Green financing directs capital towards environmentally sustainable projects, supporting renewable energy, clean technology, and conservation efforts that reduce carbon footprints. Crowdfunding pools small investments from numerous individuals, enabling innovative startups and community initiatives to access funds outside traditional banking channels. Explore how these financial models are reshaping investment landscapes and promoting ESG goals.

Why it is important

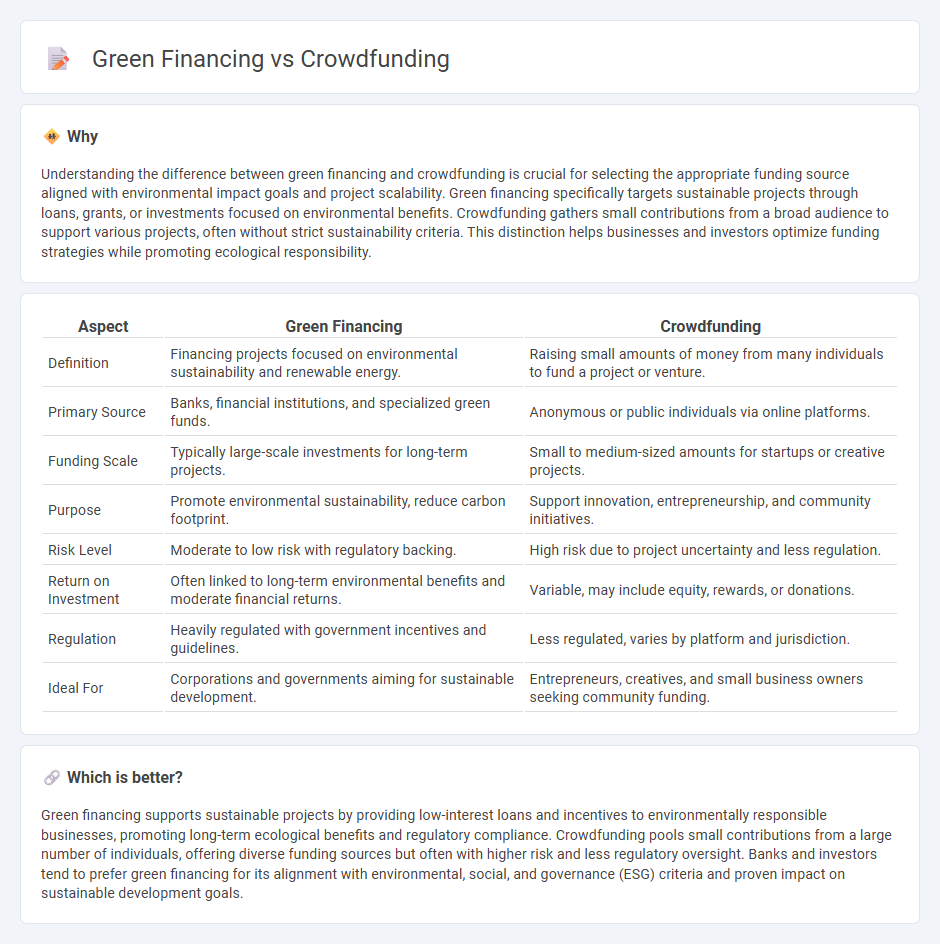

Understanding the difference between green financing and crowdfunding is crucial for selecting the appropriate funding source aligned with environmental impact goals and project scalability. Green financing specifically targets sustainable projects through loans, grants, or investments focused on environmental benefits. Crowdfunding gathers small contributions from a broad audience to support various projects, often without strict sustainability criteria. This distinction helps businesses and investors optimize funding strategies while promoting ecological responsibility.

Comparison Table

| Aspect | Green Financing | Crowdfunding |

|---|---|---|

| Definition | Financing projects focused on environmental sustainability and renewable energy. | Raising small amounts of money from many individuals to fund a project or venture. |

| Primary Source | Banks, financial institutions, and specialized green funds. | Anonymous or public individuals via online platforms. |

| Funding Scale | Typically large-scale investments for long-term projects. | Small to medium-sized amounts for startups or creative projects. |

| Purpose | Promote environmental sustainability, reduce carbon footprint. | Support innovation, entrepreneurship, and community initiatives. |

| Risk Level | Moderate to low risk with regulatory backing. | High risk due to project uncertainty and less regulation. |

| Return on Investment | Often linked to long-term environmental benefits and moderate financial returns. | Variable, may include equity, rewards, or donations. |

| Regulation | Heavily regulated with government incentives and guidelines. | Less regulated, varies by platform and jurisdiction. |

| Ideal For | Corporations and governments aiming for sustainable development. | Entrepreneurs, creatives, and small business owners seeking community funding. |

Which is better?

Green financing supports sustainable projects by providing low-interest loans and incentives to environmentally responsible businesses, promoting long-term ecological benefits and regulatory compliance. Crowdfunding pools small contributions from a large number of individuals, offering diverse funding sources but often with higher risk and less regulatory oversight. Banks and investors tend to prefer green financing for its alignment with environmental, social, and governance (ESG) criteria and proven impact on sustainable development goals.

Connection

Green financing supports environmentally sustainable projects by providing financial resources targeted at renewable energy, energy efficiency, and carbon reduction initiatives. Crowdfunding platforms enable individuals and communities to collectively fund green projects, increasing access to capital and promoting environmentally responsible investments. The synergy between green financing and crowdfunding accelerates the transition to a low-carbon economy by democratizing funding and encouraging broader participation in sustainable development.

Key Terms

Capital Raising

Crowdfunding leverages a large number of small investors through online platforms to raise capital efficiently for diverse projects, while green financing targets environmentally sustainable ventures by attracting funds from impact investors, development banks, and government incentives. Capital raising in crowdfunding tends to be fast and accessible, democratizing investment opportunities, whereas green financing often involves rigorous eligibility criteria and aims to support long-term climate goals. Explore the key differences and benefits to optimize your capital-raising strategy in sustainable finance.

Sustainable Investment

Crowdfunding enables diverse investors to pool capital for sustainable projects, often supporting small-scale renewable energy or environmental initiatives, while green financing involves structured financial products like green bonds and loans aimed at large-scale sustainable development. Both methods drive sustainable investment by channeling funds toward eco-friendly projects, but green financing typically involves institutional investors and regulatory frameworks, enhancing credibility and impact measurement. Explore how integrating crowdfunding with green financing can maximize sustainable investment outcomes and environmental benefits.

Environmental Impact

Crowdfunding mobilizes diverse individual contributions to fund eco-friendly projects, fostering community engagement and innovation in environmental initiatives. Green financing involves institutional investments and loans dedicated to sustainable development, emphasizing large-scale impact and regulatory compliance for climate change mitigation. Explore the distinct roles and benefits of crowdfunding and green financing in driving environmental progress.

Source and External Links

Crowdfunding - Wikipedia - Crowdfunding is the practice of raising money from a large number of people, typically via the internet, to fund projects or ventures and bypass traditional financial intermediaries.

What is crowdfunding? Here are four types for startups to know - Stripe - Crowdfunding allows startups and entrepreneurs to raise funds collectively from individuals online, offering an alternative to traditional financing by leveraging social networks and crowdfunding platforms.

Crowdfunding - Small Business Financing: A Resource Guide - Crowdfunding involves collecting small contributions from many individuals through online platforms, using models such as donation, reward, or equity-based funding, and even peer-to-peer lending.

dowidth.com

dowidth.com