Account aggregation consolidates financial data from multiple sources into a single dashboard, enabling a comprehensive view of a user's financial status. Credit scoring evaluates this financial data to assess an individual's creditworthiness, influencing loan approvals and interest rates. Explore how these technologies transform financial decision-making and risk management.

Why it is important

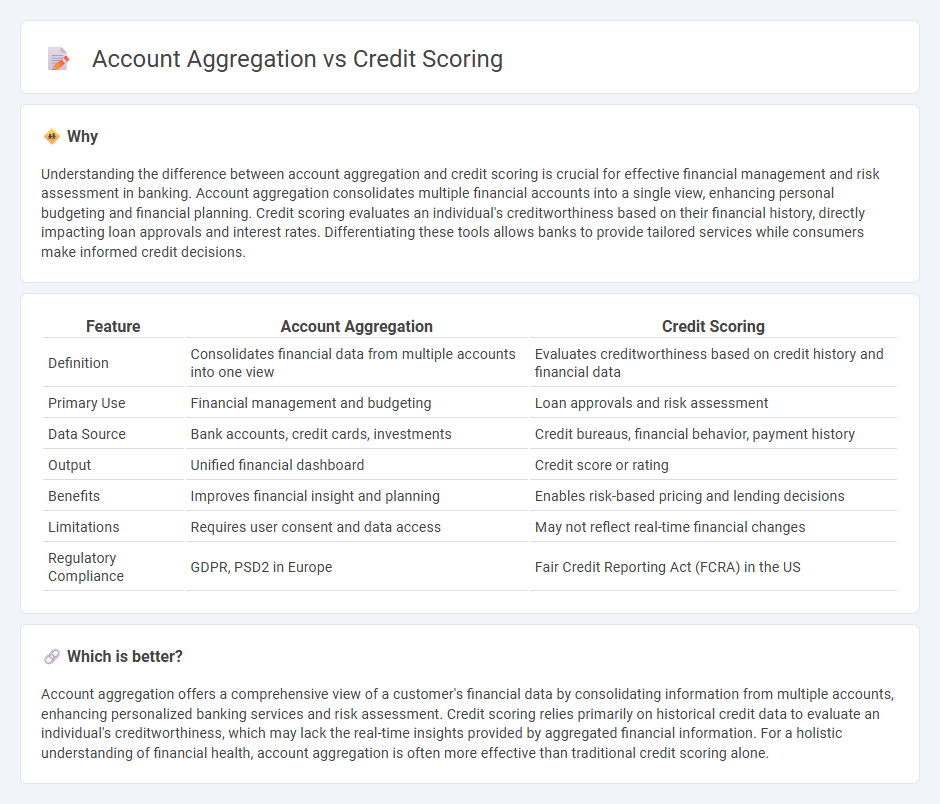

Understanding the difference between account aggregation and credit scoring is crucial for effective financial management and risk assessment in banking. Account aggregation consolidates multiple financial accounts into a single view, enhancing personal budgeting and financial planning. Credit scoring evaluates an individual's creditworthiness based on their financial history, directly impacting loan approvals and interest rates. Differentiating these tools allows banks to provide tailored services while consumers make informed credit decisions.

Comparison Table

| Feature | Account Aggregation | Credit Scoring |

|---|---|---|

| Definition | Consolidates financial data from multiple accounts into one view | Evaluates creditworthiness based on credit history and financial data |

| Primary Use | Financial management and budgeting | Loan approvals and risk assessment |

| Data Source | Bank accounts, credit cards, investments | Credit bureaus, financial behavior, payment history |

| Output | Unified financial dashboard | Credit score or rating |

| Benefits | Improves financial insight and planning | Enables risk-based pricing and lending decisions |

| Limitations | Requires user consent and data access | May not reflect real-time financial changes |

| Regulatory Compliance | GDPR, PSD2 in Europe | Fair Credit Reporting Act (FCRA) in the US |

Which is better?

Account aggregation offers a comprehensive view of a customer's financial data by consolidating information from multiple accounts, enhancing personalized banking services and risk assessment. Credit scoring relies primarily on historical credit data to evaluate an individual's creditworthiness, which may lack the real-time insights provided by aggregated financial information. For a holistic understanding of financial health, account aggregation is often more effective than traditional credit scoring alone.

Connection

Account aggregation consolidates financial data from multiple accounts, providing a comprehensive view of a customer's financial behavior. This aggregated data enhances credit scoring models by offering more accurate and real-time insights into spending patterns, income stability, and debt levels. Improved credit scoring enables banks to make better-informed lending decisions and personalize financial products.

Key Terms

Credit Scoring:

Credit scoring involves evaluating a borrower's creditworthiness by analyzing financial data, payment history, and credit utilization to assign a risk score used by lenders for decision-making. Advanced credit scoring models integrate diverse data sources, including payment behavior and income trends, to improve accuracy and predict likelihood of default. Explore the latest innovations in credit scoring techniques to optimize lending strategies and enhance risk assessment.

Risk Assessment

Credit scoring uses algorithms and historical data to evaluate an individual's creditworthiness, emphasizing repayment history, credit utilization, and income stability for risk assessment. Account aggregation compiles financial data from multiple sources, providing a holistic financial profile that enhances the accuracy of risk evaluation by capturing varied financial behaviors beyond credit scores. Explore how integrating these tools can optimize risk management strategies and improve lending decisions.

Creditworthiness

Credit scoring evaluates an individual's creditworthiness by analyzing credit history, payment patterns, and outstanding debts to generate a numerical score used by lenders for risk assessment. Account aggregation consolidates financial information from multiple accounts to provide a comprehensive view of an individual's financial health, enabling better-informed credit decisions. Explore how combining credit scoring and account aggregation enhances the accuracy of creditworthiness evaluations.

Source and External Links

What is a credit score? | Consumer Financial Protection Bureau - A credit score is a numerical prediction of how likely you are to pay back a loan on time, based on your credit report information, and is used by lenders, landlords, and insurers to make decisions about offering credit or services.

CREDIT SCORING APPROACHES GUIDELINES - The World Bank - Credit scoring is a statistical method that estimates the probability a borrower will default, providing lenders with a quick, consistent way to assess credit risk and set loan terms.

Credit score - Wikipedia - A credit score is a numerical expression derived from a person's credit files, representing their creditworthiness and used by banks, insurers, and other organizations to evaluate lending risk and potential revenue.

dowidth.com

dowidth.com