Predictive analytics leverages historical banking data to forecast customer behaviors, enabling tailored financial product recommendations and risk assessments. Cross-selling in banking focuses on promoting complementary products, increasing customer lifetime value by identifying opportunities to offer relevant services such as loans, credit cards, or investment options. Explore how these strategies enhance bank profitability and customer satisfaction.

Why it is important

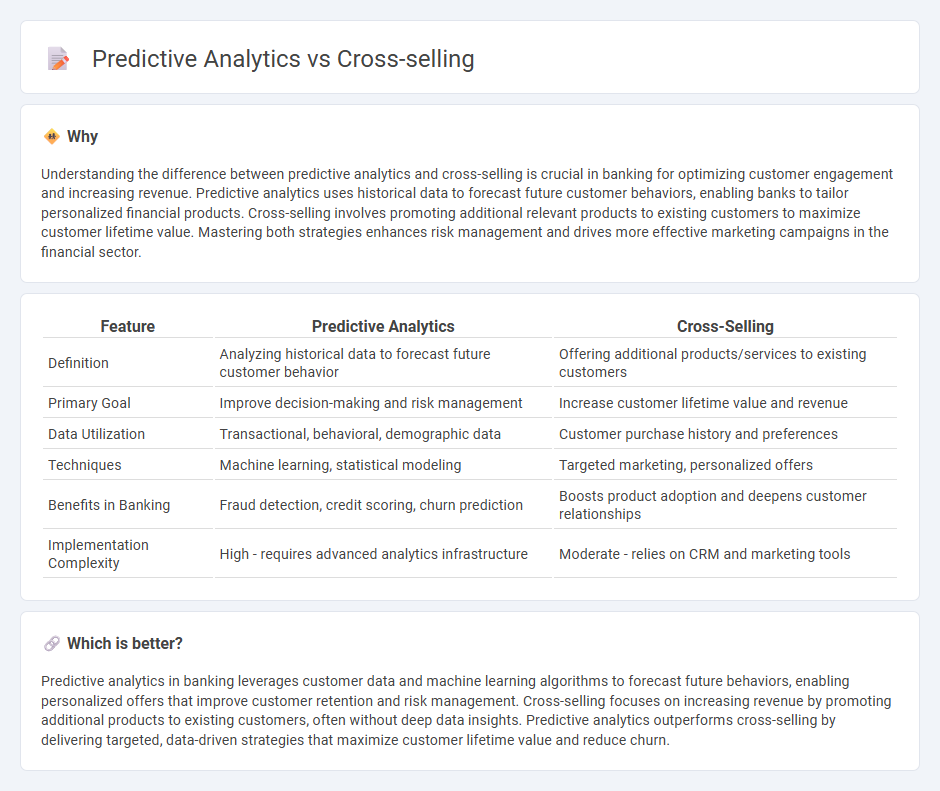

Understanding the difference between predictive analytics and cross-selling is crucial in banking for optimizing customer engagement and increasing revenue. Predictive analytics uses historical data to forecast future customer behaviors, enabling banks to tailor personalized financial products. Cross-selling involves promoting additional relevant products to existing customers to maximize customer lifetime value. Mastering both strategies enhances risk management and drives more effective marketing campaigns in the financial sector.

Comparison Table

| Feature | Predictive Analytics | Cross-Selling |

|---|---|---|

| Definition | Analyzing historical data to forecast future customer behavior | Offering additional products/services to existing customers |

| Primary Goal | Improve decision-making and risk management | Increase customer lifetime value and revenue |

| Data Utilization | Transactional, behavioral, demographic data | Customer purchase history and preferences |

| Techniques | Machine learning, statistical modeling | Targeted marketing, personalized offers |

| Benefits in Banking | Fraud detection, credit scoring, churn prediction | Boosts product adoption and deepens customer relationships |

| Implementation Complexity | High - requires advanced analytics infrastructure | Moderate - relies on CRM and marketing tools |

Which is better?

Predictive analytics in banking leverages customer data and machine learning algorithms to forecast future behaviors, enabling personalized offers that improve customer retention and risk management. Cross-selling focuses on increasing revenue by promoting additional products to existing customers, often without deep data insights. Predictive analytics outperforms cross-selling by delivering targeted, data-driven strategies that maximize customer lifetime value and reduce churn.

Connection

Predictive analytics in banking uses customer data and behavior patterns to forecast future needs and preferences, enabling targeted cross-selling of financial products such as loans, credit cards, and investment services. By leveraging machine learning algorithms and big data, banks can identify high-value customers and anticipate product demand, increasing conversion rates and customer retention. This data-driven approach enhances personalized marketing strategies, optimizing revenue growth while improving customer satisfaction.

Key Terms

Customer Segmentation

Cross-selling leverages customer segmentation to target specific groups with relevant product recommendations, enhancing personalized marketing efforts and increasing sales potential. Predictive analytics utilizes machine learning algorithms to analyze historical customer data and forecast future buying behaviors, enabling more precise segmentation and tailored offers. Explore how integrating customer segmentation with these strategies can maximize your business growth.

Product Recommendation

Cross-selling leverages historical purchase data to suggest complementary products, increasing average order value and customer lifetime value. Predictive analytics uses machine learning algorithms to forecast future buying behavior and tailor product recommendations with higher accuracy. Discover how integrating predictive analytics can enhance your cross-selling strategy and boost sales.

Data Modeling

Cross-selling leverages customer purchase history and demographic data to build predictive models that identify complementary products, enhancing personalized marketing strategies. Predictive analytics employs advanced data modeling techniques, such as regression analysis and machine learning algorithms, to forecast customer behavior and optimize cross-selling opportunities. Explore in-depth methodologies and best practices to maximize revenue and customer engagement through strategic data modeling.

Source and External Links

What Is Cross-Selling? Intro, Steps, and Pro Tips [+Data] - Cross-selling is offering customers extra products or services that complement their original purchase, such as suggesting fries and a drink with a burger order.

Cross-Sell - Overview, How It Works, and Examples - A cross-sell is the sale of an adjacent, related product or service to a customer making a primary purchase, like offering a pedicure to someone buying a manicure at a spa.

What is Cross-Selling? - Salesforce - Cross-selling involves selling related, supplementary products or services based on the customer's interest in or purchase of one of your company's products, aiming to increase loyalty and revenue.

dowidth.com

dowidth.com