Neobanking offers a fully digital banking experience through mobile apps and online platforms, eliminating the need for physical branches and reducing operational costs. Branch banking maintains traditional physical locations, providing in-person services and personalized customer interactions, which can benefit those preferring face-to-face communication. Explore the differences in convenience, cost, and service between neobanking and branch banking to understand which suits your financial needs best.

Why it is important

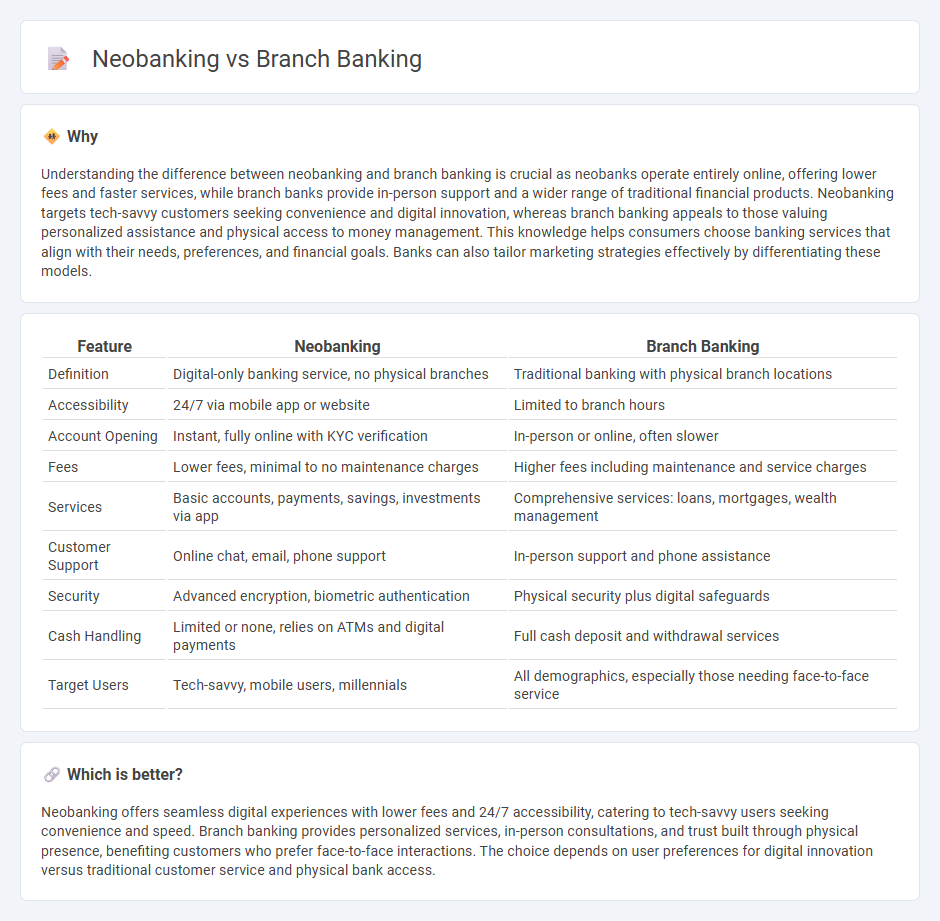

Understanding the difference between neobanking and branch banking is crucial as neobanks operate entirely online, offering lower fees and faster services, while branch banks provide in-person support and a wider range of traditional financial products. Neobanking targets tech-savvy customers seeking convenience and digital innovation, whereas branch banking appeals to those valuing personalized assistance and physical access to money management. This knowledge helps consumers choose banking services that align with their needs, preferences, and financial goals. Banks can also tailor marketing strategies effectively by differentiating these models.

Comparison Table

| Feature | Neobanking | Branch Banking |

|---|---|---|

| Definition | Digital-only banking service, no physical branches | Traditional banking with physical branch locations |

| Accessibility | 24/7 via mobile app or website | Limited to branch hours |

| Account Opening | Instant, fully online with KYC verification | In-person or online, often slower |

| Fees | Lower fees, minimal to no maintenance charges | Higher fees including maintenance and service charges |

| Services | Basic accounts, payments, savings, investments via app | Comprehensive services: loans, mortgages, wealth management |

| Customer Support | Online chat, email, phone support | In-person support and phone assistance |

| Security | Advanced encryption, biometric authentication | Physical security plus digital safeguards |

| Cash Handling | Limited or none, relies on ATMs and digital payments | Full cash deposit and withdrawal services |

| Target Users | Tech-savvy, mobile users, millennials | All demographics, especially those needing face-to-face service |

Which is better?

Neobanking offers seamless digital experiences with lower fees and 24/7 accessibility, catering to tech-savvy users seeking convenience and speed. Branch banking provides personalized services, in-person consultations, and trust built through physical presence, benefiting customers who prefer face-to-face interactions. The choice depends on user preferences for digital innovation versus traditional customer service and physical bank access.

Connection

Neobanking and branch banking are connected through their shared objective of providing comprehensive financial services, with neobanks leveraging digital technology to enhance customer convenience and branch banking offering traditional in-person assistance. Integration of digital platforms by branch banks often includes features typical of neobanks, such as mobile apps and online accounts, bridging the gap between physical and virtual banking experiences. This convergence allows customers to access banking services anytime while retaining the option for face-to-face interactions, optimizing overall customer engagement and satisfaction.

Key Terms

Physical Branches

Branch banking provides customers with physical locations where they can access services, conduct transactions, and receive personalized assistance from bank staff. Neobanks operate entirely online without physical branches, relying on digital platforms and mobile apps for customer interaction and account management. Explore deeper insights into how physical branches impact customer experience and banking security.

Digital-Only Services

Branch banking offers traditional in-person services through physical locations, while neobanking operates exclusively online, providing digital-only banking services with streamlined user experiences and lower fees. Neobanks leverage advanced technology for real-time transactions, personalized financial insights, and seamless mobile app interfaces, enhancing convenience and accessibility. Explore further to understand how digital-only services are reshaping the future of banking.

Customer Experience

Branch banking offers in-person services that facilitate personalized customer interactions and build trust through face-to-face communication, while neobanking delivers seamless digital experiences powered by AI-driven personalization and 24/7 accessibility via mobile apps. The rise of neobanks emphasizes intuitive user interfaces, faster transaction processing, and cost-effective banking without physical branches, appealing to tech-savvy and convenience-focused customers. Explore how these models reshape customer expectations and drive innovation in financial services.

Source and External Links

Branch Banking - Branch banking refers to a system where a bank offers services across multiple locations, enhancing accessibility for customers.

What Is a Bank Branch? - A bank branch is a physical location where customers can engage in banking activities such as deposits, withdrawals, and seeking financial advice.

Branch (banking) - A branch in banking is a retail site where financial institutions provide a range of services to their customers, including face-to-face and automated services.

dowidth.com

dowidth.com