Social trading platforms enable individuals to copy expert traders' strategies in real-time, providing a dynamic and accessible way to engage in financial markets. Investment clubs involve a group of investors pooling resources to collectively research and decide on investments, fostering collaborative decision-making and shared returns. Discover how both approaches can enhance your portfolio diversification and investment knowledge.

Why it is important

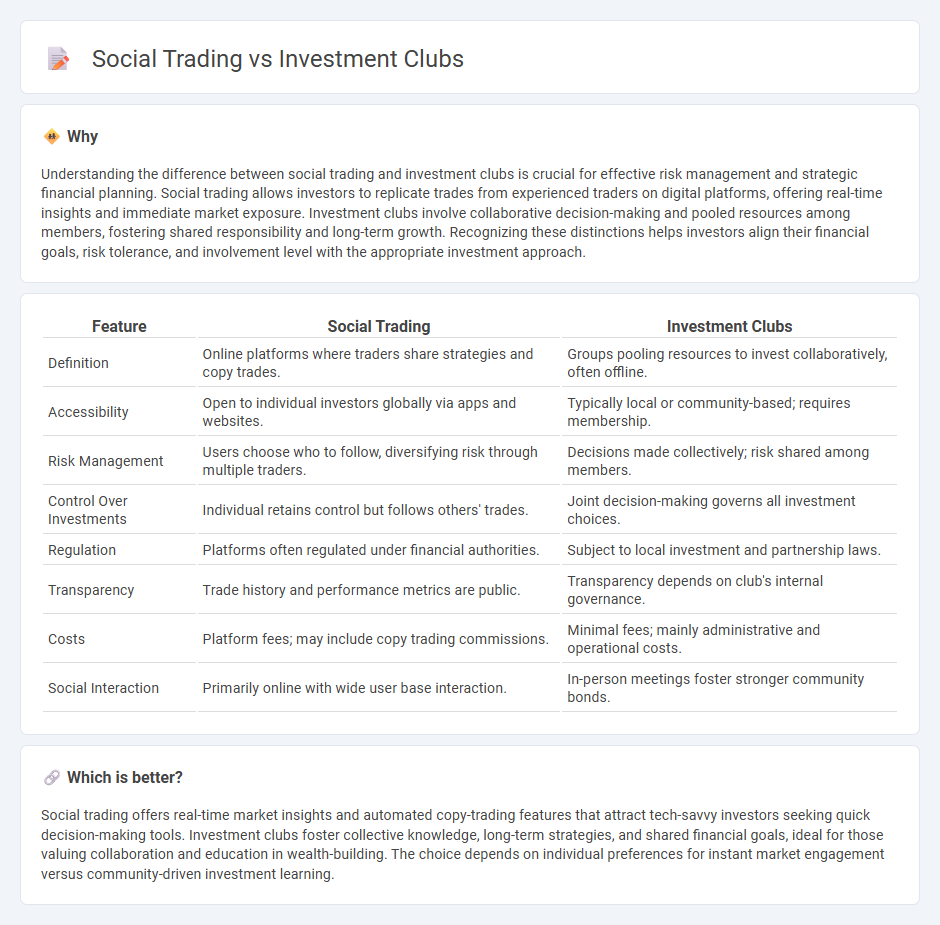

Understanding the difference between social trading and investment clubs is crucial for effective risk management and strategic financial planning. Social trading allows investors to replicate trades from experienced traders on digital platforms, offering real-time insights and immediate market exposure. Investment clubs involve collaborative decision-making and pooled resources among members, fostering shared responsibility and long-term growth. Recognizing these distinctions helps investors align their financial goals, risk tolerance, and involvement level with the appropriate investment approach.

Comparison Table

| Feature | Social Trading | Investment Clubs |

|---|---|---|

| Definition | Online platforms where traders share strategies and copy trades. | Groups pooling resources to invest collaboratively, often offline. |

| Accessibility | Open to individual investors globally via apps and websites. | Typically local or community-based; requires membership. |

| Risk Management | Users choose who to follow, diversifying risk through multiple traders. | Decisions made collectively; risk shared among members. |

| Control Over Investments | Individual retains control but follows others' trades. | Joint decision-making governs all investment choices. |

| Regulation | Platforms often regulated under financial authorities. | Subject to local investment and partnership laws. |

| Transparency | Trade history and performance metrics are public. | Transparency depends on club's internal governance. |

| Costs | Platform fees; may include copy trading commissions. | Minimal fees; mainly administrative and operational costs. |

| Social Interaction | Primarily online with wide user base interaction. | In-person meetings foster stronger community bonds. |

Which is better?

Social trading offers real-time market insights and automated copy-trading features that attract tech-savvy investors seeking quick decision-making tools. Investment clubs foster collective knowledge, long-term strategies, and shared financial goals, ideal for those valuing collaboration and education in wealth-building. The choice depends on individual preferences for instant market engagement versus community-driven investment learning.

Connection

Social trading platforms enable investors to share strategies and replicate successful trades, fostering collaborative investment environments similar to traditional investment clubs. Investment clubs aggregate resources and expertise from members to collectively analyze markets and make informed financial decisions, complementing the interactive features of social trading. Both models leverage community-driven insights to enhance portfolio diversification and risk management in banking and finance.

Key Terms

Collective Investment

Collective investment through investment clubs involves pooling funds from members to make joint decisions and share profits, fostering financial education and community involvement. Social trading enables individuals to follow and replicate the trades of experienced investors in real-time on digital platforms, offering ease of access and diversification. Explore how these approaches can enhance your investment strategy and financial growth.

Copy Trading

Investment clubs enable members to pool capital and make collective decisions on asset allocations, fostering a sense of community and shared financial goals. Social trading, especially Copy Trading, allows individual investors to mimic the trades of successful traders in real-time through online platforms, offering a hands-off approach to portfolio management. Discover how Copy Trading can fit your investment strategy and enhance your market engagement.

Portfolio Diversification

Investment clubs enable members to pool resources and collectively decide on diversified portfolios, spreading risk across various asset classes to enhance returns. Social trading platforms offer real-time insights from multiple investors, allowing individuals to mimic diversified strategies without direct management involvement. Explore how each approach can optimize your portfolio diversification strategy.

Source and External Links

Investment club - An investment club is a group of individuals who meet periodically to pool their money and invest together.

Investment Clubs: How To Join One Or Start Your Own - Investment clubs allow members to discuss investing strategies, set shared goals, and, in many cases, pool funds to invest as a group, often with regular meetings and elected officers.

Starting an Investment Club - Members of an investment club meet regularly to learn about investing, research potential investments, and jointly decide where to allocate their pooled money, with the added benefit of shared knowledge and perspectives.

dowidth.com

dowidth.com