Neo brokerages leverage advanced technology platforms to offer low-cost, commission-free trading, appealing to tech-savvy and cost-conscious investors. Traditional brokerages provide comprehensive financial services, including personalized advice and access to extensive research tools, often with higher fees and minimum account balances. Explore the key differences and benefits to determine which brokerage suits your investment strategy best.

Why it is important

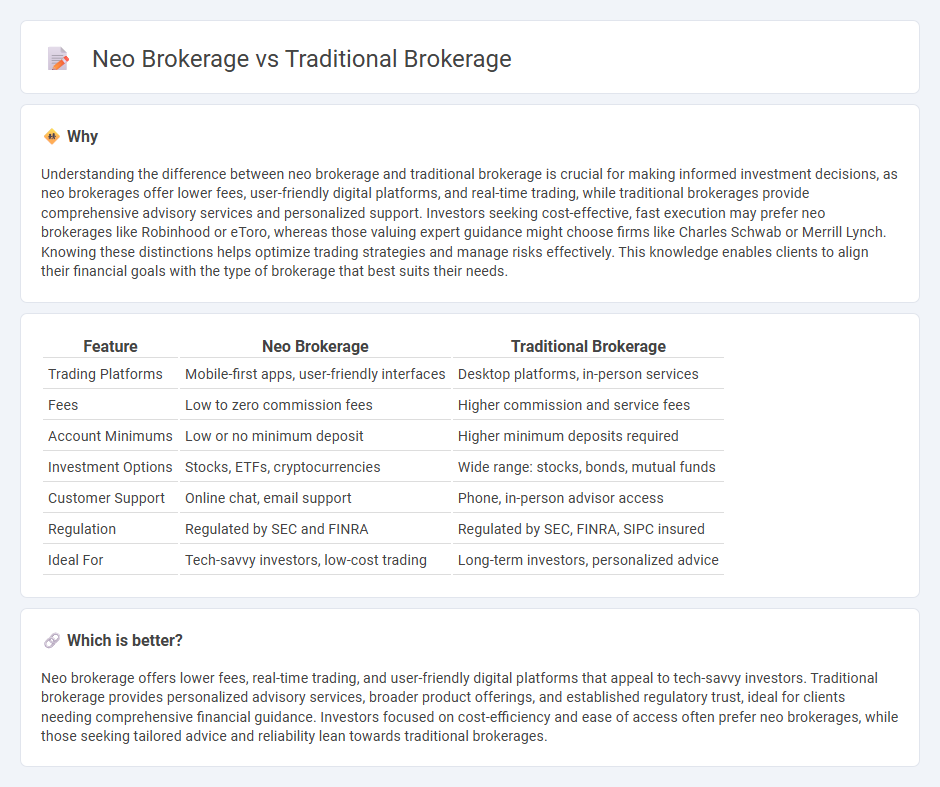

Understanding the difference between neo brokerage and traditional brokerage is crucial for making informed investment decisions, as neo brokerages offer lower fees, user-friendly digital platforms, and real-time trading, while traditional brokerages provide comprehensive advisory services and personalized support. Investors seeking cost-effective, fast execution may prefer neo brokerages like Robinhood or eToro, whereas those valuing expert guidance might choose firms like Charles Schwab or Merrill Lynch. Knowing these distinctions helps optimize trading strategies and manage risks effectively. This knowledge enables clients to align their financial goals with the type of brokerage that best suits their needs.

Comparison Table

| Feature | Neo Brokerage | Traditional Brokerage |

|---|---|---|

| Trading Platforms | Mobile-first apps, user-friendly interfaces | Desktop platforms, in-person services |

| Fees | Low to zero commission fees | Higher commission and service fees |

| Account Minimums | Low or no minimum deposit | Higher minimum deposits required |

| Investment Options | Stocks, ETFs, cryptocurrencies | Wide range: stocks, bonds, mutual funds |

| Customer Support | Online chat, email support | Phone, in-person advisor access |

| Regulation | Regulated by SEC and FINRA | Regulated by SEC, FINRA, SIPC insured |

| Ideal For | Tech-savvy investors, low-cost trading | Long-term investors, personalized advice |

Which is better?

Neo brokerage offers lower fees, real-time trading, and user-friendly digital platforms that appeal to tech-savvy investors. Traditional brokerage provides personalized advisory services, broader product offerings, and established regulatory trust, ideal for clients needing comprehensive financial guidance. Investors focused on cost-efficiency and ease of access often prefer neo brokerages, while those seeking tailored advice and reliability lean towards traditional brokerages.

Connection

Neo brokerage platforms leverage digital technology to streamline trading and investment services traditionally offered by conventional brokerages, enhancing accessibility and lowering transaction costs. Traditional brokerages provide established infrastructure, regulatory compliance, and personalized advisory services, which neo brokerages often integrate through partnerships or hybrid models. This convergence fosters a more competitive financial ecosystem, blending innovation with regulatory rigor to meet diverse investor needs.

Key Terms

Commission Fees

Traditional brokerage firms typically charge higher commission fees ranging from $5 to $10 per trade, reflecting their extensive service offerings and personalized support. Neo brokerages, also known as discount brokers, offer significantly lower or zero commission fees by leveraging digital platforms and streamlined operations. Explore the differences in fee structures to determine which brokerage aligns best with your investment strategy.

Digital Platforms

Traditional brokerage platforms often involve higher fees, in-person consultations, and limited digital tools, catering primarily to experienced investors. Neo brokerages leverage advanced digital platforms offering low-cost or commission-free trades, user-friendly interfaces, and real-time market data, attracting a broader demographic including novice traders. Explore detailed comparisons to discover which brokerage model aligns with your investment goals.

Advisory Services

Traditional brokerages provide personalized advisory services with access to licensed financial advisors who offer tailored investment strategies, portfolio management, and comprehensive financial planning. Neo brokerages often emphasize technology-driven advisory tools such as robo-advisors and AI-based portfolio recommendations, delivering cost-effective, automated guidance primarily suited for self-directed investors. Explore the evolving landscape of advisory services to determine which brokerage model best aligns with your investment goals.

Source and External Links

American Capital Partners: Traditional Brokerage Services - Offers personalized guidance for trading stocks, bonds, and other securities, along with retirement planning and portfolio management.

NerdWallet: What Is a Brokerage Account? - Enables buying and selling of investments such as stocks, bonds, ETFs, and mutual funds through a brokerage firm.

Vanguard: What is a Brokerage Account? - A flexible, nonretirement investment account that holds various assets and allows easy access to funds, suitable for saving toward any financial goal.

dowidth.com

dowidth.com