Cloud migration enhances banking agility by enabling scalable infrastructure and real-time data processing, while core banking modernization focuses on updating legacy systems to improve transaction speed and security. Both strategies drive operational efficiency and customer experience improvement but differ in approach and technological emphasis. Explore detailed insights to understand which solution best aligns with your banking transformation goals.

Why it is important

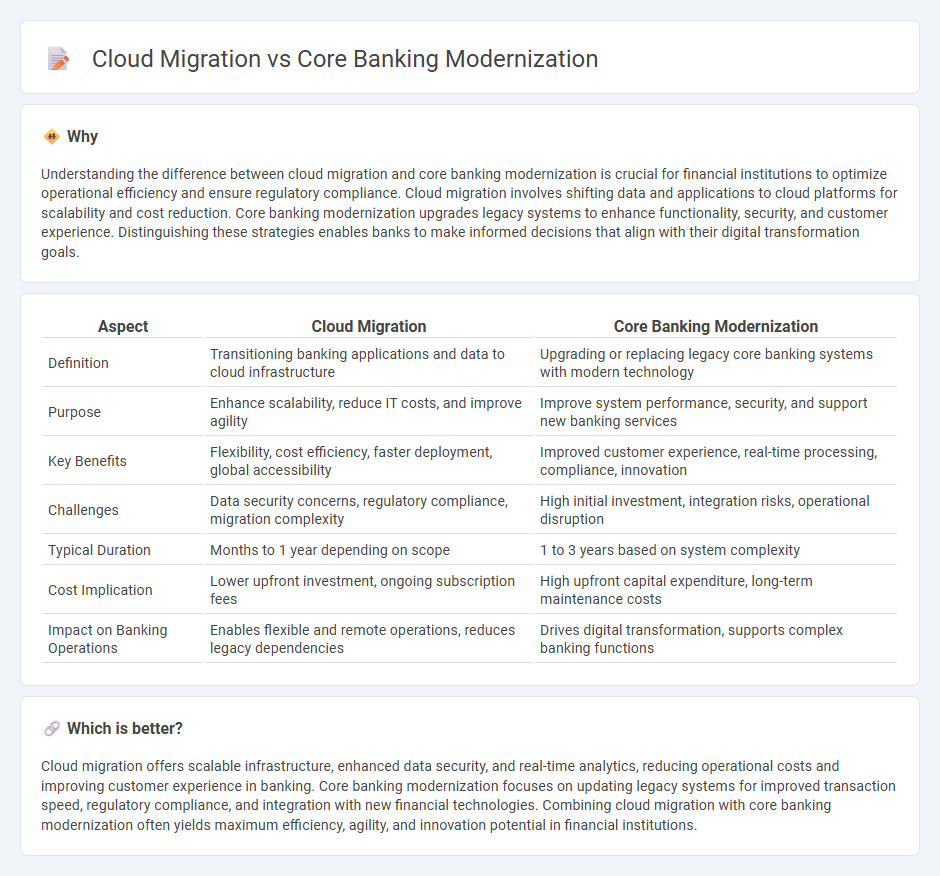

Understanding the difference between cloud migration and core banking modernization is crucial for financial institutions to optimize operational efficiency and ensure regulatory compliance. Cloud migration involves shifting data and applications to cloud platforms for scalability and cost reduction. Core banking modernization upgrades legacy systems to enhance functionality, security, and customer experience. Distinguishing these strategies enables banks to make informed decisions that align with their digital transformation goals.

Comparison Table

| Aspect | Cloud Migration | Core Banking Modernization |

|---|---|---|

| Definition | Transitioning banking applications and data to cloud infrastructure | Upgrading or replacing legacy core banking systems with modern technology |

| Purpose | Enhance scalability, reduce IT costs, and improve agility | Improve system performance, security, and support new banking services |

| Key Benefits | Flexibility, cost efficiency, faster deployment, global accessibility | Improved customer experience, real-time processing, compliance, innovation |

| Challenges | Data security concerns, regulatory compliance, migration complexity | High initial investment, integration risks, operational disruption |

| Typical Duration | Months to 1 year depending on scope | 1 to 3 years based on system complexity |

| Cost Implication | Lower upfront investment, ongoing subscription fees | High upfront capital expenditure, long-term maintenance costs |

| Impact on Banking Operations | Enables flexible and remote operations, reduces legacy dependencies | Drives digital transformation, supports complex banking functions |

Which is better?

Cloud migration offers scalable infrastructure, enhanced data security, and real-time analytics, reducing operational costs and improving customer experience in banking. Core banking modernization focuses on updating legacy systems for improved transaction speed, regulatory compliance, and integration with new financial technologies. Combining cloud migration with core banking modernization often yields maximum efficiency, agility, and innovation potential in financial institutions.

Connection

Cloud migration significantly enhances core banking modernization by enabling scalable infrastructure, real-time data processing, and improved security protocols. Modern core banking systems leverage cloud platforms to integrate advanced APIs, facilitate omni-channel customer experiences, and accelerate product innovation cycles. This synergy drives operational efficiency and regulatory compliance while reducing total cost of ownership for financial institutions.

Key Terms

Core Banking Modernization:

Core banking modernization involves upgrading legacy systems to enhance scalability, improve customer experience, and increase operational efficiency through advanced technologies like APIs, microservices, and real-time data processing. It emphasizes seamless integration with digital channels and regulatory compliance, enabling banks to respond swiftly to market demands. Discover how core banking modernization drives innovation and competitive advantage in today's financial landscape.

Legacy System Transformation

Core banking modernization involves upgrading legacy systems with advanced technologies to enhance operational efficiency and customer experience, while cloud migration shifts these systems to cloud environments for scalability, flexibility, and cost reduction. Legacy system transformation requires careful integration of modern APIs, real-time data processing, and improved security measures to ensure seamless transition and compliance with regulatory standards. Discover how combining modernization with cloud migration strategies can optimize core banking infrastructure for future-ready financial services.

API Integration

Core banking modernization leverages API integration to enable seamless communication between legacy systems and new digital platforms, enhancing operational agility and customer experience. Cloud migration amplifies these benefits by providing scalable infrastructure and real-time data processing, facilitating continuous innovation and faster service deployment. Explore how combining API integration with cloud migration transforms banking ecosystems for future-ready financial institutions.

Source and External Links

How to Start Your Journey Toward Core Banking Modernization - This article discusses the necessity for financial institutions to modernize their core banking systems to stay competitive in the digital transformation era.

How Banks Can Use Seven Levers to Modernize Their Core Systems - The article outlines strategies for modernizing core banking systems, including full replacement, greenfield technologies, and revamping existing systems.

Core Banking Transformation Strategies for Modernization and Value Creation - This blog post focuses on creating a strong business case for core banking modernization, emphasizing the importance of assessing current situations and engaging stakeholders.

dowidth.com

dowidth.com