Negative interest rates occur when central banks set nominal rates below zero, compelling lenders to pay borrowers, which aims to stimulate economic activity during downturns. Real interest rates adjust nominal rates for inflation, reflecting the true cost of borrowing or return on savings, and can turn negative if inflation exceeds nominal rates. Explore the impact of these rates on consumer behavior and financial markets to understand their broader economic implications.

Why it is important

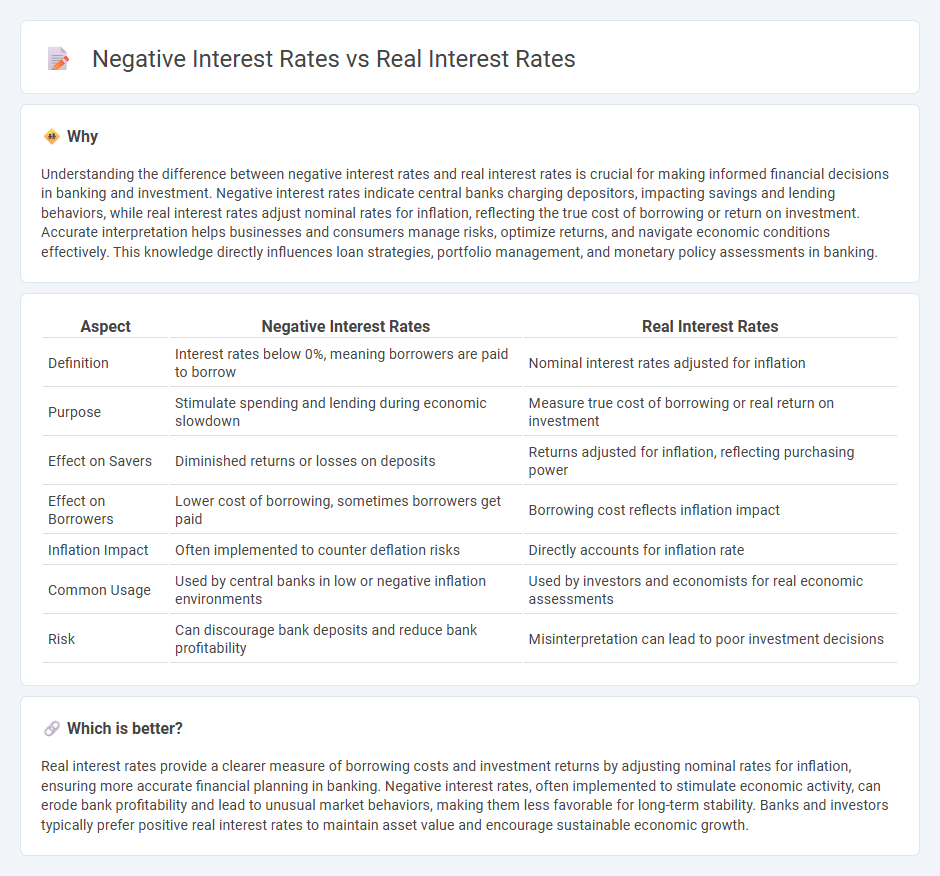

Understanding the difference between negative interest rates and real interest rates is crucial for making informed financial decisions in banking and investment. Negative interest rates indicate central banks charging depositors, impacting savings and lending behaviors, while real interest rates adjust nominal rates for inflation, reflecting the true cost of borrowing or return on investment. Accurate interpretation helps businesses and consumers manage risks, optimize returns, and navigate economic conditions effectively. This knowledge directly influences loan strategies, portfolio management, and monetary policy assessments in banking.

Comparison Table

| Aspect | Negative Interest Rates | Real Interest Rates |

|---|---|---|

| Definition | Interest rates below 0%, meaning borrowers are paid to borrow | Nominal interest rates adjusted for inflation |

| Purpose | Stimulate spending and lending during economic slowdown | Measure true cost of borrowing or real return on investment |

| Effect on Savers | Diminished returns or losses on deposits | Returns adjusted for inflation, reflecting purchasing power |

| Effect on Borrowers | Lower cost of borrowing, sometimes borrowers get paid | Borrowing cost reflects inflation impact |

| Inflation Impact | Often implemented to counter deflation risks | Directly accounts for inflation rate |

| Common Usage | Used by central banks in low or negative inflation environments | Used by investors and economists for real economic assessments |

| Risk | Can discourage bank deposits and reduce bank profitability | Misinterpretation can lead to poor investment decisions |

Which is better?

Real interest rates provide a clearer measure of borrowing costs and investment returns by adjusting nominal rates for inflation, ensuring more accurate financial planning in banking. Negative interest rates, often implemented to stimulate economic activity, can erode bank profitability and lead to unusual market behaviors, making them less favorable for long-term stability. Banks and investors typically prefer positive real interest rates to maintain asset value and encourage sustainable economic growth.

Connection

Negative interest rates occur when nominal rates fall below zero, impacting borrowing and saving behaviors by encouraging spending and investment. Real interest rates adjust nominal rates for inflation, revealing the true cost of borrowing and the real yield on savings. When nominal rates are negative and inflation is low or negative, real interest rates can become positive or even higher, influencing economic decisions differently than when both rates are positive.

Key Terms

Inflation

Real interest rates measure the nominal interest rate adjusted for inflation, reflecting the true cost of borrowing or return on savings. Negative interest rates occur when the nominal rate falls below inflation, eroding purchasing power and often used to stimulate economic activity. Explore how inflation drives these interest rate dynamics and their impact on financial decisions.

Nominal Interest Rate

Nominal interest rates represent the stated percentage return on a loan or investment before adjusting for inflation, whereas real interest rates account for inflation's impact, revealing the true purchasing power of the returns. Negative interest rates occur when inflation exceeds nominal rates, causing real interest rates to fall below zero, which can incentivize borrowing and spending but challenge traditional savings growth. Explore how nominal and real interest rates influence economic behavior and financial decisions in detail.

Central Bank Policy

Central bank policy on real interest rates, which adjust nominal rates for inflation, plays a crucial role in economic stability and growth by influencing borrowing costs and consumer spending. Negative interest rates, implemented by central banks during periods of economic slowdown, aim to stimulate lending and investment by charging banks for holding excess reserves, thereby encouraging more active monetary circulation. Explore the impact of these policies on global markets and monetary strategy to understand their long-term economic implications.

Source and External Links

Real interest rate - Wikipedia - The real interest rate is the interest rate an investor or lender receives after adjusting for inflation, calculated approximately by subtracting the inflation rate from the nominal interest rate according to the Fisher equation.

Getting Real about Interest Rates | Federal Reserve Education - The real interest rate is the nominal interest rate minus the inflation rate, showing the inflation-adjusted return that affects purchasing power of savings.

Real Interest Rate - Updated Chart | LongTermTrends.net - The real interest rate is the nominal interest rate minus inflation, often measured using Treasury yields adjusted by inflation to show the true purchasing power of returns.

dowidth.com

dowidth.com