Loyalty fintech companies specialize in enhancing customer retention by offering rewards, cashback, and personalized financial incentives that increase user engagement. Insurance tech firms focus on leveraging advanced analytics, AI, and automation to streamline underwriting, claims processing, and risk assessment, ultimately improving customer experience and operational efficiency. Discover how these innovations are transforming the banking sector and reshaping customer loyalty strategies.

Why it is important

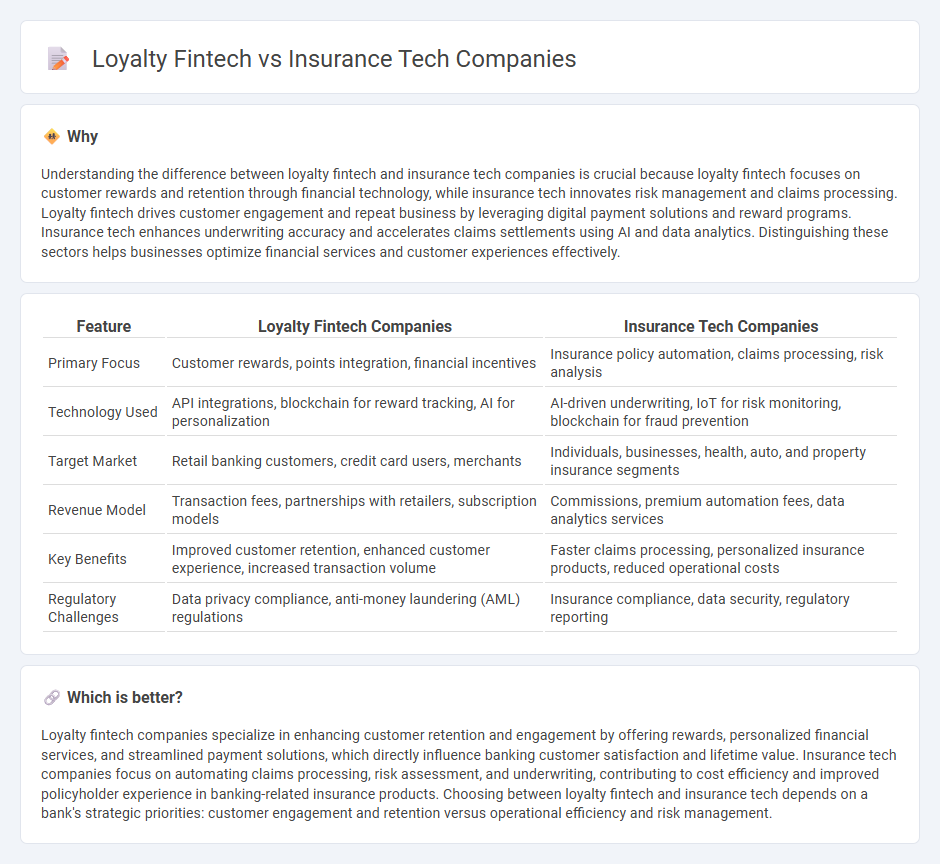

Understanding the difference between loyalty fintech and insurance tech companies is crucial because loyalty fintech focuses on customer rewards and retention through financial technology, while insurance tech innovates risk management and claims processing. Loyalty fintech drives customer engagement and repeat business by leveraging digital payment solutions and reward programs. Insurance tech enhances underwriting accuracy and accelerates claims settlements using AI and data analytics. Distinguishing these sectors helps businesses optimize financial services and customer experiences effectively.

Comparison Table

| Feature | Loyalty Fintech Companies | Insurance Tech Companies |

|---|---|---|

| Primary Focus | Customer rewards, points integration, financial incentives | Insurance policy automation, claims processing, risk analysis |

| Technology Used | API integrations, blockchain for reward tracking, AI for personalization | AI-driven underwriting, IoT for risk monitoring, blockchain for fraud prevention |

| Target Market | Retail banking customers, credit card users, merchants | Individuals, businesses, health, auto, and property insurance segments |

| Revenue Model | Transaction fees, partnerships with retailers, subscription models | Commissions, premium automation fees, data analytics services |

| Key Benefits | Improved customer retention, enhanced customer experience, increased transaction volume | Faster claims processing, personalized insurance products, reduced operational costs |

| Regulatory Challenges | Data privacy compliance, anti-money laundering (AML) regulations | Insurance compliance, data security, regulatory reporting |

Which is better?

Loyalty fintech companies specialize in enhancing customer retention and engagement by offering rewards, personalized financial services, and streamlined payment solutions, which directly influence banking customer satisfaction and lifetime value. Insurance tech companies focus on automating claims processing, risk assessment, and underwriting, contributing to cost efficiency and improved policyholder experience in banking-related insurance products. Choosing between loyalty fintech and insurance tech depends on a bank's strategic priorities: customer engagement and retention versus operational efficiency and risk management.

Connection

Loyalty fintech and insurtech companies are interconnected through their shared use of advanced data analytics and blockchain technology to enhance customer engagement and streamline financial services. Both sectors leverage personalized rewards programs and risk assessment algorithms to provide tailored products, improve retention rates, and reduce operational costs. Integration of these technologies enables seamless cross-industry solutions, driving innovation in banking by combining financial incentives with insurance coverage.

Key Terms

Insurance Tech Companies:

Insurance tech companies leverage advanced technologies such as AI, big data, and blockchain to revolutionize risk assessment, claims processing, and customer experience, driving efficiency and personalization in the insurance industry. Key players like Lemonade, Root Insurance, and Metromile use data analytics and digital platforms to offer tailored policies, faster claim settlements, and fraud detection, setting them apart from traditional insurers and loyalty fintech firms. Explore the latest trends and innovations shaping insurance technology to understand the future of this dynamic sector.

Underwriting

Insurance tech companies leverage advanced data analytics and AI-driven algorithms to enhance underwriting accuracy, reducing risk and improving policy pricing. Loyalty fintech firms integrate customer behavioral data and transaction histories to customize underwriting processes, aiming to increase customer retention and lifetime value. Explore how these innovations transform underwriting by diving deeper into their distinct methodologies.

Claims Processing

Insurance tech companies leverage AI and automation to streamline claims processing, reducing approval times and minimizing human error for enhanced customer satisfaction. Loyalty fintech firms integrate rewards and incentives into claims settlements, encouraging policyholder engagement while improving retention rates. Explore how these innovations transform claims management and boost operational efficiency.

Source and External Links

Top 10: Insurtech Platforms - Lists leading insurtech companies like Root Insurance, which uses telematics for personalized car insurance, and Policygenius, a digital marketplace simplifying insurance comparison for consumers across multiple types of insurance.

39 Insurtech Companies Making Coverage Simpler 2025 | Built In - Highlights innovative insurtech firms such as Kin Insurance, Insurify, Embroker, and Pie Insurance that use AI, data analytics, and digital platforms to provide tailored homeowners, auto, business, and workers' compensation insurance solutions.

Revealed - The top US insurtech unicorns - Describes top U.S. insurtech unicorns like Next Insurance, specializing in digital small business insurance, Mercury Insurance modernizing traditional insurance, and Doma, which uses machine learning for title insurance in real estate transactions.

dowidth.com

dowidth.com