Super apps integrate multiple financial services, including payments, lending, and investments, into a single digital platform, enhancing user convenience and accessibility. Branch banking, in contrast, relies on physical locations for face-to-face interactions, offering personalized service and trust through direct human engagement. Explore how these banking models transform customer experiences and drive the future of financial services.

Why it is important

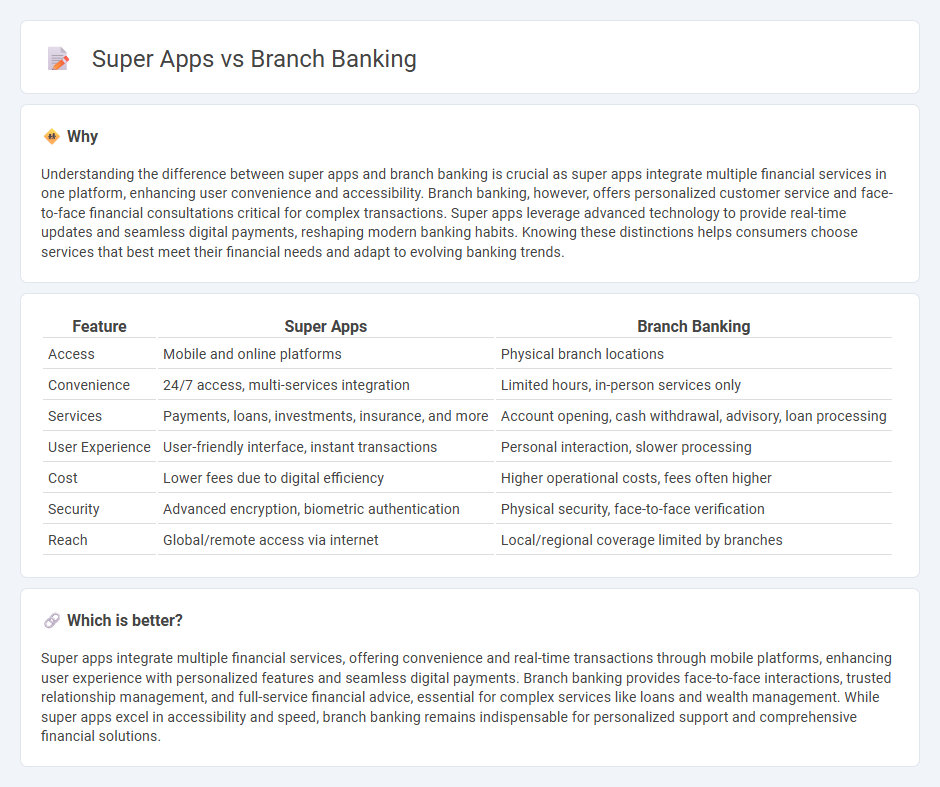

Understanding the difference between super apps and branch banking is crucial as super apps integrate multiple financial services in one platform, enhancing user convenience and accessibility. Branch banking, however, offers personalized customer service and face-to-face financial consultations critical for complex transactions. Super apps leverage advanced technology to provide real-time updates and seamless digital payments, reshaping modern banking habits. Knowing these distinctions helps consumers choose services that best meet their financial needs and adapt to evolving banking trends.

Comparison Table

| Feature | Super Apps | Branch Banking |

|---|---|---|

| Access | Mobile and online platforms | Physical branch locations |

| Convenience | 24/7 access, multi-services integration | Limited hours, in-person services only |

| Services | Payments, loans, investments, insurance, and more | Account opening, cash withdrawal, advisory, loan processing |

| User Experience | User-friendly interface, instant transactions | Personal interaction, slower processing |

| Cost | Lower fees due to digital efficiency | Higher operational costs, fees often higher |

| Security | Advanced encryption, biometric authentication | Physical security, face-to-face verification |

| Reach | Global/remote access via internet | Local/regional coverage limited by branches |

Which is better?

Super apps integrate multiple financial services, offering convenience and real-time transactions through mobile platforms, enhancing user experience with personalized features and seamless digital payments. Branch banking provides face-to-face interactions, trusted relationship management, and full-service financial advice, essential for complex services like loans and wealth management. While super apps excel in accessibility and speed, branch banking remains indispensable for personalized support and comprehensive financial solutions.

Connection

Super apps increasingly integrate banking services by offering seamless financial transactions, while traditional branch banking provides personalized customer support and trust. This connection enhances user experience by combining digital convenience with physical access to financial advice and services. Together, they drive innovation in banking by bridging technology and human interaction.

Key Terms

Physical Branches

Physical branches remain a crucial component of branch banking by offering personalized customer service, direct financial consultations, and immediate access to cash handling. Super apps, while prioritizing seamless digital transactions and integrated services, often lack the tactile engagement and trust built through in-person interactions. Explore the evolving balance between physical branches and super app convenience to understand which best suits diverse customer needs.

Digital Ecosystem

Branch banking relies on physical locations to offer personalized customer service, while super apps integrate multiple financial and lifestyle services into a unified digital ecosystem, enhancing convenience and user engagement. Super apps leverage AI-driven analytics and real-time data to provide customized product recommendations, seamless payments, and embedded financial tools, significantly transforming traditional banking experiences. Explore how digital ecosystems are reshaping financial interactions and driving the future of banking innovation.

Customer Experience

Branch banking offers personalized, face-to-face customer interactions that build trust and foster loyalty through direct support. Super apps redefine customer experience by integrating multiple financial services into a single digital platform, enhancing convenience and accessibility with real-time alerts, seamless transactions, and personalized recommendations. Explore how these evolving models transform customer experience and choose the best fit for your banking needs.

Source and External Links

What is Branch Banking? Future Trends & Digital Impact - Branch banking refers to the operation of physical bank or credit union locations that provide face-to-face customer service, financial transactions, and personalized advice, serving as a tangible community presence for financial institutions.

What Is a Bank Branch? | Everything You Should Know - SmartAsset - A bank branch is a brick-and-mortar location where customers can interact directly with tellers and professionals for services like deposits, withdrawals, loans, and investment advice, offering in-person assistance that online platforms cannot fully replicate.

Branch (banking) - Wikipedia - A bank branch is a retail location where banks, credit unions, or other financial institutions offer a wide range of face-to-face and automated services to customers, with variations including in-store branches and foreign bank branches operating under different regulatory frameworks.

dowidth.com

dowidth.com