Blockchain remittance leverages decentralized ledger technology to enhance security, reduce transaction costs, and enable near-instant cross-border payments compared to traditional digital banking platforms. Digital banking platforms provide comprehensive financial services, including account management, loans, and payments, often relying on centralized systems that may incur higher fees and longer processing times for international transfers. Explore the evolving landscape of banking innovations to understand how blockchain and digital platforms transform global remittance and financial services.

Why it is important

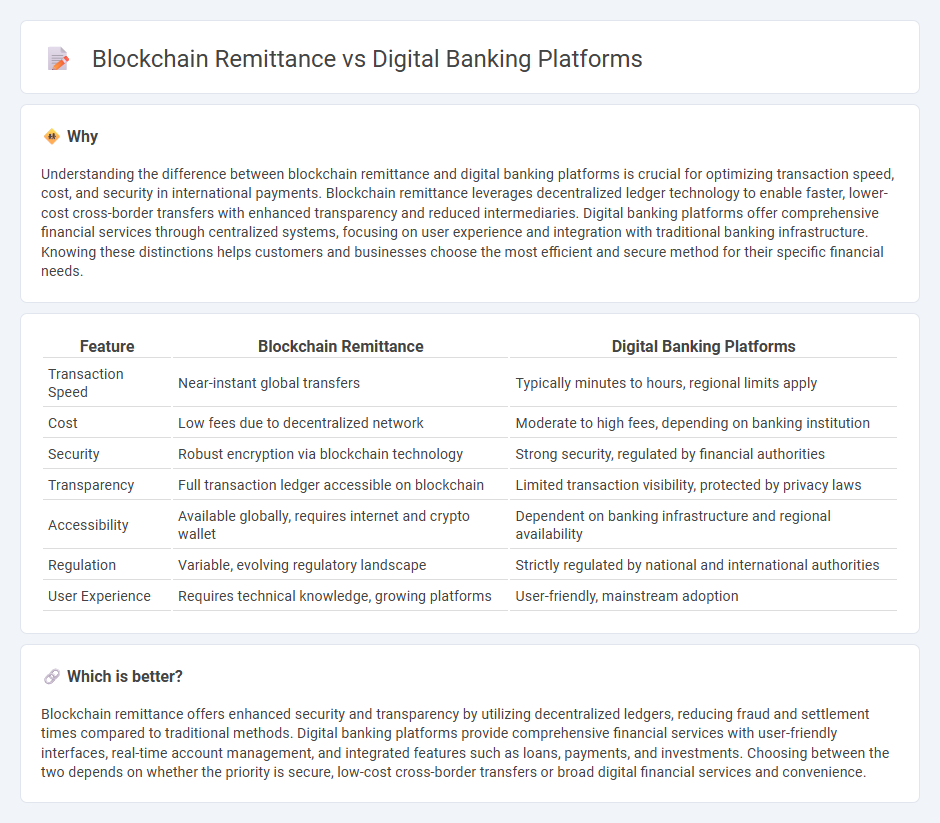

Understanding the difference between blockchain remittance and digital banking platforms is crucial for optimizing transaction speed, cost, and security in international payments. Blockchain remittance leverages decentralized ledger technology to enable faster, lower-cost cross-border transfers with enhanced transparency and reduced intermediaries. Digital banking platforms offer comprehensive financial services through centralized systems, focusing on user experience and integration with traditional banking infrastructure. Knowing these distinctions helps customers and businesses choose the most efficient and secure method for their specific financial needs.

Comparison Table

| Feature | Blockchain Remittance | Digital Banking Platforms |

|---|---|---|

| Transaction Speed | Near-instant global transfers | Typically minutes to hours, regional limits apply |

| Cost | Low fees due to decentralized network | Moderate to high fees, depending on banking institution |

| Security | Robust encryption via blockchain technology | Strong security, regulated by financial authorities |

| Transparency | Full transaction ledger accessible on blockchain | Limited transaction visibility, protected by privacy laws |

| Accessibility | Available globally, requires internet and crypto wallet | Dependent on banking infrastructure and regional availability |

| Regulation | Variable, evolving regulatory landscape | Strictly regulated by national and international authorities |

| User Experience | Requires technical knowledge, growing platforms | User-friendly, mainstream adoption |

Which is better?

Blockchain remittance offers enhanced security and transparency by utilizing decentralized ledgers, reducing fraud and settlement times compared to traditional methods. Digital banking platforms provide comprehensive financial services with user-friendly interfaces, real-time account management, and integrated features such as loans, payments, and investments. Choosing between the two depends on whether the priority is secure, low-cost cross-border transfers or broad digital financial services and convenience.

Connection

Blockchain remittance leverages decentralized ledger technology to enable faster, secure cross-border payments, reducing reliance on traditional intermediaries and lowering transaction costs. Digital banking platforms integrate these blockchain solutions to offer seamless remittance services, enhancing transparency and real-time tracking for customers. This synergy transforms global money transfers by providing efficient, cost-effective, and trustworthy financial operations within digital banking ecosystems.

Key Terms

Core Banking System

Digital banking platforms integrate core banking systems to deliver seamless, real-time financial services including account management, lending, and payments, optimizing customer experience with advanced analytics and AI. Blockchain remittance leverages decentralized ledger technology to facilitate cross-border transactions with enhanced security, reduced fraud risk, and lower operational costs, though it often operates alongside traditional core banking infrastructure rather than replacing it. Explore the differences and synergies between digital banking platforms and blockchain remittance for a deeper understanding of modern financial ecosystems.

Distributed Ledger Technology

Digital banking platforms utilize centralized systems to enhance transaction efficiency and customer experience, while blockchain remittance leverages Distributed Ledger Technology (DLT) to enable secure, transparent, and near-instant cross-border payments. DLT ensures immutable transaction records across decentralized networks, reducing fraud risk and operational costs in remittance services. Explore the transformative impact of Distributed Ledger Technology on modern financial infrastructures and how it reshapes digital banking and cross-border payment solutions.

Smart Contracts

Digital banking platforms leverage centralized databases to facilitate transactions, while blockchain remittance utilizes decentralized ledgers to enhance transparency and security. Smart contracts automate agreement execution on blockchain networks, reducing intermediaries and enabling faster cross-border payments. Explore how smart contract integration transforms financial services and remittance efficiency.

Source and External Links

Top 8 Digital Banking Platforms in 2025 - Creatio - Lists leading platforms like Creatio, Oracle, Sopra, nCino, Finflux, Finacle, and NCR Digital, highlighting their features for retail, corporate, and SME banking, payments, compliance, and AI-powered automation.

Best Digital Banking Platforms Reviews 2025 | Gartner Peer Insights - Provides verified user reviews and comparisons of platforms such as ebankIT, Intellect Digital Face, Temenos, and Veritran, focusing on omnichannel experiences, cloud-native architecture, and global scalability.

Digital Banking: 2025 Market Overview, Trends & Insights - Discusses white-label solutions like SDK.finance for rapid deployment of digital wallets, neobanks, and payment systems, emphasizing cost efficiency, customization, and regulatory compliance.

dowidth.com

dowidth.com