Alternative data lending leverages non-traditional information such as social media activity, utility payments, and mobile phone usage to assess creditworthiness, offering financial access to underserved populations. Community banking focuses on localized, relationship-driven services, fostering trust and personalized support within specific geographic areas. Explore how these distinct approaches are reshaping the lending landscape and driving financial inclusion.

Why it is important

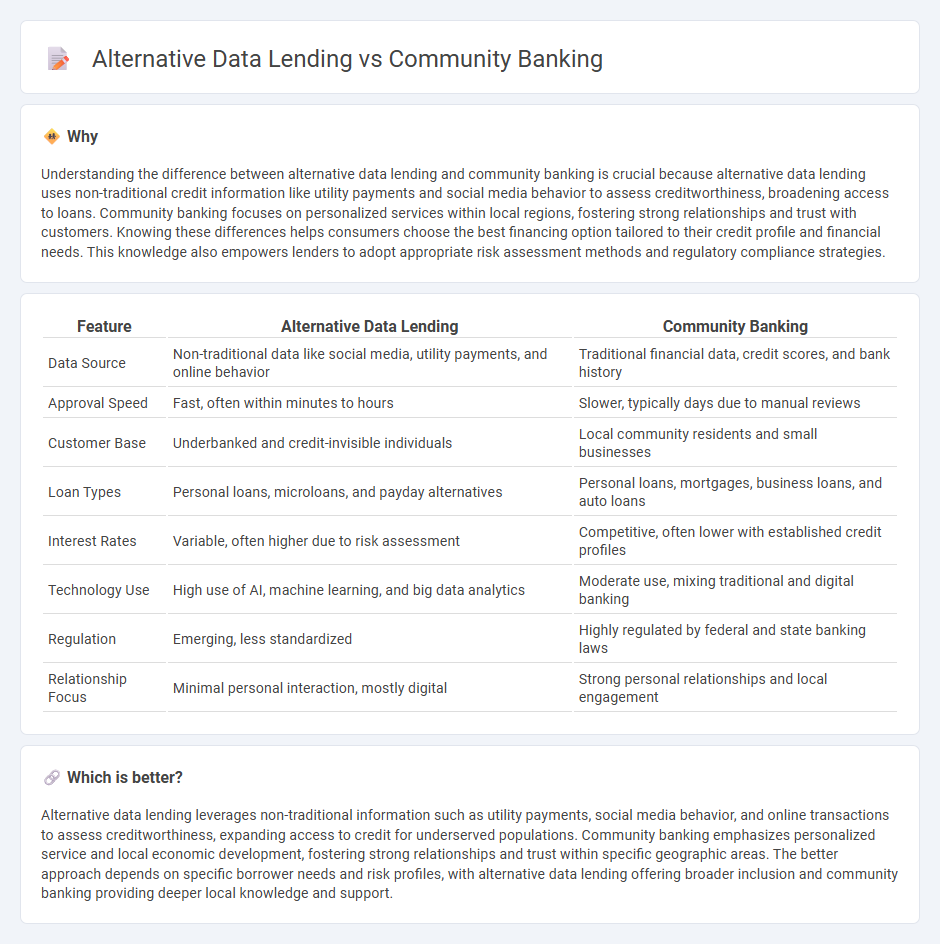

Understanding the difference between alternative data lending and community banking is crucial because alternative data lending uses non-traditional credit information like utility payments and social media behavior to assess creditworthiness, broadening access to loans. Community banking focuses on personalized services within local regions, fostering strong relationships and trust with customers. Knowing these differences helps consumers choose the best financing option tailored to their credit profile and financial needs. This knowledge also empowers lenders to adopt appropriate risk assessment methods and regulatory compliance strategies.

Comparison Table

| Feature | Alternative Data Lending | Community Banking |

|---|---|---|

| Data Source | Non-traditional data like social media, utility payments, and online behavior | Traditional financial data, credit scores, and bank history |

| Approval Speed | Fast, often within minutes to hours | Slower, typically days due to manual reviews |

| Customer Base | Underbanked and credit-invisible individuals | Local community residents and small businesses |

| Loan Types | Personal loans, microloans, and payday alternatives | Personal loans, mortgages, business loans, and auto loans |

| Interest Rates | Variable, often higher due to risk assessment | Competitive, often lower with established credit profiles |

| Technology Use | High use of AI, machine learning, and big data analytics | Moderate use, mixing traditional and digital banking |

| Regulation | Emerging, less standardized | Highly regulated by federal and state banking laws |

| Relationship Focus | Minimal personal interaction, mostly digital | Strong personal relationships and local engagement |

Which is better?

Alternative data lending leverages non-traditional information such as utility payments, social media behavior, and online transactions to assess creditworthiness, expanding access to credit for underserved populations. Community banking emphasizes personalized service and local economic development, fostering strong relationships and trust within specific geographic areas. The better approach depends on specific borrower needs and risk profiles, with alternative data lending offering broader inclusion and community banking providing deeper local knowledge and support.

Connection

Alternative data lending leverages non-traditional information such as utility payments, social media activity, and rental history to assess creditworthiness, expanding access to credit for underserved populations. Community banks utilize this data to personalize lending decisions, fostering stronger relationships and supporting local economic growth. This integration enhances financial inclusion by enabling community banks to approve loans for individuals often overlooked by traditional credit scoring models.

Key Terms

Relationship Banking

Community banking emphasizes relationship banking, leveraging personalized customer interactions and deep local market knowledge to assess creditworthiness beyond traditional metrics. Alternative data lending incorporates non-traditional data sources such as utility payments, social media activity, and transactional data to expand credit access for underserved populations. Explore how these approaches transform lending decisions and broaden financial inclusion.

Credit Scoring Models

Community banking credit scoring models primarily rely on traditional financial data such as credit history, income statements, and loan repayment records to assess borrower risk. Alternative data lending incorporates non-traditional information, including utility payments, social media activity, and mobile phone usage, which enhances credit accessibility for underbanked populations. Explore more to understand how these models shape inclusive lending ecosystems.

Financial Inclusion

Community banking leverages localized relationships and traditional credit metrics to provide financial services, fostering greater financial inclusion through personalized support and accessibility in underserved areas. Alternative data lending incorporates non-traditional credit information such as utility payments, rental history, and social data, expanding credit access to unbanked and underbanked populations often excluded from mainstream financial systems. Explore the evolving landscape of financial inclusion driven by community banking and alternative data lending to understand their distinct roles and benefits.

Source and External Links

About Community Banking - Community banks are locally owned financial institutions that reinvest local dollars back into their communities and help create local jobs, focusing on meeting community needs.

The Critical Role of Community Banks - Community banks emphasize personalized "relationship banking," offering credit and financial services tailored to local businesses and consumers, often playing a crucial role during economic stress by supporting agriculture, small businesses, and emergency relief efforts.

Community bank - In the U.S., community banks are typically locally owned and operated, focusing on lending to families, businesses, and farmers in their immediate geographic area, with lending decisions made by people familiar with local needs; they represent a significant portion of banks by number, though their share of national deposits has decreased over time.

dowidth.com

dowidth.com