Social trading offers investors the opportunity to mirror the strategies of experienced traders in real-time, leveraging collective market insights and community dynamics. ETF investing provides diversified exposure to specific indexes or sectors, balancing risk through broad asset allocation and typically lower costs. Explore the nuances of social trading and ETF investing to discover which strategy aligns best with your financial goals.

Why it is important

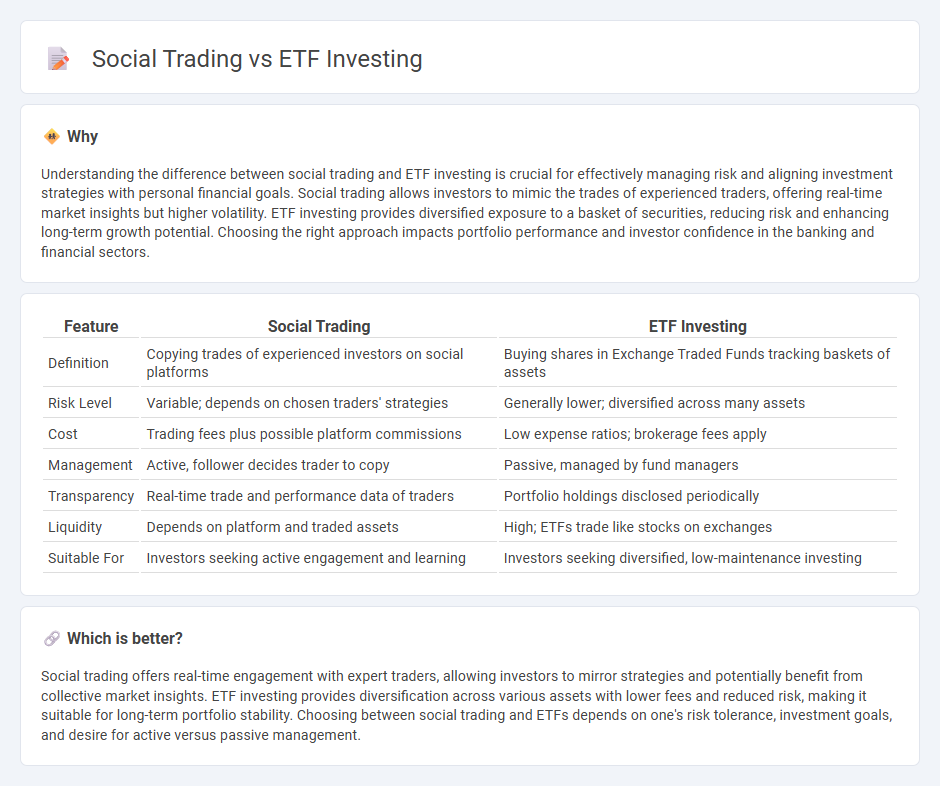

Understanding the difference between social trading and ETF investing is crucial for effectively managing risk and aligning investment strategies with personal financial goals. Social trading allows investors to mimic the trades of experienced traders, offering real-time market insights but higher volatility. ETF investing provides diversified exposure to a basket of securities, reducing risk and enhancing long-term growth potential. Choosing the right approach impacts portfolio performance and investor confidence in the banking and financial sectors.

Comparison Table

| Feature | Social Trading | ETF Investing |

|---|---|---|

| Definition | Copying trades of experienced investors on social platforms | Buying shares in Exchange Traded Funds tracking baskets of assets |

| Risk Level | Variable; depends on chosen traders' strategies | Generally lower; diversified across many assets |

| Cost | Trading fees plus possible platform commissions | Low expense ratios; brokerage fees apply |

| Management | Active, follower decides trader to copy | Passive, managed by fund managers |

| Transparency | Real-time trade and performance data of traders | Portfolio holdings disclosed periodically |

| Liquidity | Depends on platform and traded assets | High; ETFs trade like stocks on exchanges |

| Suitable For | Investors seeking active engagement and learning | Investors seeking diversified, low-maintenance investing |

Which is better?

Social trading offers real-time engagement with expert traders, allowing investors to mirror strategies and potentially benefit from collective market insights. ETF investing provides diversification across various assets with lower fees and reduced risk, making it suitable for long-term portfolio stability. Choosing between social trading and ETFs depends on one's risk tolerance, investment goals, and desire for active versus passive management.

Connection

Social trading platforms enable investors to follow and replicate the trades of experienced ETF investors, enhancing accessibility and strategy diversification. ETFs provide a diversified portfolio of assets, making them attractive options for social traders seeking exposure to various markets with lower risk. The synergy between social trading and ETF investing empowers users with collective insights and simplified investment mechanisms within the banking and financial sectors.

Key Terms

Diversification

ETF investing offers broad market exposure by pooling assets across various sectors and industries, minimizing risk through diversification. Social trading involves copying strategies from multiple traders, which can diversify exposure but depends on individual performance. Explore deeper insights on how diversification impacts these investment methods to optimize your portfolio.

Copy Trading

Exchange-Traded Funds (ETFs) offer diversified, low-cost exposure to broad market indices, making them a popular choice for long-term investors seeking steady growth. Social trading, particularly Copy Trading, allows investors to automatically replicate the trades of experienced traders, providing a hands-off approach to potentially higher returns through real-time market insights. Explore how combining ETF investing with Copy Trading strategies can enhance your portfolio performance and risk management.

Expense Ratio

ETF investing typically offers lower expense ratios, averaging around 0.1% to 0.5%, making it cost-effective for long-term growth. Social trading platforms often charge higher fees due to management and performance-based commissions, which can impact net returns. Explore detailed comparisons to understand how expense ratios influence your investment strategy.

Source and External Links

What is an ETF (Exchange-Traded Fund)? - ETFs are investment funds traded on stock exchanges, offering diversified exposure to various asset classes with the trading flexibility and cost efficiency of individual stocks.

Investing in ETFs for beginners - ETFs provide an easy, cost-effective way to invest in a broad range of markets by tracking specific indices, allowing investors to buy a basket of securities with a single transaction.

Exchange-traded Funds (ETFs) - Vanguard - Vanguard ETFs offer diversified, low-cost portfolios managed by experts, with the added benefit of real-time market pricing and high tax efficiency.

dowidth.com

dowidth.com