Central bank digital currency (CBDC) represents a digital form of a country's sovereign currency issued and regulated by the central bank, offering enhanced security, transparency, and efficiency in transactions. Mobile money refers to financial services conducted via mobile devices, enabling users to store, transfer, and manage money without traditional banking infrastructure, primarily serving unbanked populations. Explore the fundamental differences and impact of CBDC versus mobile money on the future of digital finance.

Why it is important

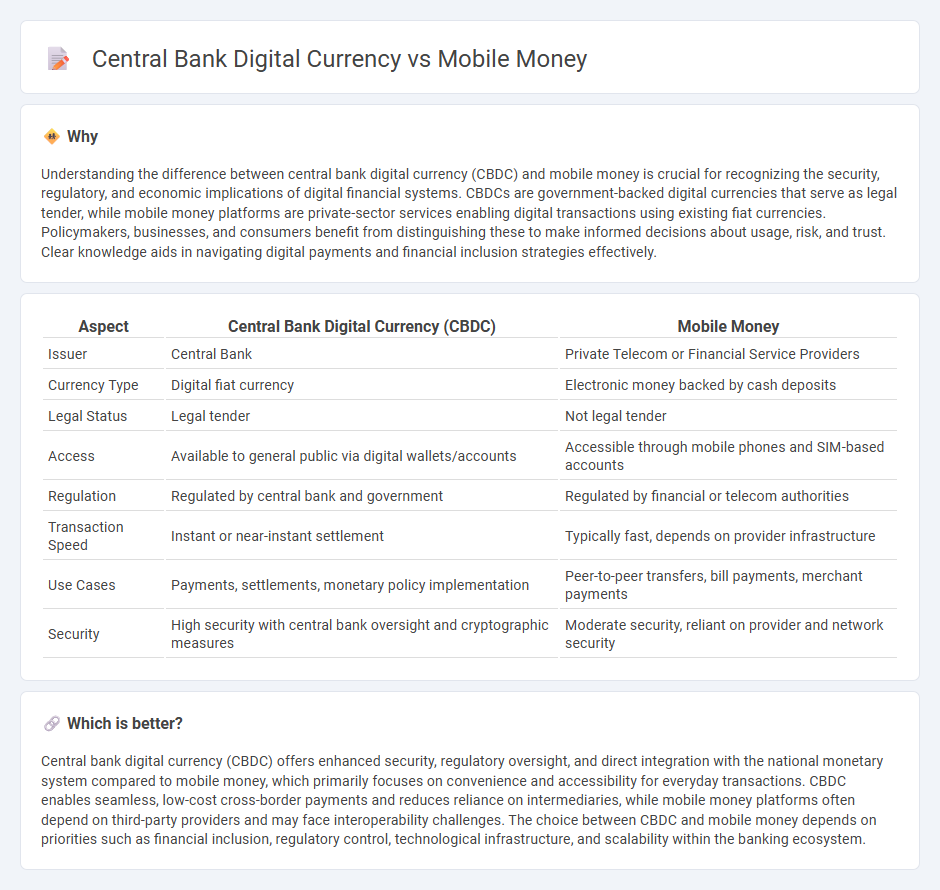

Understanding the difference between central bank digital currency (CBDC) and mobile money is crucial for recognizing the security, regulatory, and economic implications of digital financial systems. CBDCs are government-backed digital currencies that serve as legal tender, while mobile money platforms are private-sector services enabling digital transactions using existing fiat currencies. Policymakers, businesses, and consumers benefit from distinguishing these to make informed decisions about usage, risk, and trust. Clear knowledge aids in navigating digital payments and financial inclusion strategies effectively.

Comparison Table

| Aspect | Central Bank Digital Currency (CBDC) | Mobile Money |

|---|---|---|

| Issuer | Central Bank | Private Telecom or Financial Service Providers |

| Currency Type | Digital fiat currency | Electronic money backed by cash deposits |

| Legal Status | Legal tender | Not legal tender |

| Access | Available to general public via digital wallets/accounts | Accessible through mobile phones and SIM-based accounts |

| Regulation | Regulated by central bank and government | Regulated by financial or telecom authorities |

| Transaction Speed | Instant or near-instant settlement | Typically fast, depends on provider infrastructure |

| Use Cases | Payments, settlements, monetary policy implementation | Peer-to-peer transfers, bill payments, merchant payments |

| Security | High security with central bank oversight and cryptographic measures | Moderate security, reliant on provider and network security |

Which is better?

Central bank digital currency (CBDC) offers enhanced security, regulatory oversight, and direct integration with the national monetary system compared to mobile money, which primarily focuses on convenience and accessibility for everyday transactions. CBDC enables seamless, low-cost cross-border payments and reduces reliance on intermediaries, while mobile money platforms often depend on third-party providers and may face interoperability challenges. The choice between CBDC and mobile money depends on priorities such as financial inclusion, regulatory control, technological infrastructure, and scalability within the banking ecosystem.

Connection

Central bank digital currency (CBDC) and mobile money both enhance financial inclusion by providing secure and accessible digital payment solutions. CBDCs leverage blockchain technology to offer sovereign-backed digital currency, which can be seamlessly integrated into mobile money platforms to facilitate instant, low-cost transactions. The combination of CBDCs with mobile money systems modernizes payment infrastructures and reduces reliance on cash, promoting economic growth and transparency.

Key Terms

Digital Wallet

Digital wallets serve as the primary interface for both mobile money and Central Bank Digital Currency (CBDC) transactions, enabling seamless peer-to-peer transfers and retail payments. Mobile money platforms, often operated by telecom companies, emphasize financial inclusion through widespread agent networks and ease of cash-in/cash-out procedures, while CBDC wallets offer enhanced security and regulatory oversight by central banks. Explore how digital wallets are revolutionizing financial ecosystems and shaping the future of digital payments.

Legal Tender

Mobile money platforms operate through private providers and rely on users' mobile devices but are generally not considered legal tender, limiting their universal acceptance for all transactions. Central Bank Digital Currency (CBDC), issued by a nation's central bank, holds the status of legal tender, ensuring mandatory acceptance within the country's financial system. Explore more about the legal frameworks and implications governing mobile money and CBDCs.

Interoperability

Mobile money platforms thrive on interoperability by enabling seamless transactions across diverse networks and providers, fostering financial inclusion in emerging markets. Central Bank Digital Currencies (CBDCs) aim to achieve interoperability through standardized protocols and regulatory frameworks, ensuring secure cross-border payments and integration with existing financial systems. Explore the evolving landscape of interoperability in digital finance to understand how mobile money and CBDCs shape the future of cashless economies.

Source and External Links

Mobile Money: Why It Matters - Mobile money enables people without traditional bank accounts to securely transfer funds via mobile text messages and has rapidly grown, providing financial inclusion and reducing the need for cash transactions in developing countries.

What Is Mobile Money? Explaining Its Importance and Impact - Mobile money allows users to transfer, store, and request money via cell phones, facilitating microloans, remittances, shopping, business payments, and personal savings especially for those without bank accounts.

Mobile Money: Issue 2 | VoxDevLit - Mobile money services, widely adopted in Africa and developing countries, allow users to store and transfer money without banks, improving financial access and resilience, with daily global transactions totaling $2 billion in 2021.

dowidth.com

dowidth.com