Negative interest rates challenge traditional banking models by incentivizing lenders to pay borrowers, while LIBOR serves as a global benchmark reference rate for short-term interest rates on interbank loans. Banks monitor LIBOR closely for pricing loans, derivatives, and managing risk, whereas negative interest rates can impact profitability and customer behavior. Discover how these contrasting financial mechanisms influence modern banking strategies and market stability.

Why it is important

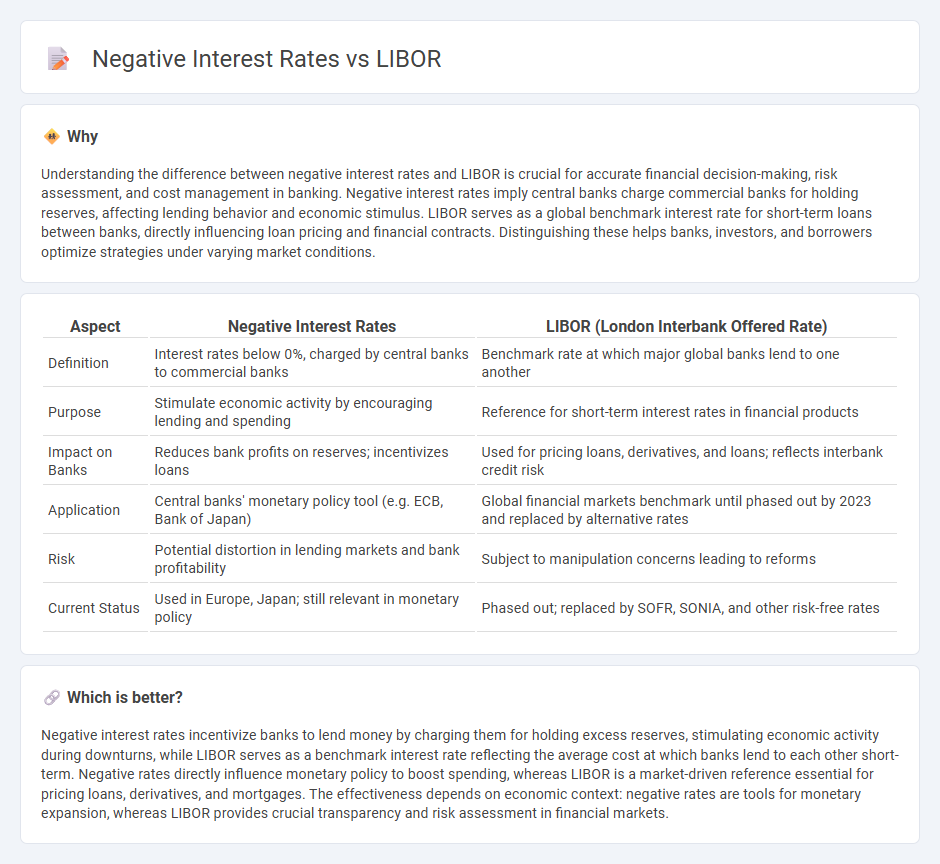

Understanding the difference between negative interest rates and LIBOR is crucial for accurate financial decision-making, risk assessment, and cost management in banking. Negative interest rates imply central banks charge commercial banks for holding reserves, affecting lending behavior and economic stimulus. LIBOR serves as a global benchmark interest rate for short-term loans between banks, directly influencing loan pricing and financial contracts. Distinguishing these helps banks, investors, and borrowers optimize strategies under varying market conditions.

Comparison Table

| Aspect | Negative Interest Rates | LIBOR (London Interbank Offered Rate) |

|---|---|---|

| Definition | Interest rates below 0%, charged by central banks to commercial banks | Benchmark rate at which major global banks lend to one another |

| Purpose | Stimulate economic activity by encouraging lending and spending | Reference for short-term interest rates in financial products |

| Impact on Banks | Reduces bank profits on reserves; incentivizes loans | Used for pricing loans, derivatives, and loans; reflects interbank credit risk |

| Application | Central banks' monetary policy tool (e.g. ECB, Bank of Japan) | Global financial markets benchmark until phased out by 2023 and replaced by alternative rates |

| Risk | Potential distortion in lending markets and bank profitability | Subject to manipulation concerns leading to reforms |

| Current Status | Used in Europe, Japan; still relevant in monetary policy | Phased out; replaced by SOFR, SONIA, and other risk-free rates |

Which is better?

Negative interest rates incentivize banks to lend money by charging them for holding excess reserves, stimulating economic activity during downturns, while LIBOR serves as a benchmark interest rate reflecting the average cost at which banks lend to each other short-term. Negative rates directly influence monetary policy to boost spending, whereas LIBOR is a market-driven reference essential for pricing loans, derivatives, and mortgages. The effectiveness depends on economic context: negative rates are tools for monetary expansion, whereas LIBOR provides crucial transparency and risk assessment in financial markets.

Connection

Negative interest rates influence LIBOR by pushing benchmark borrowing costs below zero, reflecting central banks' efforts to stimulate economic activity. LIBOR, a key reference rate for trillions of dollars in loans and derivatives, adjusts as market expectations shift due to negative rates, impacting bank lending and global financial contracts. The interplay between negative interest rates and LIBOR signals changing liquidity conditions, risk perceptions, and monetary policy stances worldwide.

Key Terms

Benchmark Rate

Benchmark rates such as LIBOR serve as critical reference points in global financial markets, influencing the cost of borrowing and lending across various instruments. Negative interest rates, which occur when benchmark rates fall below zero, challenge traditional financial models by incentivizing lenders to pay borrowers, altering cash flow dynamics and impacting banks' profitability. Explore the evolving role of benchmark rates and their implications in a world of shifting interest rate paradigms to deepen your understanding.

Monetary Policy

LIBOR (London Interbank Offered Rate) serves as a critical benchmark for short-term interest rates, influencing global financial transactions and monetary policy decisions. Negative interest rates represent an unconventional monetary policy tool used by central banks to stimulate economic activity by encouraging lending and investment, often leading to LIBOR adjustments reflecting these policy shifts. Explore how these mechanisms interact to shape economic landscapes and affect financial markets worldwide.

Interest Rate Floor

The London Interbank Offered Rate (LIBOR) historically served as a benchmark for interest rates, but negative interest rates challenge its relevance by pushing rates below zero, thereby activating interest rate floors to prevent losses on loan principal. Interest rate floors are contractual minimums that guarantee lenders do not receive below a specified rate, offering protection in environments where central banks implement negative policy rates. Explore further to understand how interest rate floors impact financial contracts and market stability in a negative rate world.

Source and External Links

Libor - Wikipedia - LIBOR was a global benchmark interest rate calculated from estimates by leading London banks, used as a reference for trillions in financial products before being fully phased out by June 2023 and replaced by rates like SOFR.

LIBOR interest rates - Originally, LIBOR reflected the average rate at which major banks in London would lend unsecured funds to one another, with published rates across multiple currencies and maturities until its discontinuation in 2024, after which alternative benchmarks became standard.

Libor Transition - IDB - Due to integrity concerns and manipulation risks, global regulators mandated a transition from LIBOR to alternative risk-free rates, with the final cessation for US dollar LIBOR occurring on June 30, 2023.

dowidth.com

dowidth.com