Predictive analytics leverages historical data and machine learning algorithms to identify patterns and forecast future trends in banking operations. Branch performance forecasting specifically applies these techniques to anticipate key metrics such as customer footfall, loan approvals, and deposit growth at individual bank branches. Explore how predictive analytics transforms branch performance forecasting to optimize resource allocation and drive strategic decision-making.

Why it is important

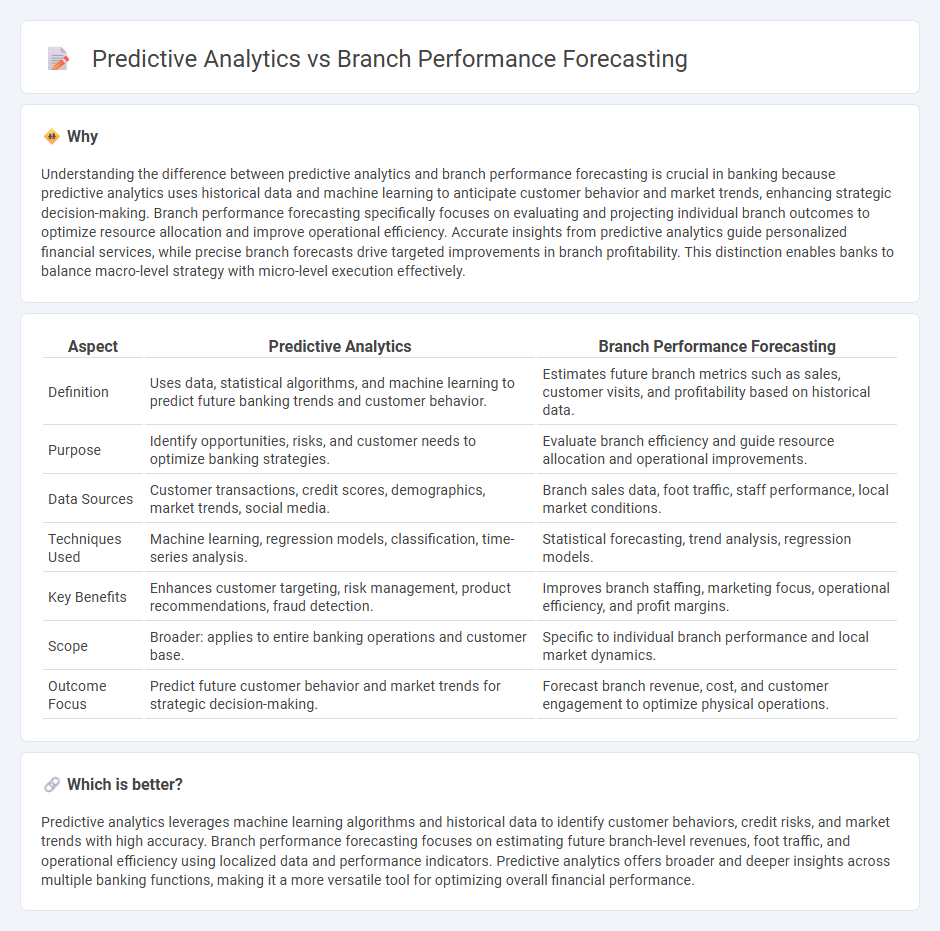

Understanding the difference between predictive analytics and branch performance forecasting is crucial in banking because predictive analytics uses historical data and machine learning to anticipate customer behavior and market trends, enhancing strategic decision-making. Branch performance forecasting specifically focuses on evaluating and projecting individual branch outcomes to optimize resource allocation and improve operational efficiency. Accurate insights from predictive analytics guide personalized financial services, while precise branch forecasts drive targeted improvements in branch profitability. This distinction enables banks to balance macro-level strategy with micro-level execution effectively.

