Cloud core banking offers scalable, cost-efficient solutions with rapid deployment and seamless updates, suitable for institutions seeking flexibility and innovation. Private cloud core banking provides enhanced security, regulatory compliance, and control by hosting data on dedicated infrastructure, ideal for banks prioritizing data privacy and sovereignty. Explore the differences further to determine which core banking model aligns with your financial institution's strategic goals.

Why it is important

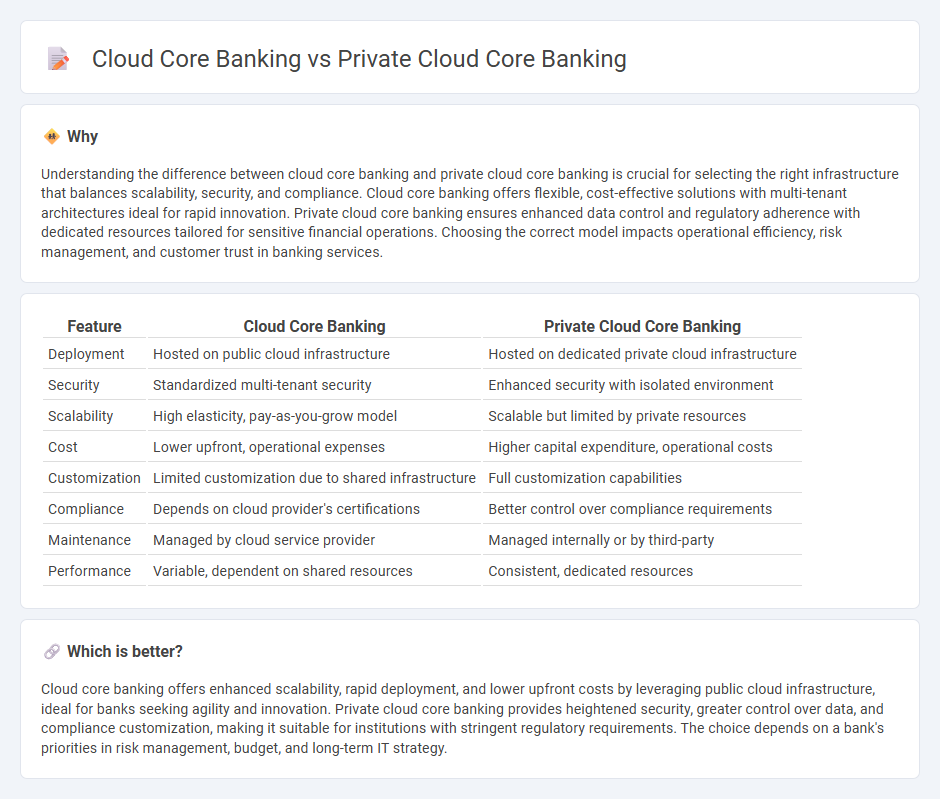

Understanding the difference between cloud core banking and private cloud core banking is crucial for selecting the right infrastructure that balances scalability, security, and compliance. Cloud core banking offers flexible, cost-effective solutions with multi-tenant architectures ideal for rapid innovation. Private cloud core banking ensures enhanced data control and regulatory adherence with dedicated resources tailored for sensitive financial operations. Choosing the correct model impacts operational efficiency, risk management, and customer trust in banking services.

Comparison Table

| Feature | Cloud Core Banking | Private Cloud Core Banking |

|---|---|---|

| Deployment | Hosted on public cloud infrastructure | Hosted on dedicated private cloud infrastructure |

| Security | Standardized multi-tenant security | Enhanced security with isolated environment |

| Scalability | High elasticity, pay-as-you-grow model | Scalable but limited by private resources |

| Cost | Lower upfront, operational expenses | Higher capital expenditure, operational costs |

| Customization | Limited customization due to shared infrastructure | Full customization capabilities |

| Compliance | Depends on cloud provider's certifications | Better control over compliance requirements |

| Maintenance | Managed by cloud service provider | Managed internally or by third-party |

| Performance | Variable, dependent on shared resources | Consistent, dedicated resources |

Which is better?

Cloud core banking offers enhanced scalability, rapid deployment, and lower upfront costs by leveraging public cloud infrastructure, ideal for banks seeking agility and innovation. Private cloud core banking provides heightened security, greater control over data, and compliance customization, making it suitable for institutions with stringent regulatory requirements. The choice depends on a bank's priorities in risk management, budget, and long-term IT strategy.

Connection

Cloud core banking and private cloud core banking share a foundation in delivering core financial services via cloud technology, enhancing scalability, flexibility, and real-time processing for banks. Private cloud core banking offers heightened security and compliance by hosting banking applications within a dedicated cloud environment, catering to institutions with stringent regulatory requirements. Their connection lies in leveraging virtualization and cloud architecture to optimize operational efficiency while addressing varying levels of control and data privacy.

Key Terms

Data Sovereignty

Private cloud core banking ensures data sovereignty by storing sensitive financial information within a controlled and localized environment, complying with strict regulatory requirements. Cloud core banking, utilizing public cloud infrastructure, often faces challenges in maintaining full data sovereignty due to data residency and jurisdiction complexities. Explore how these platforms manage data sovereignty to choose the best fit for your banking needs.

Scalability

Private cloud core banking offers enhanced scalability by providing dedicated resources that can be tailored to the financial institution's specific needs, ensuring consistent performance during peak transaction volumes. Cloud core banking leverages public or hybrid cloud infrastructure, enabling rapid scaling with cost-efficient resource allocation and elasticity suitable for fluctuating workloads. Discover more about how scalability impacts core banking solutions and the best fit for your organization.

Customization

Private cloud core banking offers enhanced customization capabilities by enabling financial institutions to tailor infrastructure, security protocols, and software features to specific business needs. In contrast, cloud core banking typically relies on standardized configurations in public cloud environments, limiting the extent of customization but providing greater scalability and cost efficiency. Explore detailed comparisons to determine which approach aligns best with your organization's customization priorities.

Source and External Links

Private cloud for banks: mastering compliance, security, fintech, and ... - Private cloud enables banks to deploy core banking software with open APIs for fintech integration, maintain legacy systems, and customize security and compliance controls for regulatory requirements.

The benefits of a core banking system in cloud - Speednet - Cloud-native core banking systems streamline operations, support real-time data processing for personalized services, and allow banks to retain full control over data and operations while integrating with third-party fintechs via APIs.

Core banking on cloud - solutions, system, platform provider - Cloud-based core banking solutions automate workflows, offer advanced encryption for security, enable 24/7 service access, and reduce operational costs while improving scalability and flexibility.

dowidth.com

dowidth.com