Virtual cards offer enhanced security and convenience for online transactions by providing temporary, single-use card numbers linked to your main bank account. Traditional bank accounts deliver comprehensive financial management services, including direct deposits, bill payments, and access to physical branches. Explore the benefits and differences between virtual cards and bank accounts to find the best fit for your financial needs.

Why it is important

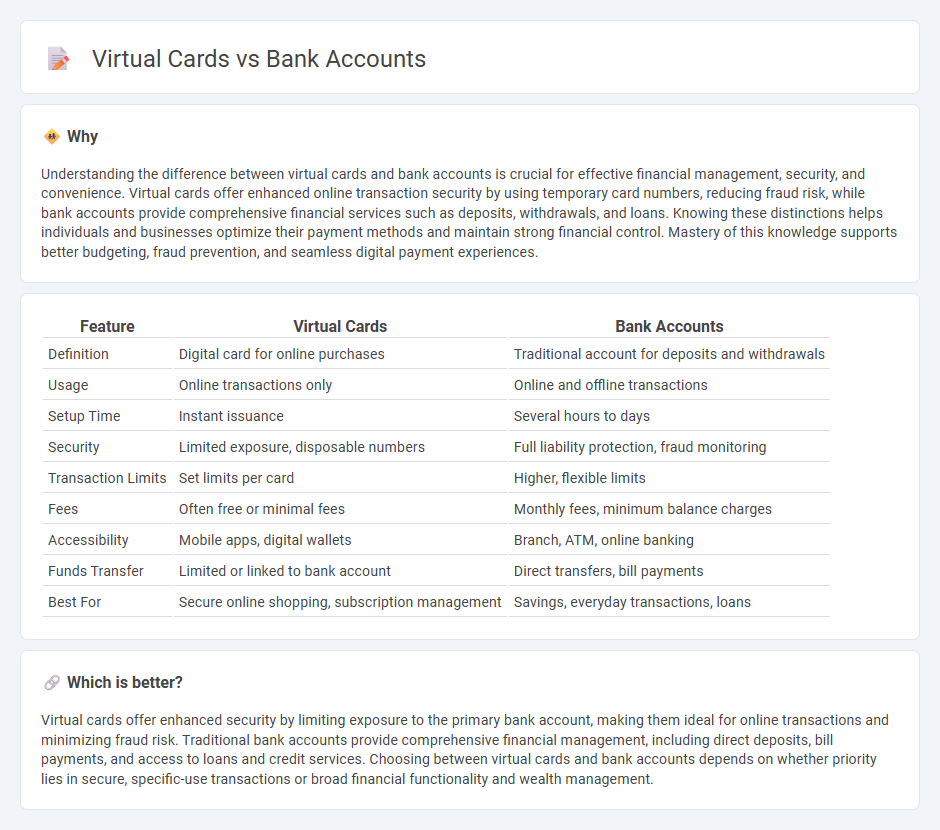

Understanding the difference between virtual cards and bank accounts is crucial for effective financial management, security, and convenience. Virtual cards offer enhanced online transaction security by using temporary card numbers, reducing fraud risk, while bank accounts provide comprehensive financial services such as deposits, withdrawals, and loans. Knowing these distinctions helps individuals and businesses optimize their payment methods and maintain strong financial control. Mastery of this knowledge supports better budgeting, fraud prevention, and seamless digital payment experiences.

Comparison Table

| Feature | Virtual Cards | Bank Accounts |

|---|---|---|

| Definition | Digital card for online purchases | Traditional account for deposits and withdrawals |

| Usage | Online transactions only | Online and offline transactions |

| Setup Time | Instant issuance | Several hours to days |

| Security | Limited exposure, disposable numbers | Full liability protection, fraud monitoring |

| Transaction Limits | Set limits per card | Higher, flexible limits |

| Fees | Often free or minimal fees | Monthly fees, minimum balance charges |

| Accessibility | Mobile apps, digital wallets | Branch, ATM, online banking |

| Funds Transfer | Limited or linked to bank account | Direct transfers, bill payments |

| Best For | Secure online shopping, subscription management | Savings, everyday transactions, loans |

Which is better?

Virtual cards offer enhanced security by limiting exposure to the primary bank account, making them ideal for online transactions and minimizing fraud risk. Traditional bank accounts provide comprehensive financial management, including direct deposits, bill payments, and access to loans and credit services. Choosing between virtual cards and bank accounts depends on whether priority lies in secure, specific-use transactions or broad financial functionality and wealth management.

Connection

Virtual cards are directly linked to bank accounts, serving as digital extensions that allow secure online transactions without exposing the primary account details. These virtual cards draw funds from the associated bank accounts in real-time, ensuring seamless payment processes and immediate transaction updates. Banks provide virtual cards to enhance security and convenience for users managing their finances electronically.

Key Terms

Account Number

Bank accounts provide a unique account number essential for direct deposits, withdrawals, and electronic transfers within the banking network. Virtual cards, however, typically use a temporary card number linked to an underlying bank account, enhancing security but not replacing the fundamental account number. Explore the key differences in how account numbers function to optimize financial management.

Card Issuer

A bank account provides foundational financial services directly linked to traditional banking institutions, whereas virtual cards are issued by specialized card issuers typically affiliated with banks or fintech companies, offering enhanced security and spending controls. Virtual card issuers generate unique card numbers for online transactions, minimizing fraud risk compared to physical cards tied to bank accounts. Explore the evolving roles of card issuers and banks to understand the advantages of each payment method.

Transaction Security

Bank accounts offer robust transaction security through government-backed deposit insurance and strong regulatory oversight, protecting funds against unauthorized access. Virtual cards provide enhanced fraud prevention by generating unique card numbers for each transaction, limiting exposure of the main account details. Explore the latest advancements in securing your financial transactions to choose the best option for your needs.

Source and External Links

Bank of America Advantage Banking: Open a Checking Account - Bank accounts include checking (for everyday transactions with debit card and sometimes checks), savings (for longer-term saving with interest), and CDs (fixed-term deposits with higher interest), with options to link checking and savings accounts for easy ATM access and payments.

Checking Accounts: Open Online Today | Wells Fargo - You can open checking accounts online or at branches (joint accounts require branch visits), access accounts via online or mobile banking, and find routing and account numbers through multiple channels including mobile apps, statements, or physical checks.

Chase Checking Accounts: Compare & Apply Today | Chase - Chase offers various checking accounts with benefits like no minimum opening deposit, early direct deposit, ATM fee savings, online and mobile banking tools, autosave features, and specialized accounts for kids and teens with debit cards controlled by parents.

dowidth.com

dowidth.com