Comparison Table

| Aspect | Predictive Analytics | Branch Performance Forecasting |

|---|---|---|

| Definition | Uses data, statistical algorithms, and machine learning to predict future banking trends and customer behavior. | Estimates future branch metrics such as sales, customer visits, and profitability based on historical data. |

| Purpose | Identify opportunities, risks, and customer needs to optimize banking strategies. | Evaluate branch efficiency and guide resource allocation and operational improvements. |

| Data Sources | Customer transactions, credit scores, demographics, market trends, social media. | Branch sales data, foot traffic, staff performance, local market conditions. |

| Techniques Used | Machine learning, regression models, classification, time-series analysis. | Statistical forecasting, trend analysis, regression models. |

| Key Benefits | Enhances customer targeting, risk management, product recommendations, fraud detection. | Improves branch staffing, marketing focus, operational efficiency, and profit margins. |

| Scope | Broader: applies to entire banking operations and customer base. | Specific to individual branch performance and local market dynamics. |

| Outcome Focus | Predict future customer behavior and market trends for strategic decision-making. | Forecast branch revenue, cost, and customer engagement to optimize physical operations. |

Which is better?

Predictive analytics leverages machine learning algorithms and historical data to identify customer behaviors, credit risks, and market trends with high accuracy. Branch performance forecasting focuses on estimating future branch-level revenues, foot traffic, and operational efficiency using localized data and performance indicators. Predictive analytics offers broader and deeper insights across multiple banking functions, making it a more versatile tool for optimizing overall financial performance.

Connection

Predictive analytics utilizes historical banking data, customer behaviors, and market trends to accurately forecast branch performance metrics such as transaction volume, revenue growth, and customer retention rates. By leveraging machine learning algorithms, banks can identify patterns that predict which branches will excel or underperform, optimizing resource allocation and staffing decisions. This connection enhances strategic planning, improves operational efficiency, and drives profitability across banking networks.

Key Terms

**Branch Performance Forecasting:**

Branch performance forecasting utilizes historical transaction data, customer footfall metrics, and local market trends to project future branch-specific revenue and operational efficiency. It incorporates machine learning algorithms tailored to regional variables, enabling banks to optimize staffing, inventory, and service offerings. Discover how branch performance forecasting can transform your financial institution's strategic planning.

Key Performance Indicators (KPIs)

Branch performance forecasting relies on analyzing historical data and trends to predict future outcomes related to key performance indicators (KPIs) such as customer footfall, loan disbursement, and deposit growth. Predictive analytics integrates advanced machine learning models and real-time data to identify patterns and forecast specific KPI metrics like sales conversion rates and customer retention with higher accuracy. Explore deeper insights into how these approaches optimize KPI-driven decision-making for enhanced branch efficiency.

Revenue Projection

Branch performance forecasting utilizes historical branch-specific data such as foot traffic, sales volume, and local market trends to estimate future revenue, enabling targeted operational adjustments. Predictive analytics leverages advanced algorithms and machine learning techniques to analyze broader datasets, including customer behavior and economic indicators, providing more dynamic and granular revenue projections. Explore how integrating these approaches can optimize your revenue projection accuracy and strategic planning.

Source and External Links

BRANCH PERFORMANCE - IBM - Branch performance forecasting in retail banking involves creating rolling forecasts based on product and customer-segment data, assessing market and branch-specific factors, and establishing consensus forecasts to drive plans for marketing, finance, and customer service across the branch network.

Balancing Branch Performance in an Era of Branch Transformation - Branch performance forecasting includes interactive tools like a 'branch scorecard' for scenario planning to optimize branch revenue and efficiency ratios, leveraging benchmarks and best practices from high-performing banks.

Branch Prediction: Improving Processor Performance Through ... - In computer architecture, branch prediction forecasts the outcome of conditional instructions to enhance processor throughput by minimizing pipeline stalls, using techniques such as dynamic prediction to increase accuracy and performance.

dowidth.com

dowidth.com