Wealthtech integrates cutting-edge digital tools to enhance personalized financial planning and investment strategies, focusing on individual investors' wealth growth. Asset management technology streamlines portfolio management, risk assessment, and regulatory compliance for institutional investors and fund managers. Explore the evolving landscape of Wealthtech and asset management tech to understand their impact on modern banking solutions.

Why it is important

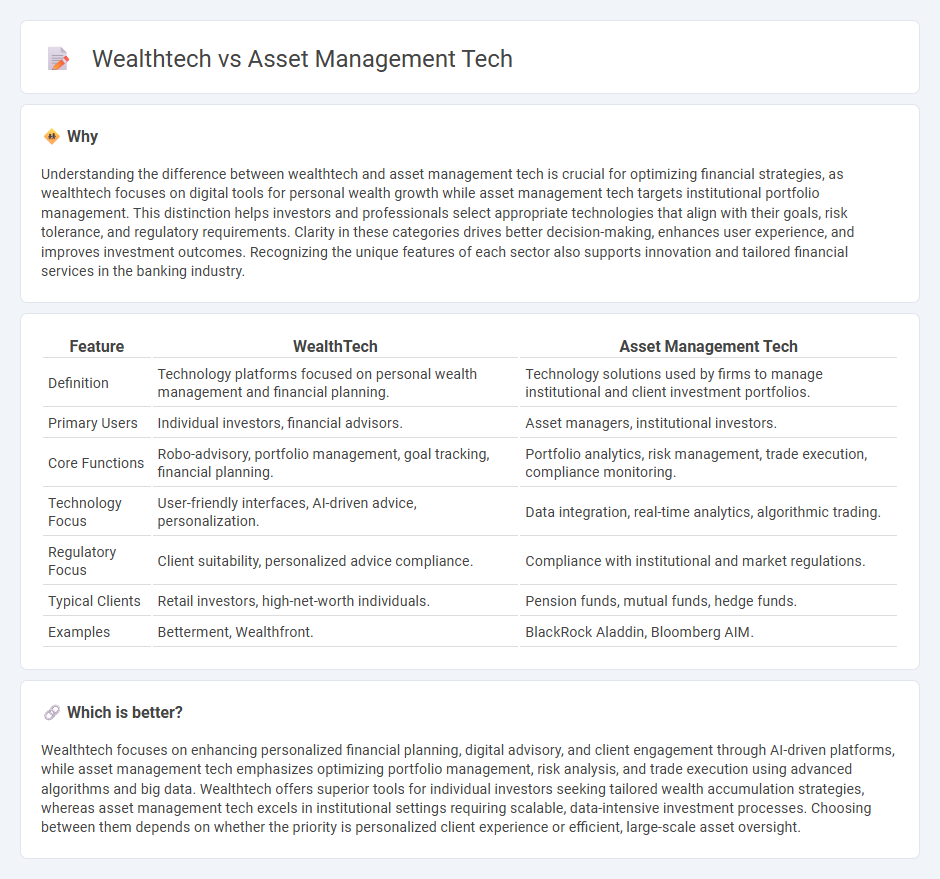

Understanding the difference between wealthtech and asset management tech is crucial for optimizing financial strategies, as wealthtech focuses on digital tools for personal wealth growth while asset management tech targets institutional portfolio management. This distinction helps investors and professionals select appropriate technologies that align with their goals, risk tolerance, and regulatory requirements. Clarity in these categories drives better decision-making, enhances user experience, and improves investment outcomes. Recognizing the unique features of each sector also supports innovation and tailored financial services in the banking industry.

Comparison Table

| Feature | WealthTech | Asset Management Tech |

|---|---|---|

| Definition | Technology platforms focused on personal wealth management and financial planning. | Technology solutions used by firms to manage institutional and client investment portfolios. |

| Primary Users | Individual investors, financial advisors. | Asset managers, institutional investors. |

| Core Functions | Robo-advisory, portfolio management, goal tracking, financial planning. | Portfolio analytics, risk management, trade execution, compliance monitoring. |

| Technology Focus | User-friendly interfaces, AI-driven advice, personalization. | Data integration, real-time analytics, algorithmic trading. |

| Regulatory Focus | Client suitability, personalized advice compliance. | Compliance with institutional and market regulations. |

| Typical Clients | Retail investors, high-net-worth individuals. | Pension funds, mutual funds, hedge funds. |

| Examples | Betterment, Wealthfront. | BlackRock Aladdin, Bloomberg AIM. |

Which is better?

Wealthtech focuses on enhancing personalized financial planning, digital advisory, and client engagement through AI-driven platforms, while asset management tech emphasizes optimizing portfolio management, risk analysis, and trade execution using advanced algorithms and big data. Wealthtech offers superior tools for individual investors seeking tailored wealth accumulation strategies, whereas asset management tech excels in institutional settings requiring scalable, data-intensive investment processes. Choosing between them depends on whether the priority is personalized client experience or efficient, large-scale asset oversight.

Connection

Wealthtech and asset management technology are interconnected through advanced data analytics and AI-driven investment platforms that enhance portfolio customization and risk management. These technologies integrate real-time financial data, enabling seamless automation of asset allocation and optimized wealth growth strategies. By leveraging machine learning algorithms, both sectors improve client advisory services and operational efficiency in financial institutions.

Key Terms

**Asset Management Tech:**

Asset management tech leverages advanced algorithms, AI, and big data analytics to optimize investment portfolios, improve risk management, and automate trading processes for institutional and retail clients. It integrates real-time market data, predictive analytics, and cloud computing to enhance decision-making efficiency and portfolio performance. Discover more about how asset management technology transforms financial strategies and investment outcomes.

Portfolio Optimization

Asset management technology leverages advanced algorithms and AI to optimize portfolio allocation, risk assessment, and performance tracking for institutional investors. Wealthtech platforms prioritize personalized portfolio optimization, integrating robo-advisors and real-time analytics to tailor investment strategies for individual clients. Explore how these technologies transform portfolio optimization by enhancing decision-making and maximizing returns.

Risk Analytics

Asset management technology utilizes advanced risk analytics to optimize portfolio performance by quantifying market, credit, and liquidity risks on institutional assets. Wealthtech integrates risk analytics for personalized investment strategies, focusing on individual risk tolerance and behavioral insights to tailor financial advice. Explore how these risk analytics innovations redefine decision-making in asset management and wealthtech sectors.

Source and External Links

6 Asset Management Technology Trends to Watch in 2025 - AI and machine learning are extensively transforming asset management by enabling predictive risk analytics, optimized asset allocation, and automating operations such as client communication and compliance, with AI adoption expected to grow exponentially in the coming years.

The role of technology in Asset Management and portfolio optimization - Advanced trading technology and AI-driven investment strategies are revolutionizing asset management by automating trade processes, enhancing decision-making, and enabling real-time dynamic asset allocation for improved risk-adjusted returns and client personalization.

7 Asset Management Integration Technology Best Practices - Seamless integration through modern APIs, cloud adoption, and automation is critical for asset management firms to eliminate data silos, streamline workflows, ensure compliance, and build connected, future-proof technology ecosystems.

dowidth.com

dowidth.com