Digital KYC leverages online platforms to streamline identity verification by allowing customers to upload documents through secure portals, enhancing convenience and reducing paperwork. Video KYC incorporates real-time video interactions between customers and bank agents to validate identity, ensuring higher security and compliance with regulatory standards. Explore the differences between digital KYC and video KYC to understand which method suits your banking needs best.

Why it is important

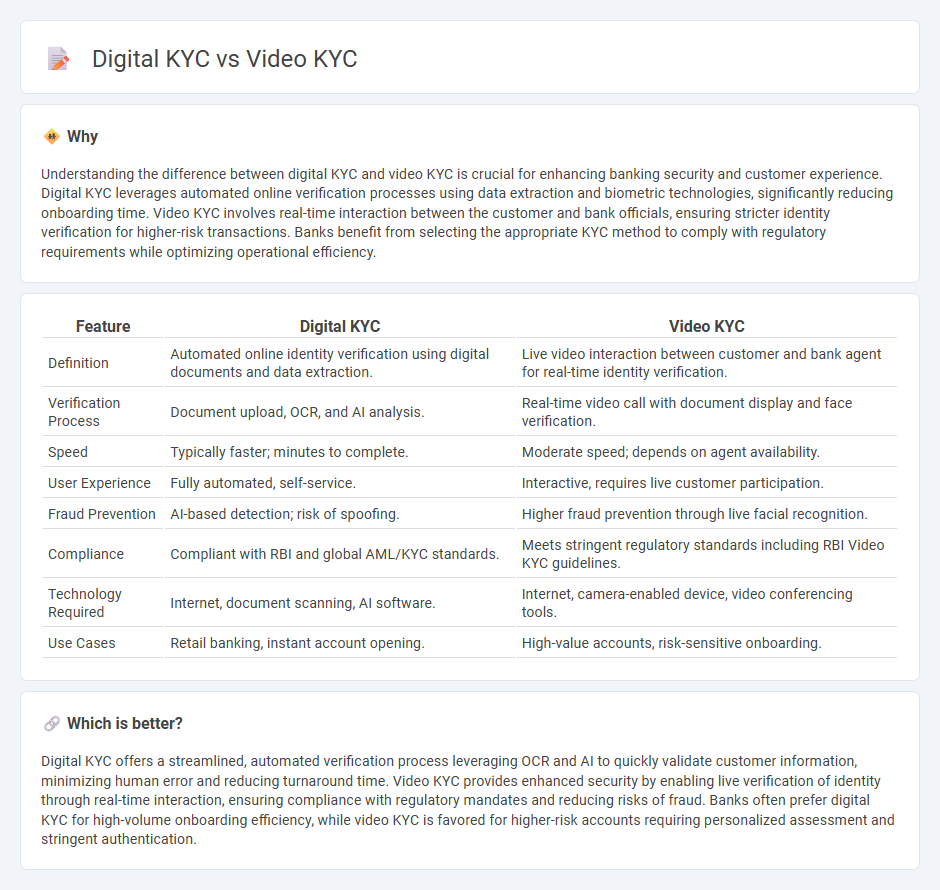

Understanding the difference between digital KYC and video KYC is crucial for enhancing banking security and customer experience. Digital KYC leverages automated online verification processes using data extraction and biometric technologies, significantly reducing onboarding time. Video KYC involves real-time interaction between the customer and bank officials, ensuring stricter identity verification for higher-risk transactions. Banks benefit from selecting the appropriate KYC method to comply with regulatory requirements while optimizing operational efficiency.

Comparison Table

| Feature | Digital KYC | Video KYC |

|---|---|---|

| Definition | Automated online identity verification using digital documents and data extraction. | Live video interaction between customer and bank agent for real-time identity verification. |

| Verification Process | Document upload, OCR, and AI analysis. | Real-time video call with document display and face verification. |

| Speed | Typically faster; minutes to complete. | Moderate speed; depends on agent availability. |

| User Experience | Fully automated, self-service. | Interactive, requires live customer participation. |

| Fraud Prevention | AI-based detection; risk of spoofing. | Higher fraud prevention through live facial recognition. |

| Compliance | Compliant with RBI and global AML/KYC standards. | Meets stringent regulatory standards including RBI Video KYC guidelines. |

| Technology Required | Internet, document scanning, AI software. | Internet, camera-enabled device, video conferencing tools. |

| Use Cases | Retail banking, instant account opening. | High-value accounts, risk-sensitive onboarding. |

Which is better?

Digital KYC offers a streamlined, automated verification process leveraging OCR and AI to quickly validate customer information, minimizing human error and reducing turnaround time. Video KYC provides enhanced security by enabling live verification of identity through real-time interaction, ensuring compliance with regulatory mandates and reducing risks of fraud. Banks often prefer digital KYC for high-volume onboarding efficiency, while video KYC is favored for higher-risk accounts requiring personalized assessment and stringent authentication.

Connection

Digital KYC and video KYC are integral components of modern banking compliance, utilizing technology to verify customer identities remotely and securely. Digital KYC leverages electronic documents and biometric data, while video KYC incorporates live video interactions to confirm authenticity in real-time. Together, they streamline onboarding processes, reduce fraud risk, and ensure adherence to regulatory standards in financial institutions.

Key Terms

Real-time Verification

Real-time verification enhances video KYC by enabling instant identity confirmation through live video interactions, reducing fraud and improving customer onboarding speed. Digital KYC without real-time elements often relies on document uploads and asynchronous verification, which can delay processes and increase the risk of identity discrepancies. Explore how real-time verification in video KYC transforms compliance and user experience for more secure and efficient digital identity checks.

Document Upload

Video KYC involves live verification of identity through a video call, whereas digital KYC emphasizes automated document upload and verification using AI-based algorithms. Document upload in digital KYC enables faster, secure processing by extracting and validating data from scanned images, reducing manual errors. Discover how integrating advanced document upload solutions can streamline your KYC compliance process effectively.

Face Recognition

Video KYC leverages live video calls to verify identity through real-time face recognition, ensuring authenticity by capturing dynamic facial features and expressions. Digital KYC often utilizes stored biometric data and AI-based face recognition algorithms for automated, faster identity verification without human intervention. Discover how face recognition technology differentiates video KYC from digital KYC by exploring their security protocols and operational efficiencies.

Source and External Links

What is Video KYC (VKYC) & How Does it Work? - Video KYC involves verifying a customer's identity through a live video call, eliminating the need for physical presence by using technologies like OCR and machine learning.

Video KYC verification: What is it, and how does it work? - Video KYC is a Know Your Customer process that uses video in some capacity, such as video calls with KYC agents or automated video capture for fraud detection.

Video ID Verification | Video KYC for Online Banking - ICICI Bank offers Video KYC as an alternative way to complete the customer identification process, allowing new customers to open and manage accounts through video interaction.

dowidth.com

dowidth.com