Virtual cards offer enhanced security features by generating unique card numbers for online transactions, reducing fraud risks compared to traditional physical cards used in in-store purchases. Physical cards provide tangible access to ATMs and retail outlets, supporting seamless payment experiences worldwide. Explore the benefits and use cases of virtual and physical cards to optimize your financial management.

Why it is important

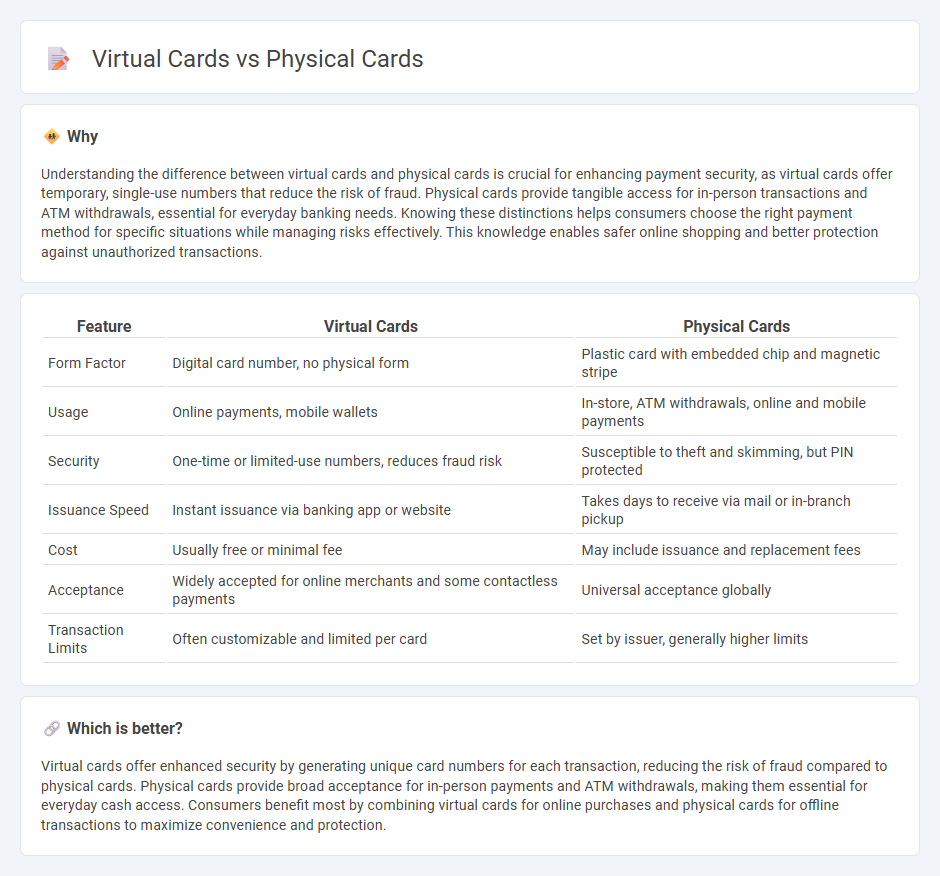

Understanding the difference between virtual cards and physical cards is crucial for enhancing payment security, as virtual cards offer temporary, single-use numbers that reduce the risk of fraud. Physical cards provide tangible access for in-person transactions and ATM withdrawals, essential for everyday banking needs. Knowing these distinctions helps consumers choose the right payment method for specific situations while managing risks effectively. This knowledge enables safer online shopping and better protection against unauthorized transactions.

Comparison Table

| Feature | Virtual Cards | Physical Cards |

|---|---|---|

| Form Factor | Digital card number, no physical form | Plastic card with embedded chip and magnetic stripe |

| Usage | Online payments, mobile wallets | In-store, ATM withdrawals, online and mobile payments |

| Security | One-time or limited-use numbers, reduces fraud risk | Susceptible to theft and skimming, but PIN protected |

| Issuance Speed | Instant issuance via banking app or website | Takes days to receive via mail or in-branch pickup |

| Cost | Usually free or minimal fee | May include issuance and replacement fees |

| Acceptance | Widely accepted for online merchants and some contactless payments | Universal acceptance globally |

| Transaction Limits | Often customizable and limited per card | Set by issuer, generally higher limits |

Which is better?

Virtual cards offer enhanced security by generating unique card numbers for each transaction, reducing the risk of fraud compared to physical cards. Physical cards provide broad acceptance for in-person payments and ATM withdrawals, making them essential for everyday cash access. Consumers benefit most by combining virtual cards for online purchases and physical cards for offline transactions to maximize convenience and protection.

Connection

Virtual cards and physical cards are linked through the same underlying bank account or credit line, enabling seamless transactions across digital and in-store platforms. Both card types share identical account numbers or tokenized credentials, ensuring synchronized spending limits, transaction histories, and security features. This integrated connection allows users to manage finances efficiently while benefiting from the convenience of virtual payments and the tangibility of physical cards.

Key Terms

Card Issuance

Physical card issuance involves manufacturing, embossing, and mailing plastic cards, resulting in longer fulfillment times and higher costs. Virtual cards are instantly generated through digital platforms, offering immediate access for online transactions without the need for physical delivery. Explore how card issuance innovations can streamline payment solutions and enhance user experience.

Security Features

Physical cards offer tactile security elements such as holograms, EMV chips, and magnetic strips that provide robust fraud protection against unauthorized transactions. Virtual cards enhance security with dynamic CVV codes, limited-use numbers, and instant card freezing options that significantly reduce the risk of data breaches during online purchases. Explore the latest advancements in card security to determine the best choice for safeguarding your financial transactions.

Payment Channels

Physical cards offer tangible payment methods widely accepted at retail locations, ATMs, and point-of-sale terminals, facilitating in-person transactions with swipe, chip, or contactless options. Virtual cards function as digital-only payment channels, ideal for online shopping, subscription services, and secure payments without exposing actual card details. Discover how each payment channel can optimize your spending and security needs in different transaction environments.

Source and External Links

Virtual Cards vs Physical Cards - Difference & Benefits - Bill.com - Physical cards are traditional plastic credit cards used for both online and in-person purchases, widely accepted and easy to use offline, with the ability to be physically controlled by cardholders.

Funds, virtual cards, and physical cards - Ramp Support - Physical cards are linked to company funds and can be used for all types of purchases, including in-store, and can also be added to mobile wallets for convenience.

Digital vs Physical Cards: Benefits & Choices - Tapt - Despite the growth of digital cards, physical cards remain trusted and reliable due to their tangible nature, longer functional lifespan without tech issues, and enhanced privacy control over sensitive information.

dowidth.com

dowidth.com