Open banking enables secure data sharing between banks and third-party providers through APIs, fostering innovative financial services and personalized customer experiences. Neo banking operates entirely online without traditional branch networks, offering streamlined digital banking solutions often with lower fees and user-friendly interfaces. Explore how these revolutionary models are transforming the future of finance.

Why it is important

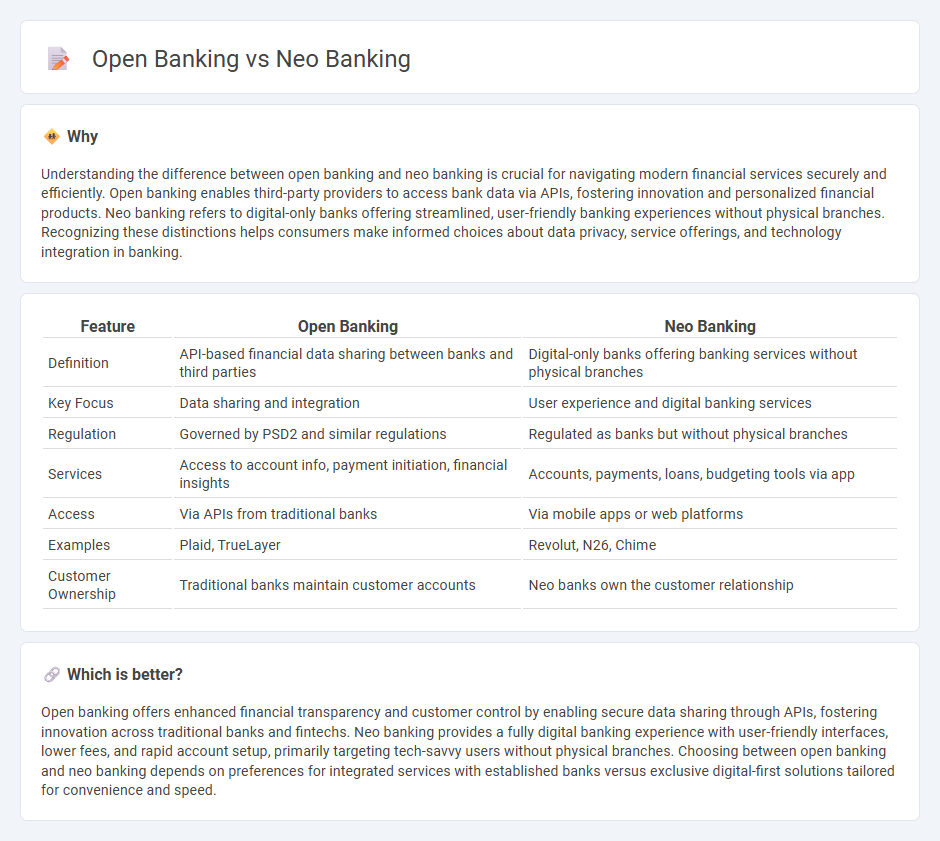

Understanding the difference between open banking and neo banking is crucial for navigating modern financial services securely and efficiently. Open banking enables third-party providers to access bank data via APIs, fostering innovation and personalized financial products. Neo banking refers to digital-only banks offering streamlined, user-friendly banking experiences without physical branches. Recognizing these distinctions helps consumers make informed choices about data privacy, service offerings, and technology integration in banking.

Comparison Table

| Feature | Open Banking | Neo Banking |

|---|---|---|

| Definition | API-based financial data sharing between banks and third parties | Digital-only banks offering banking services without physical branches |

| Key Focus | Data sharing and integration | User experience and digital banking services |

| Regulation | Governed by PSD2 and similar regulations | Regulated as banks but without physical branches |

| Services | Access to account info, payment initiation, financial insights | Accounts, payments, loans, budgeting tools via app |

| Access | Via APIs from traditional banks | Via mobile apps or web platforms |

| Examples | Plaid, TrueLayer | Revolut, N26, Chime |

| Customer Ownership | Traditional banks maintain customer accounts | Neo banks own the customer relationship |

Which is better?

Open banking offers enhanced financial transparency and customer control by enabling secure data sharing through APIs, fostering innovation across traditional banks and fintechs. Neo banking provides a fully digital banking experience with user-friendly interfaces, lower fees, and rapid account setup, primarily targeting tech-savvy users without physical branches. Choosing between open banking and neo banking depends on preferences for integrated services with established banks versus exclusive digital-first solutions tailored for convenience and speed.

Connection

Open banking and neo banking are connected through their reliance on API technology, enabling seamless third-party access to customer financial data and services. Neo banks leverage open banking frameworks to offer innovative, user-centric digital banking experiences without traditional branch networks. This integration fosters enhanced financial transparency, personalized products, and competitive market disruption in the banking sector.

Key Terms

Digital-Only Platform (Neo Banking)

Neo banking operates as digital-only platforms providing streamlined financial services without traditional branch networks, leveraging advanced APIs and cloud technology for seamless user experiences. Open banking enables third-party developers to build applications and services around financial institutions by securely sharing customer data via APIs, promoting innovation and competition. Explore how neo banking revolutionizes digital finance and the synergy with open banking in reshaping modern banking.

API Integration (Open Banking)

API integration in open banking enables third-party developers to securely access financial data and services through standardized protocols, fostering innovation and personalized customer experiences. Neo banking relies heavily on these APIs to offer seamless digital banking services without traditional branch infrastructure. Explore how API integration transforms financial ecosystems by diving deeper into open banking advantages.

Third-Party Providers

Neo banking leverages digital-only platforms to provide streamlined banking services, often integrating Third-Party Providers (TPPs) for added functionalities like payments and budgeting tools. Open banking mandates banks to securely share customer data with authorized TPPs via APIs, enhancing transparency and fostering competition in financial services. Explore further to understand how TPPs shape the future of digital banking ecosystems.

Source and External Links

What is a Neobank? How fintech is transforming banking - Plaid - Neobanks are digital-only financial companies that offer banking services like checking accounts and debit cards without physical locations, providing benefits such as reduced fees and faster loan approvals while reshaping financial services globally.

What are neobanks, and how do they work? | Stripe - Neobanks operate primarily through mobile apps and websites, offering innovative, user-friendly banking services with lower fees, real-time features, and high accessibility compared to traditional banks.

What is a Neobank? How It Works, Examples, Pros & Cons - Statrys - Neobanks are fintech companies providing online-only banking services without physical branches, featuring lower fees, better interest rates, and convenience, but with limitations such as the absence of checkbooks and sometimes no deposit insurance.

dowidth.com

dowidth.com