Sustainable investing integrates environmental, social, and governance (ESG) criteria into financial decisions to generate long-term value while promoting positive societal impact. Philanthropic investing focuses on donating resources to charitable causes without expecting financial returns, prioritizing social good over profit. Explore the distinctions and benefits of both approaches to align your banking strategy with purposeful financial goals.

Why it is important

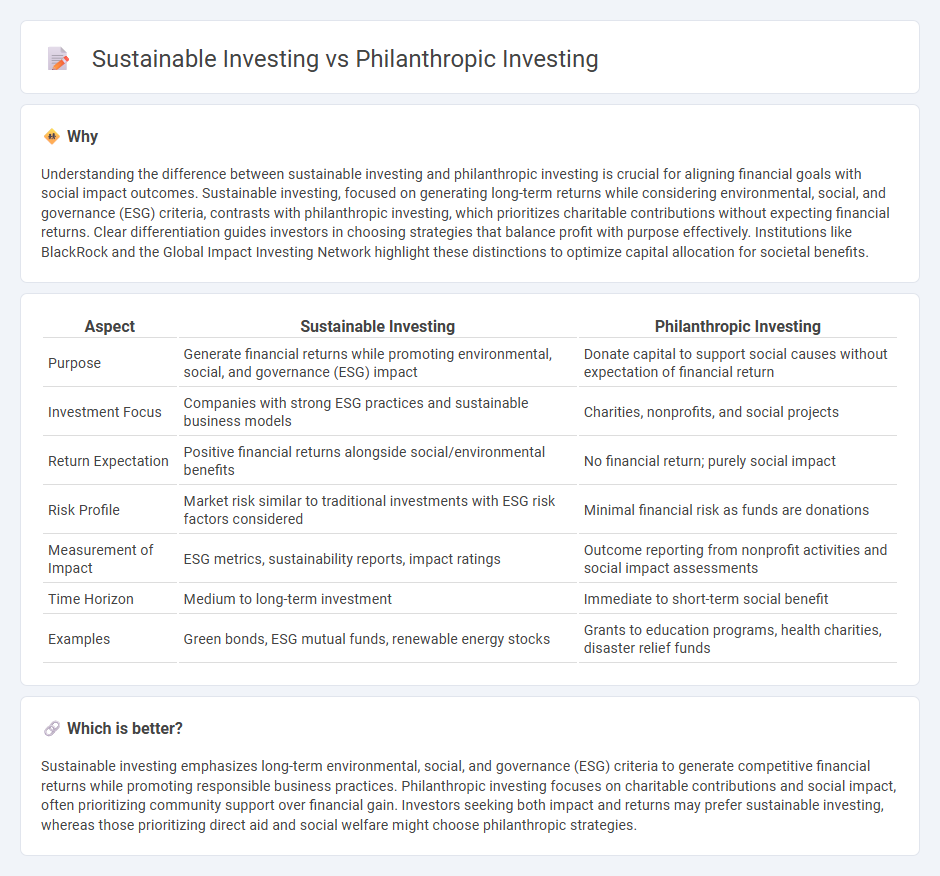

Understanding the difference between sustainable investing and philanthropic investing is crucial for aligning financial goals with social impact outcomes. Sustainable investing, focused on generating long-term returns while considering environmental, social, and governance (ESG) criteria, contrasts with philanthropic investing, which prioritizes charitable contributions without expecting financial returns. Clear differentiation guides investors in choosing strategies that balance profit with purpose effectively. Institutions like BlackRock and the Global Impact Investing Network highlight these distinctions to optimize capital allocation for societal benefits.

Comparison Table

| Aspect | Sustainable Investing | Philanthropic Investing |

|---|---|---|

| Purpose | Generate financial returns while promoting environmental, social, and governance (ESG) impact | Donate capital to support social causes without expectation of financial return |

| Investment Focus | Companies with strong ESG practices and sustainable business models | Charities, nonprofits, and social projects |

| Return Expectation | Positive financial returns alongside social/environmental benefits | No financial return; purely social impact |

| Risk Profile | Market risk similar to traditional investments with ESG risk factors considered | Minimal financial risk as funds are donations |

| Measurement of Impact | ESG metrics, sustainability reports, impact ratings | Outcome reporting from nonprofit activities and social impact assessments |

| Time Horizon | Medium to long-term investment | Immediate to short-term social benefit |

| Examples | Green bonds, ESG mutual funds, renewable energy stocks | Grants to education programs, health charities, disaster relief funds |

Which is better?

Sustainable investing emphasizes long-term environmental, social, and governance (ESG) criteria to generate competitive financial returns while promoting responsible business practices. Philanthropic investing focuses on charitable contributions and social impact, often prioritizing community support over financial gain. Investors seeking both impact and returns may prefer sustainable investing, whereas those prioritizing direct aid and social welfare might choose philanthropic strategies.

Connection

Sustainable investing integrates environmental, social, and governance (ESG) criteria to generate long-term financial returns while promoting positive societal impact, aligning closely with the principles of philanthropic investing focused on social good. Both investment strategies prioritize capital allocation to projects and companies that foster community development, environmental stewardship, and ethical governance. Financial institutions increasingly offer products that combine sustainable and philanthropic investing, enabling clients to support impactful causes alongside financial growth.

Key Terms

Social Impact

Philanthropic investing prioritizes social impact by allocating funds to nonprofit organizations and projects primarily aimed at addressing societal challenges without expecting financial returns. Sustainable investing integrates environmental, social, and governance (ESG) criteria into investment decisions to support companies that drive long-term social and environmental benefits alongside financial performance. Explore further to understand how each investment approach uniquely advances social impact objectives.

ESG (Environmental, Social, Governance)

Philanthropic investing prioritizes social impact by allocating capital to charitable causes and nonprofit initiatives, often with less concern for financial returns. Sustainable investing emphasizes ESG criteria to balance financial performance with environmental stewardship, social responsibility, and strong governance practices. Explore how these distinct approaches drive change and align investments with values.

Financial Returns

Philanthropic investing prioritizes social impact over financial returns, often accepting lower or no profit to support charitable causes. Sustainable investing seeks to generate competitive financial returns by integrating environmental, social, and governance (ESG) factors into investment decisions. Explore further to understand how these approaches balance profit and purpose in diverse portfolios.

Source and External Links

Amplifying Your Philanthropy Through Impact Investing - Impact investing allows philanthropists to deploy more of their assets for social benefit, align their investments with their values, and leverage market-based solutions to achieve scalable, sustainable social impact beyond traditional grants and donations.

dowidth.com

dowidth.com