Account aggregation consolidates financial data from multiple institutions into a single interface, enhancing user convenience and financial management. Core banking refers to the backend systems that process daily banking transactions and maintain customer accounts in real time. Discover how these technologies transform banking experiences and operations.

Why it is important

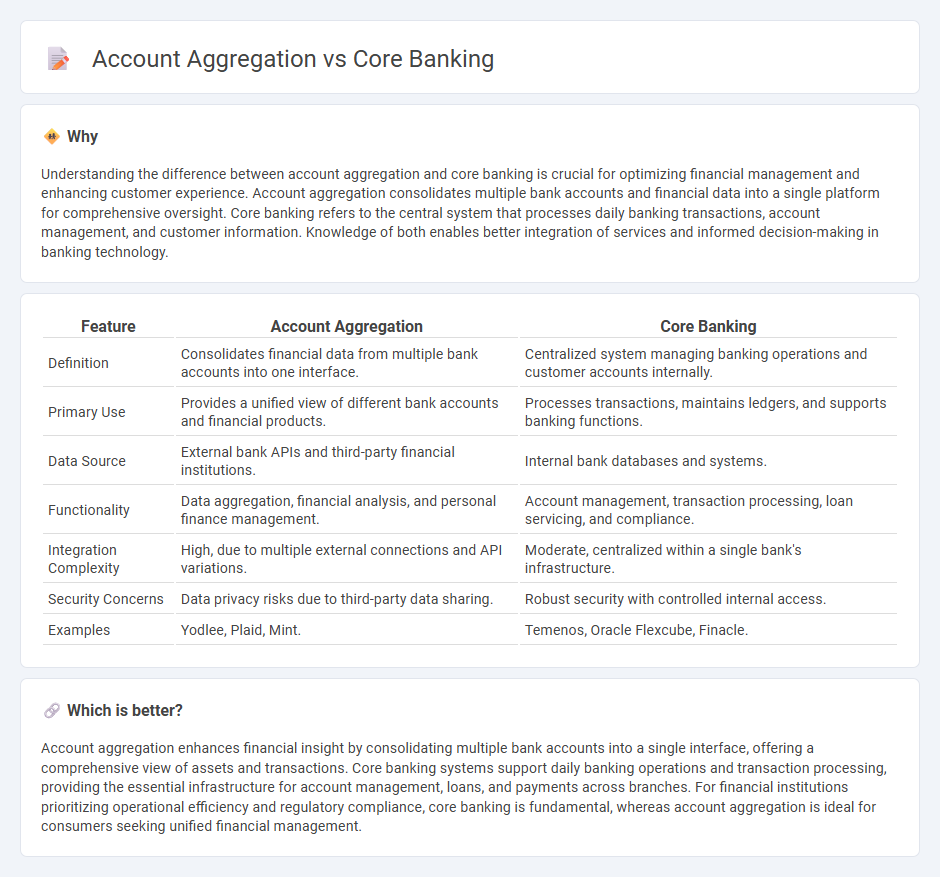

Understanding the difference between account aggregation and core banking is crucial for optimizing financial management and enhancing customer experience. Account aggregation consolidates multiple bank accounts and financial data into a single platform for comprehensive oversight. Core banking refers to the central system that processes daily banking transactions, account management, and customer information. Knowledge of both enables better integration of services and informed decision-making in banking technology.

Comparison Table

| Feature | Account Aggregation | Core Banking |

|---|---|---|

| Definition | Consolidates financial data from multiple bank accounts into one interface. | Centralized system managing banking operations and customer accounts internally. |

| Primary Use | Provides a unified view of different bank accounts and financial products. | Processes transactions, maintains ledgers, and supports banking functions. |

| Data Source | External bank APIs and third-party financial institutions. | Internal bank databases and systems. |

| Functionality | Data aggregation, financial analysis, and personal finance management. | Account management, transaction processing, loan servicing, and compliance. |

| Integration Complexity | High, due to multiple external connections and API variations. | Moderate, centralized within a single bank's infrastructure. |

| Security Concerns | Data privacy risks due to third-party data sharing. | Robust security with controlled internal access. |

| Examples | Yodlee, Plaid, Mint. | Temenos, Oracle Flexcube, Finacle. |

Which is better?

Account aggregation enhances financial insight by consolidating multiple bank accounts into a single interface, offering a comprehensive view of assets and transactions. Core banking systems support daily banking operations and transaction processing, providing the essential infrastructure for account management, loans, and payments across branches. For financial institutions prioritizing operational efficiency and regulatory compliance, core banking is fundamental, whereas account aggregation is ideal for consumers seeking unified financial management.

Connection

Account aggregation consolidates financial data from multiple accounts into a unified view, enhancing customer experience within core banking systems. Core banking platforms integrate this aggregated data to provide real-time, comprehensive insights, streamlining account management and personalized service delivery. This connection enables banks to offer seamless financial monitoring, improved decision-making, and efficient cross-product recommendations.

Key Terms

**Core Banking:**

Core banking systems centralize and streamline all banking operations, enabling real-time transaction processing and customer data management across branches. These platforms support essential financial services such as deposits, loans, payments, and account maintenance, ensuring consistent and secure access to banking functions. Discover how core banking drives efficiency and customer satisfaction in modern financial institutions.

Centralized Database

Core banking relies on a centralized database to enable real-time processing and unified management of customer accounts, deposits, loans, and transactions across multiple branches. Account aggregation consolidates financial data from diverse institutions into a single platform for enhanced visibility but does not directly manage transactional operations like core banking. Explore the distinct functionalities and benefits of centralized databases in core banking versus account aggregation to deepen your understanding.

Real-time Transaction Processing

Core banking systems enable real-time transaction processing by directly managing customer accounts and facilitating immediate updates across branch networks and digital channels. Account aggregation platforms collect and consolidate financial data from multiple banks but depend on the source institutions' update frequencies, often resulting in delays. Explore more to understand the distinct functionalities and benefits of each approach in enhancing financial services.

Source and External Links

What is Core Banking? - IBM - Core banking is a centralized, real-time back-end system connecting multiple bank branches allowing customers to access and transact through any branch, ATM, or online, providing services like loan management, deposits, and withdrawals with seamless transaction processing and security.

Core banking - Wikipedia - Core banking is banking service offered by networked branches that lets customers perform basic transactions from any branch, supported by software that centralizes record-keeping enabling real-time updates across all branches.

What Is Core Banking: Definition, Features, Benefits - SDK.finance - Core banking systems improve operational efficiency, enhance customer experience by enabling remote access, help banks innovate new products to increase revenue, and reduce risks through advanced security features in banking transactions.

dowidth.com

dowidth.com