Cloud core banking leverages scalable, cloud-based infrastructure to deliver real-time processing, enhanced security, and seamless updates, improving operational efficiency for financial institutions. API-driven core banking emphasizes modularity and integration, enabling banks to rapidly deploy new services and connect with third-party applications for a more personalized customer experience. Explore the distinctions between these innovative banking models to determine which aligns best with your financial technology goals.

Why it is important

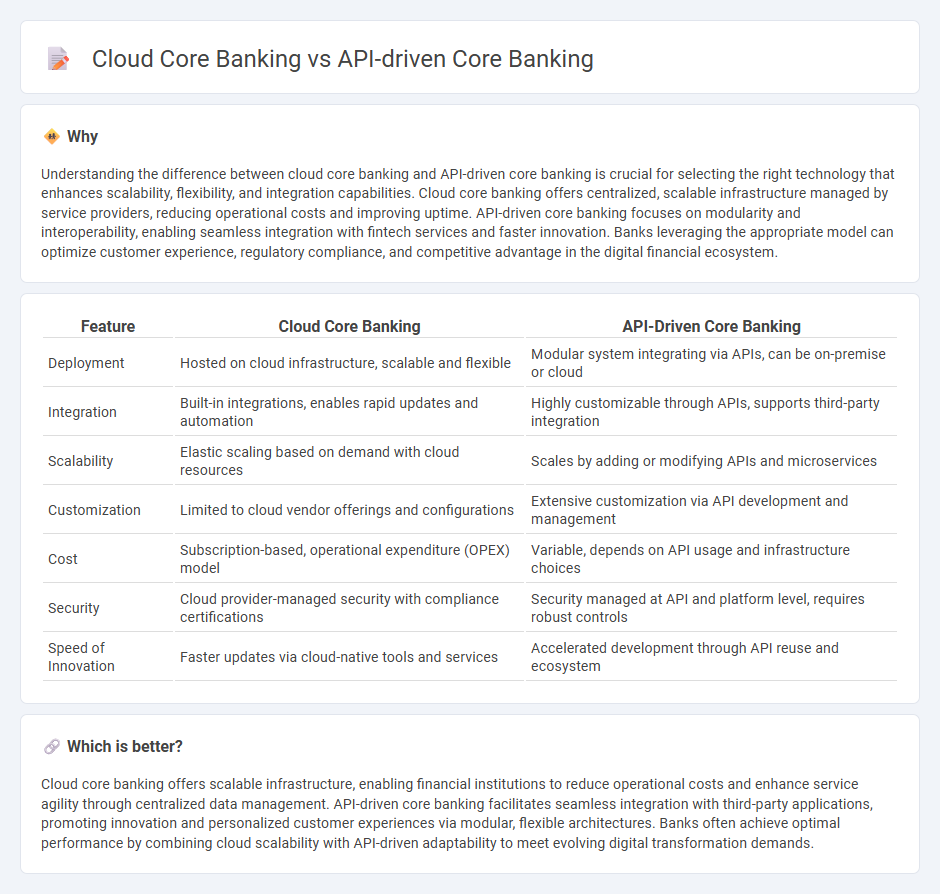

Understanding the difference between cloud core banking and API-driven core banking is crucial for selecting the right technology that enhances scalability, flexibility, and integration capabilities. Cloud core banking offers centralized, scalable infrastructure managed by service providers, reducing operational costs and improving uptime. API-driven core banking focuses on modularity and interoperability, enabling seamless integration with fintech services and faster innovation. Banks leveraging the appropriate model can optimize customer experience, regulatory compliance, and competitive advantage in the digital financial ecosystem.

Comparison Table

| Feature | Cloud Core Banking | API-Driven Core Banking |

|---|---|---|

| Deployment | Hosted on cloud infrastructure, scalable and flexible | Modular system integrating via APIs, can be on-premise or cloud |

| Integration | Built-in integrations, enables rapid updates and automation | Highly customizable through APIs, supports third-party integration |

| Scalability | Elastic scaling based on demand with cloud resources | Scales by adding or modifying APIs and microservices |

| Customization | Limited to cloud vendor offerings and configurations | Extensive customization via API development and management |

| Cost | Subscription-based, operational expenditure (OPEX) model | Variable, depends on API usage and infrastructure choices |

| Security | Cloud provider-managed security with compliance certifications | Security managed at API and platform level, requires robust controls |

| Speed of Innovation | Faster updates via cloud-native tools and services | Accelerated development through API reuse and ecosystem |

Which is better?

Cloud core banking offers scalable infrastructure, enabling financial institutions to reduce operational costs and enhance service agility through centralized data management. API-driven core banking facilitates seamless integration with third-party applications, promoting innovation and personalized customer experiences via modular, flexible architectures. Banks often achieve optimal performance by combining cloud scalability with API-driven adaptability to meet evolving digital transformation demands.

Connection

Cloud core banking leverages scalable cloud infrastructure to deliver flexible, real-time banking services while API-driven core banking uses application programming interfaces to enable seamless integration and interoperability between banking systems. Together, they facilitate faster innovation, enhanced customer experiences, and efficient data exchange by combining cloud computing's agility with API connectivity. This integration supports modern banking ecosystems, enabling banks to rapidly deploy new products and streamline operations across digital channels.

Key Terms

Integration

API-driven core banking enables seamless integration with various third-party services through standardized APIs, enhancing flexibility and customization. Cloud core banking offers scalable infrastructure and faster deployment but requires robust API management to maintain integration efficiency. Explore how these approaches impact your banking system's agility and customer experience.

Scalability

API-driven core banking offers modular scalability by enabling seamless integration of new services and third-party applications, facilitating rapid responses to changing customer needs. Cloud core banking provides elastic scalability through cloud infrastructure, allowing banks to dynamically allocate resources and handle fluctuating workloads efficiently. Explore more to understand which scalability solution best suits your banking transformation strategy.

Flexibility

API-driven core banking systems offer unparalleled flexibility by enabling seamless integration with third-party applications, allowing banks to quickly adapt to market demands and innovate customer experiences. Cloud core banking enhances scalability and accessibility, providing dynamic resource allocation and support for remote operations, which together reduce time-to-market and operational costs. Explore how these transformative technologies can reshape your banking infrastructure for enhanced agility and customer-centricity.

Source and External Links

API-led Banking: A Strategic Shift in the Future of Financial Services - This article discusses how API-led banking transforms financial services with a modular architecture, enabling agility and innovation in the digital finance ecosystem.

What Are Banking APIs? A Beginner's Guide to How They Work - This guide explains how banking APIs function as bridges between different software systems, enhancing innovation and customer experiences in financial services.

Cross River's Operating System - This proprietary API-driven bank core connects users to a range of banking solutions across payments, lending, and cards, supporting growth through a multi-rail infrastructure.

dowidth.com

dowidth.com