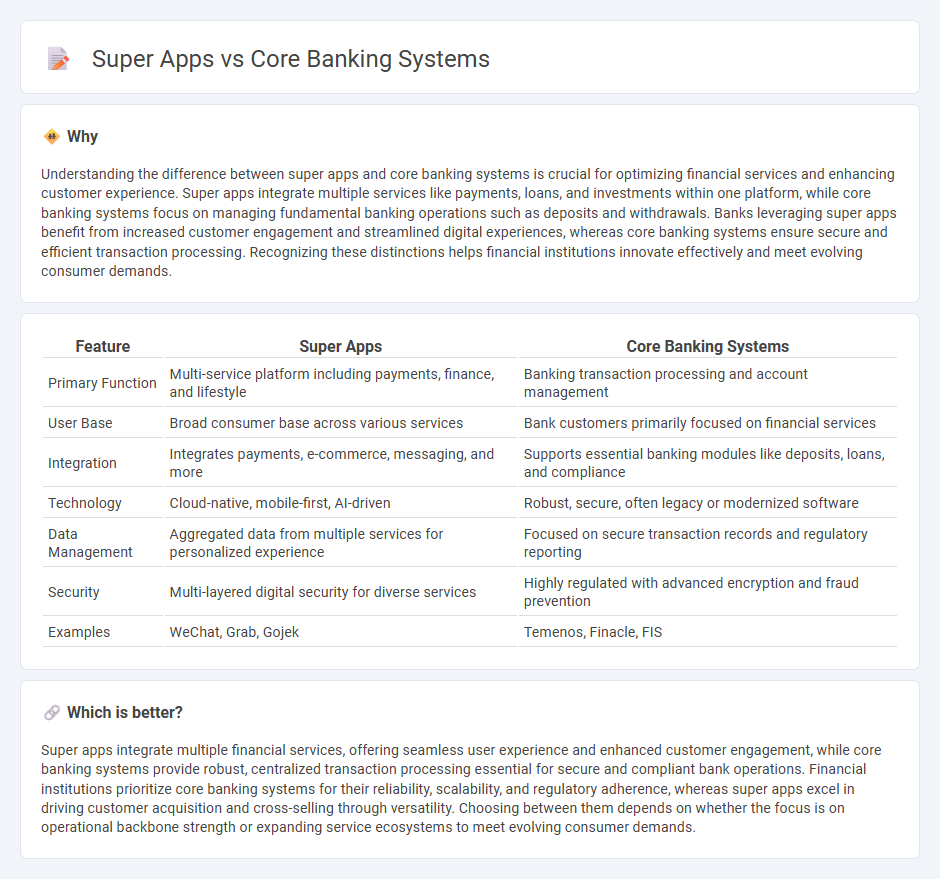

Understanding the difference between super apps and core banking systems is crucial for optimizing financial services and enhancing customer experience. Super apps integrate multiple services like payments, loans, and investments within one platform, while core banking systems focus on managing fundamental banking operations such as deposits and withdrawals. Banks leveraging super apps benefit from increased customer engagement and streamlined digital experiences, whereas core banking systems ensure secure and efficient transaction processing. Recognizing these distinctions helps financial institutions innovate effectively and meet evolving consumer demands.

Comparison Table

| Feature | Super Apps | Core Banking Systems |

|---|---|---|

| Primary Function | Multi-service platform including payments, finance, and lifestyle | Banking transaction processing and account management |

| User Base | Broad consumer base across various services | Bank customers primarily focused on financial services |

| Integration | Integrates payments, e-commerce, messaging, and more | Supports essential banking modules like deposits, loans, and compliance |

| Technology | Cloud-native, mobile-first, AI-driven | Robust, secure, often legacy or modernized software |

| Data Management | Aggregated data from multiple services for personalized experience | Focused on secure transaction records and regulatory reporting |

| Security | Multi-layered digital security for diverse services | Highly regulated with advanced encryption and fraud prevention |

| Examples | WeChat, Grab, Gojek | Temenos, Finacle, FIS |

Which is better?

Super apps integrate multiple financial services, offering seamless user experience and enhanced customer engagement, while core banking systems provide robust, centralized transaction processing essential for secure and compliant bank operations. Financial institutions prioritize core banking systems for their reliability, scalability, and regulatory adherence, whereas super apps excel in driving customer acquisition and cross-selling through versatility. Choosing between them depends on whether the focus is on operational backbone strength or expanding service ecosystems to meet evolving consumer demands.

Connection

Super apps integrate core banking systems through APIs that facilitate seamless transactions, personalized financial services, and real-time data synchronization. Core banking platforms provide the essential infrastructure for account management, payment processing, and compliance, enabling super apps to offer comprehensive banking solutions within a single interface. This connectivity enhances customer experience by allowing users to perform diverse financial activities quickly and securely through one unified application.

Key Terms

**Core Banking Systems:**

Core banking systems are centralized platforms that enable financial institutions to process daily banking transactions such as deposits, withdrawals, and loan management efficiently across multiple branches. They provide robust security, real-time processing, and seamless integration with regulatory compliance frameworks, ensuring accuracy and consistency in customer account management. Discover how core banking systems are transforming the financial industry's operational backbone and enabling digital innovation.

Centralized Ledger

Core banking systems rely on a centralized ledger to ensure real-time, accurate transaction processing across multiple financial services, providing a unified view of customer accounts and improving operational efficiency. Super apps integrate multiple services, including payments, lending, and lifestyle features, often utilizing a centralized ledger within their financial modules to maintain transactional consistency while enabling seamless user experiences. Explore how centralized ledger technology reshapes the integration and scalability of core banking and super app ecosystems.

Transaction Processing

Core banking systems provide centralized transaction processing that ensures real-time settlement, compliance, and secure handling of financial operations across branches and channels. Super apps integrate multiple services, including payments, lending, and lifestyle features, leveraging transaction data to offer seamless, holistic user experiences beyond traditional banking. Explore deeper insights into how transaction processing shapes the evolution from core banking systems to super apps.

Source and External Links

Core Banking - IBM - Core banking systems are centralized platforms that support banking operations, providing real-time transactions and services across multiple branches.

Core Banking - Wikipedia - Core banking allows customers to access and manage their accounts from any networked branch, facilitating basic transactions like deposits and loans.

Global Retail Core Banking - Gartner - Core banking systems are back-office software solutions that process transactions and update accounts in real-time or at the end of the day.

dowidth.com

dowidth.com