Open banking revolutionizes financial services by enabling secure data sharing between traditional banks and third-party providers, fostering innovation and personalized offerings. Challenger banks operate entirely online without physical branches, focusing on user-friendly digital experiences and competitive fees to attract tech-savvy customers. Explore the differences and advantages of open banking and challenger banks to understand the future of banking innovation.

Why it is important

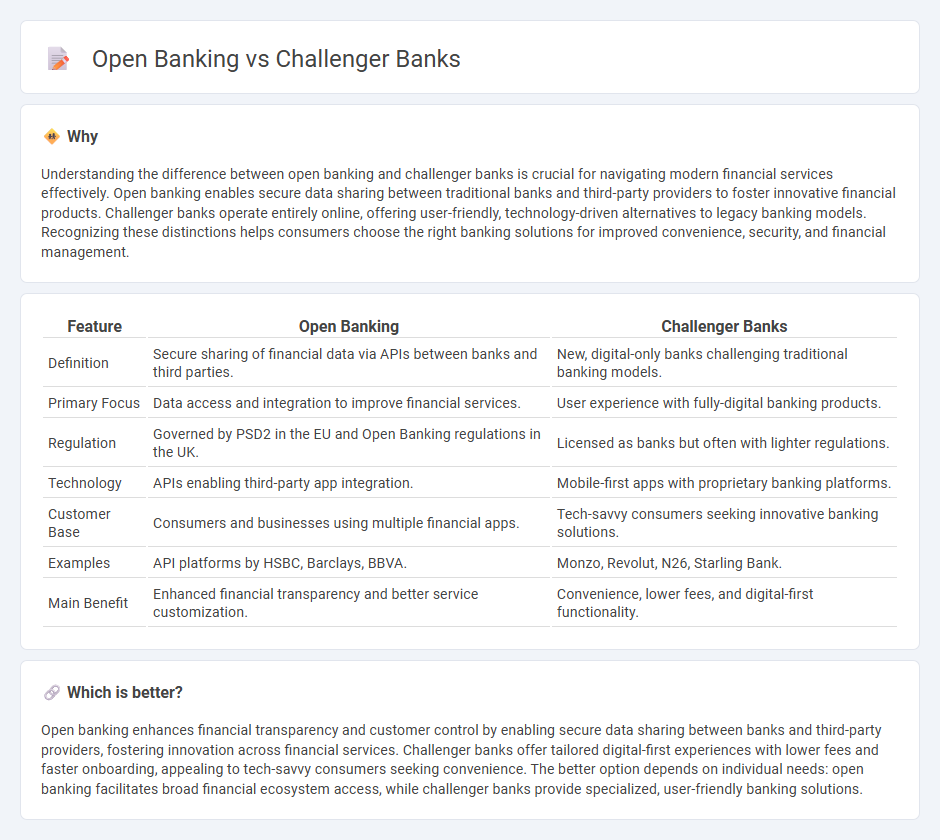

Understanding the difference between open banking and challenger banks is crucial for navigating modern financial services effectively. Open banking enables secure data sharing between traditional banks and third-party providers to foster innovative financial products. Challenger banks operate entirely online, offering user-friendly, technology-driven alternatives to legacy banking models. Recognizing these distinctions helps consumers choose the right banking solutions for improved convenience, security, and financial management.

Comparison Table

| Feature | Open Banking | Challenger Banks |

|---|---|---|

| Definition | Secure sharing of financial data via APIs between banks and third parties. | New, digital-only banks challenging traditional banking models. |

| Primary Focus | Data access and integration to improve financial services. | User experience with fully-digital banking products. |

| Regulation | Governed by PSD2 in the EU and Open Banking regulations in the UK. | Licensed as banks but often with lighter regulations. |

| Technology | APIs enabling third-party app integration. | Mobile-first apps with proprietary banking platforms. |

| Customer Base | Consumers and businesses using multiple financial apps. | Tech-savvy consumers seeking innovative banking solutions. |

| Examples | API platforms by HSBC, Barclays, BBVA. | Monzo, Revolut, N26, Starling Bank. |

| Main Benefit | Enhanced financial transparency and better service customization. | Convenience, lower fees, and digital-first functionality. |

Which is better?

Open banking enhances financial transparency and customer control by enabling secure data sharing between banks and third-party providers, fostering innovation across financial services. Challenger banks offer tailored digital-first experiences with lower fees and faster onboarding, appealing to tech-savvy consumers seeking convenience. The better option depends on individual needs: open banking facilitates broad financial ecosystem access, while challenger banks provide specialized, user-friendly banking solutions.

Connection

Open banking revolutionizes financial services by enabling third-party developers to build applications and services around banks, promoting transparency and data sharing. Challenger banks leverage open banking APIs to offer innovative, user-centric products with enhanced personalization and lower fees. This synergy accelerates digital transformation, expanding customer choice and fostering competitive financial ecosystems.

Key Terms

Digital-Only

Digital-only challenger banks leverage open banking APIs to offer seamless, personalized financial services without traditional branch networks. These challenger banks use real-time data sharing and advanced technology to enhance customer experience, streamline payments, and optimize account management. Discover how digital-only challenger banks are transforming the financial landscape through open banking integration.

APIs

Challenger banks leverage APIs to deliver innovative, user-centric financial services by integrating seamlessly with third-party platforms, enhancing customer experience and operational efficiency. Open banking mandates standardized API frameworks, enabling secure data sharing between traditional banks, fintechs, and other financial service providers to foster competition and financial innovation. Explore how APIs drive the evolution of banking through challenger banks and open banking initiatives for deeper insights.

Third-Party Providers

Challenger banks leverage open banking APIs to enhance customer experience by integrating Third-Party Providers (TPPs) that offer specialized financial services such as budgeting tools, loan comparisons, and investment platforms. These TPPs access consumer banking data securely through standardized protocols, promoting innovation and competition within the financial industry. Explore how Third-Party Providers reshape the future of banking through open banking innovations.

Source and External Links

Challenger Banks Explained: Trends and Opportunities - Ulam Labs - Challenger banks are digital-first institutions reshaping global finance, with rapid customer growth and strong revenue increases at leaders like Monzo, Starling, and Revolut, while Brazil's Nubank exemplifies explosive adoption in emerging markets.

The Rise of Challenger Banks: Are the Apps Taking Over? - Challenger banks are gaining global market share by leveraging technology and customer-centric services, prompting traditional banks to launch their own fintech brands and prompting tech giants like Google and Amazon to enter the banking space.

The US challenger bank market in 2024: Who is leading the charge? - U.S. challenger banks have sharply increased their product functionalities and resilience, but despite this, significant differentiation among offerings remains limited.

dowidth.com

dowidth.com