Social trading enables investors to follow and replicate the strategies of experienced traders in real-time, leveraging collective market insights and enhancing decision-making without extensive personal analysis. Signal trading provides specific trade alerts based on algorithmic or expert analysis, allowing users to execute trades based on pre-defined indicators and market trends. Explore how these innovative trading approaches can optimize your investment portfolio and risk management strategies.

Why it is important

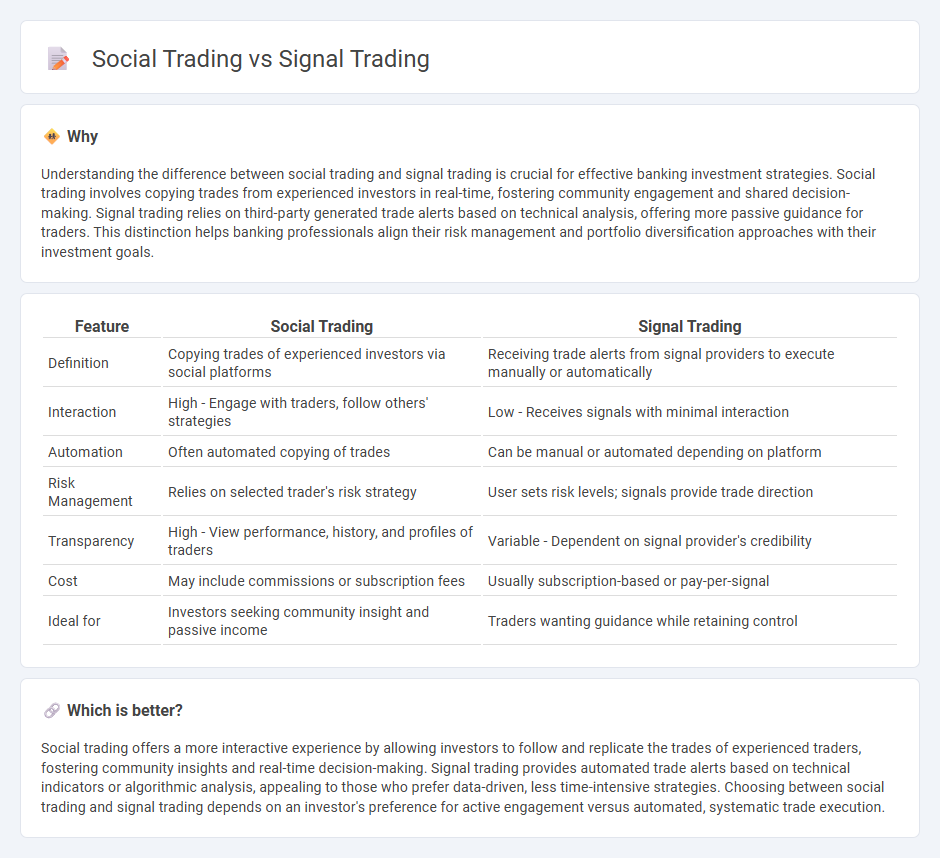

Understanding the difference between social trading and signal trading is crucial for effective banking investment strategies. Social trading involves copying trades from experienced investors in real-time, fostering community engagement and shared decision-making. Signal trading relies on third-party generated trade alerts based on technical analysis, offering more passive guidance for traders. This distinction helps banking professionals align their risk management and portfolio diversification approaches with their investment goals.

Comparison Table

| Feature | Social Trading | Signal Trading |

|---|---|---|

| Definition | Copying trades of experienced investors via social platforms | Receiving trade alerts from signal providers to execute manually or automatically |

| Interaction | High - Engage with traders, follow others' strategies | Low - Receives signals with minimal interaction |

| Automation | Often automated copying of trades | Can be manual or automated depending on platform |

| Risk Management | Relies on selected trader's risk strategy | User sets risk levels; signals provide trade direction |

| Transparency | High - View performance, history, and profiles of traders | Variable - Dependent on signal provider's credibility |

| Cost | May include commissions or subscription fees | Usually subscription-based or pay-per-signal |

| Ideal for | Investors seeking community insight and passive income | Traders wanting guidance while retaining control |

Which is better?

Social trading offers a more interactive experience by allowing investors to follow and replicate the trades of experienced traders, fostering community insights and real-time decision-making. Signal trading provides automated trade alerts based on technical indicators or algorithmic analysis, appealing to those who prefer data-driven, less time-intensive strategies. Choosing between social trading and signal trading depends on an investor's preference for active engagement versus automated, systematic trade execution.

Connection

Social trading leverages collective investor behavior by allowing users to follow and replicate the trades of experienced traders, enhancing decision-making strategies. Signal trading provides real-time alerts and recommendations based on market data analysis, which traders can use to optimize their investment actions. Integrating social trading with signal trading creates a dynamic environment where community insights and data-driven signals converge to improve portfolio performance in banking and financial markets.

Key Terms

Algorithmic Signals

Algorithmic signals in signal trading utilize automated systems to analyze market data and generate precise buy or sell recommendations based on predefined algorithms. Social trading, while often incorporating algorithmic insights, emphasizes community engagement where traders share strategies and signals in real-time, blending human expertise with automated signals. Explore deeper insights into how algorithmic signals optimize trading decisions within both signal and social trading environments.

Copy Trading

Copy trading allows investors to automatically replicate the trades of experienced traders in real-time, offering a hands-off approach that differs from signal trading, where users receive trade alerts to manually execute decisions. This method leverages transparency and direct portfolio mirroring, enhancing learning potential and portfolio diversification for novices. Discover how copy trading can optimize your investment strategy and transform your market engagement.

Trade Transparency

Signal trading offers trade transparency by providing clear entry and exit points based on algorithmic or expert-generated signals, allowing traders to understand the exact reasoning behind each trade. Social trading emphasizes transparency through open access to traders' live performance metrics, trade histories, and portfolios, enabling followers to evaluate and replicate strategies with full visibility. Explore how these transparency features impact your trading decisions and risk management by learning more about signal and social trading differences.

Source and External Links

Signal Trading Group: Home - Provides market analytics and performance data to help traders gain clear insights into specific markets.

dowidth.com

dowidth.com